Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Correct answer

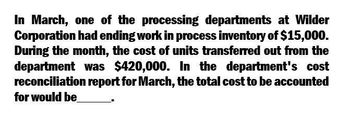

Transcribed Image Text:In March, one of the processing departments at Wilder

Corporation had ending work in process inventory of $15,000.

During the month, the cost of units transferred out from the

department was $420,000. In the department's cost

reconciliation report for March, the total cost to be accounted

for would be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardDuring the month, a company with no departmentalization incurred costs of 45,000 for materials, 36,000 for labor, and 22,500 for factory overhead. There were no units in process at the beginning or at the end of the month, and 20,000 units were completed. Determine the unit cost for the month for materials, labor, factory overhead, and the total unit cost. (Round unit costs to three decimal places.)arrow_forwardDuring October, McCourt Associates incurred total production costs of 60,000 for copyediting manuscripts and had the following equivalent units schedule: Required: 1. Calculate the cost of copyediting one manuscript for October. 2. Assign costs to manuscripts completed and to EWIP and then do a cost reconciliation. 3. What if the costs assigned to units completed and EWIP total were calculated using a unit cost of 225? What is the discrepancy between the costs assigned and the costs to account for? What could have caused an incorrect unit cost?arrow_forward

- Narwhal Swimwear has a beginning work in process inventory of 13,500 units and transferred in 130,000 units before ending the month with 14,000 units that were 100% complete with regard to materials and 30% complete with regard to conversion costs. The cost per unit of material is $5.80 and the cost per unit for conversion is $8.20 per unit. Using the weighted-average method, what is the amount of material and conversion costs assigned to the department for the month?arrow_forwardIn October, the cost of materials transferred into the Rolling Department from the Casting Department of Kraus Steel Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600 (275,000 factory overhead applied and 187,600 direct labor). The total cost transferred to Finished Goods for the period was 3,392,400. The Rolling Department had a beginning inventory of 163,800. a. Journalize for the Rolling Department (1) the cost of transferred-in materials, (2) the conversion costs, and (3) the costs transferred out to Finished Goods. b. Determine the balance of Work in ProcessRolling at the end of the period.arrow_forwardIf a factory operates at 100% of capacity one month, 90% of capacity the next month, and 105% of capacity the next month, will a different cost per unit be charged to the work-in-process account each month for factory overhead assuming that a predetermined annual overhead rate is used?arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Argo Manufacturing Co. had 500 units, three-fifths completed, in process at the beginning of the month. During the month, 2,000 units were started in process and finished. There was no work in process at the end of the month. Unit cost of production for the month was 1.20. Costs for materials, labor, and factory overhead incurred in the current month totaled 2,655. Calculate the unit cost for the prior month. (Hint: You must first determine what the dollar balance in work in process must have been at the beginning of the month, as well as the equivalent production of the units in beginning inventory.)arrow_forwardComacho Chemical Co. recorded costs for the month of 18,900 for materials, 44,100 for labor, and 26,250 for factory overhead. There was no beginning work in process, 8,000 units were finished, and 3,000 units were in process at the end of the period, two-thirds completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost. (Round unit costs to three decimal places.)arrow_forwardArdt-Barger has a beginning work in process inventory of 5.500 units and transferred in 25,000 units before ending the month with 3.000 u flits that were 100% complete with regard to materials and 80% complete with regard to conversion costs. The cost per unit of material is $5.45, and the cost per unit for conversion is $6.20 per unit, Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning