Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

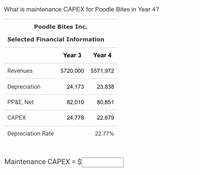

Transcribed Image Text:What is maintenance CAPEX for Poodle Bites in Year 4?

Poodle Bites Inc.

Selected Financial Information

Year 3

Year 4

Revenues

$720,000 $571,972

Depreciation

24,173

23,838

PP&E, Net

82,010

80,851

САРEХ

24,778

22,679

Depreciation Rate

22.77%

Maintenance CAPEX = $|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- rmn.2arrow_forwardPlease do not give solution in image format thankuarrow_forwardProblem 6Four, Inc. provided the following balances at the end of the current year:Wasting asset, at cost P20,000,000Accumulated depletion 2,500,000Share capital 50,000,000Capital liquidated 1,800,000Retained earnings 1,500,000Depletion based on 50,000 units at P20 per unit 1,000,000Inventory of resource deposit 100,000Required:a. Compute the maximum dividend that can be declared.b. Prepare the journal entry to record the declaration of P2,000,000 dividend.arrow_forward

- d = ces Problem 6-22A (Algo) Accounting for acquisition of assets, including a basket purchase LO 6-1 Trinkle Company made several purchases of long-term assets during the year. The details of each purchase are presented here. New Office Equipment 1. List price: $41,100; terms: 2/10, n/30; paid within the discount period. 2. Transportation-In: $740. 3. Installation: $470. 4. Cost to repair damage during unloading: $624. 5. Routine maintenance cost after eight months: $150. Basket Purchase of Copler, Computer, and Scanner for $53,500 with Fair Market Values 1. Copier, $26,445. 2. Computer, $9,030. 3. Scanner, $29,025. Land for New Warehouse with an Old Building Torn Down 1. Purchase price, $82,400. 2. Demolition of building, $5,410. 3. Lumber sold from old building, $2,210. 4. Grading in preparation for new building, $9,500. 5. Construction of new building, $217,000. Required In each of these cases, determine the amount of cost to be capitalized in the asset accounts. Asset Office…arrow_forwardPlease do not give solution in image format thankuarrow_forwardDineshbhai Don't upload image pleasearrow_forward

- ile Edit View Go Tools Window Help A MT1305Q1Spring2021.pdr (1 page) Q Search 3. An automobile purchased for use by the manager of a firm at a price of $32,000 is to be depreciated by using the straight-line method over 5 years. What will be the book value of the automobile at the end of 3 years? (Assume that the scrap value is $0). 4. AutoTime, a manufacturer of electronic digital timers, has a monthly fixed cost of $48,000 and a production cost of $8 for each timer manufactured. The timers sell for $14 each. a. What is the cost function? What is the revenue function? b. Find the profit(loss) corresponding to a production level of 4000. guys know I was in the Hunger Games?" Jennifer Lawrence on where she keeps Katniss's bow. dtv MacBook Pro 23 $ & 3arrow_forwarddo not give solution in image format otherwise give downvotearrow_forwardMACRS Year 0 Depreciation Rate 33.33% $55,998 $79,608 $57,962 A machine is purchased for $850,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule in the table above. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%? $62,985 $75,000 Project Year Year 1 44.45% $70,795 Year 2 14.81% Year 3 7.41%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education