what is the impact of a contractionary policy on the U.S. economy from a new keynesian point of view? Show the impact using a graph.

Step 1:

New Keynesian Economics provide macroeconomic foundation for the Keynesian economics. Unlike Keynesian economics, new Keynesian assumes that public have rational expectation. Unlike classical economics, they assume that prices and wages are sticky in the short run. That’s why, prices and wages don’t adjust simultaneously in response to changes in economic variables. This stickiness implies why economy fails to attain potential output. Therefore, they argued that fiscal and monetary policy are quite effective.

Impact of contractionary policy:

New Keynesians believe that stabilisation through monetary or fiscal policy is possible since they assume that firms and households have rational expectation. Due to rational expectation, Central Bank can’t systematically surprise the public. The means that public’s forecasting about the economic variables are based on reasoned and intelligent examination of available economic data and any policy which can be anticipated by public doesn’t affect the output level to a greater extent. Therefore, when expectations are rational only pure random changes are unanticipated and can affect the output.

Now, we’ll analysis how the contractionary policy affects the level of output.

Case 1: When this contractionary policy is unanticipated:

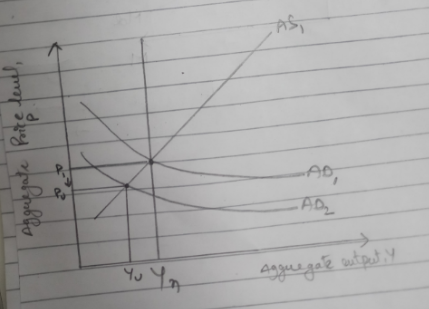

Contractionary policy cause aggregate demand curve to shift inwards i.e. from AD1 to AD2 and aggregate supply curve stays at AS1. This shows price falls from P1 to PU and output falls from Y1 to Yu.

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

- How does the self-correcting mechanism act to pull the economy out of a recession?arrow_forwardJohn Maynard Keynes was the first to show that government policy could be used to change aggregate output and prevent recession by stabilizing the economy. Describe the economy at the time Keynes was writing. What parallels do you draw comparing that period with the current condition of the United States economy as a result of Covid?arrow_forwardUse brief language and diagrams (AD-AS model) to discuss the difference between Keynesian view and Neoclassic view on Macroeconomics.arrow_forward

- Using Keynesian cross model show how a recession and the effect of the increase of government spending will look like ?arrow_forwardWhat is the Keynesian prescription for recession? For inflation?arrow_forwardWhat happens in the AD-AS model when the Federal Reserve buys government securities?arrow_forward

- Why might a Keynesian Economist argue that a Federal Reserve policy alone will not get us out of a recession? ( explain in full response)arrow_forwardIllustrate, using a Keynesian Cross diagram, the meaning of the term ‘animal spirits’.arrow_forwardusing the Keynesian AD-AS diagram how can the economy be in a state of equilibrium at any level of real output where AD intersects ASarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education