EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

What is ghs fair value of solve this question general accounting

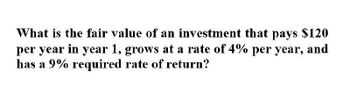

Transcribed Image Text:What is the fair value of an investment that pays $120

per year in year 1, grows at a rate of 4% per year, and

has a 9% required rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the present value of an investment that pays $190 at the end of year 1, $107 at the year of year 2, and $235 at the end of year 3 if this investment earns 5% annually? your answer should be to the nearest dollar. For example, if your answer is id=mce_marker50, then input as 150.arrow_forwardWhat is the internal rate of return (IRR) of an investment that requires an initial investmen of $11,000 today and pays $15,400 in one year's time?arrow_forwardNeed answer this questionarrow_forward

- An investment will pay S100 at the end of each of the next 3 years, $200 at the end of Year 4, 300 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal risk earn 8% annually, what is this investment's present value? Its future value?arrow_forwardWhat is the returnon an investment that costs $1,000 and is soldafter 1 year for $1,060?arrow_forwardAn investment will pay $150 at the end of each of the next 3 years, $300 at the end of Year 4, $600 at the end of Year 5, and incur a $500 cost at the end of Year 6. If other investments of equal risk earn 6.7% annually, what is this investment’s present value?arrow_forward

- Today (t=0), you invested the starting prinipal of 1536 dollars. At the end of the first, second and third years, you will receive payments in the amount of 40%, 45% and 50% respectively of your initital investment. What is the net present value (NPV) of the investment if the minimum attractive rate of return (MARR) is 7.8%. Calculate the MARR for an NPV between $0 and $1 and draw the cash flow diagram.arrow_forwardWhat is the fair value of an investment that pays $100 per year in year 1, grows at the rate of 3% and has an 8% required rate of return? A. $2,000. B. $1,250. C. $909.09 D. $1,287.50arrow_forwardThe expected profits from a $165,000 investment are $55,000 in Year 1, $80,000 in Year 2, and $120,000 in Year 3. What is the investment’s payback period?arrow_forward

- Help pleasearrow_forwardAn investment pays you $100 at the end of each of the next 3 years. The investment will then pay you $200 at the end of year 4, $300 at the end of year 5, and $500 at the end of year 6. If the rate of interest earned on the investment is 8%, what is the present value of this investment? What is its future value? How do you solve this with excel?arrow_forwardIf a particular investment will pay $500, 5 months from now, and an additional $500, 9 months from now, what is the largest amount that an investor should be willing to invest today, assuming money earns a rate of return of 7%? Assume that the investment has no money left after the two withdrawals.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you