ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

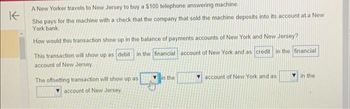

A New Yorker travels to New Jersey to buy a $100 telephone answering machine.

She pays for the machine with a check that the company that sold the machine deposits into its account at a New

York bank.

How would this transaction show up in the balance of payments accounts of New York and New Jersey?

This transaction will show up as debit in the financial account of New York and as credit in the financial

account of New Jersey.

The offsetting transaction will show up as

account of New Jersey.

in the

account of New York and as

in the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What are some of the main reasons not all countries in the EU have adopted the Euro?arrow_forwardImagine you are a German investor trying to decide whether to buy American or European bonds. A ten-year bond issued by America’s Treasury today offers about 3%; German bonds return only 1.2%. But buying American means taking a gamble on the euro-dollar exchange rate. You are interested in the return in euros. The bond issued in the US will be attractive only if the extra yield exceeds any expected loss due to swings in currency markets. This thinking explains why the dollar has recently soared against the euro. In July 2022 the dollar reached a one-for-one exchange rate with the euro for the first time since 2002. Is it always true that a currency appreciates in value when the interest rate it offers increases relative to foreign interest rates? Explain.arrow_forwardHow would each of the following transactions show on U.S. balance of accounts?20 (i) Payments of $50 million in social security to U.S. citizens living in Costa Rica. (ii) Sale overseas of 1,25,000 Elvis Presley CDs. (iii) Tuition receipts of $3 billion received by American universities from foreign students. (iv) Payment of $1 million to U.S. consultants A.D. Little by a Mexican company. (v) Sale of a $100 million Eurobond issue in London by IBM. (vi) Investment of $25 million by Ford to build a parts plant in Argentina. (vii) Payment of $45 million in dividends to U.S. citizens from foreign companies.arrow_forward

- What conditions have contributed to Interest Rate Parity not holding in the market during the past few years?arrow_forwardIn the paper by Degrauwe, The Governance of a Fragile Eurozone by Paul De Grauwe, he argues that the fundamental problem in the Euro-zone today is that countries cannot borrow in their own currencies. Explain what he means by this and what the consequences of this are for Euro-zone countries currently in crisis. DeGrauwe argues that countries in the Eurozone monetary union can face both liquidity and solvency crises – problems that could not occur in a country that issues its own currency, like the UK. Explain. Refer to his comparison of Spain to the UK.arrow_forwardplease solvearrow_forward

- The forward rate of exchange is 2 , the spot rate of exchange is 1.75. The US has a bond of 9% interest and Canada has a bond for 5% interest. What is the amount you can collect in US dollars for the Canada bond on an investment of $10,000? $10,937.50 and the Canadian investment is better than the US investment $10,937.50 and the Canadian investment is worse than the US investment $10,900 and the Canadian investment is better than the US investment $10,900 and the Canadian investment is worse than the US investmentarrow_forwardEurodollar deposits constitute what?arrow_forwardA US firm plans to use a money market hedge to hedge its payment of five million British pounds for British goods in one year. The US interest rate is 5% and the British interest rate is 7%. The spot rate of the British pound is $1.65 and the one-year forward rate is $1.60.How many British pounds does the firm need to invest today?How many US dollars does the firm need to borrow today?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education