Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

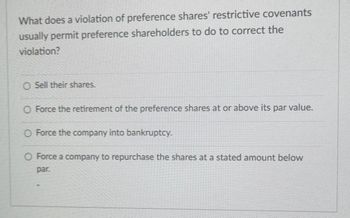

Transcribed Image Text:What does a violation of preference shares' restrictive covenants

usually permit preference shareholders to do to correct the

violation?

O Sell their shares.

O Force the retirement of the preference shares at or above its par value.

O Force the company into bankruptcy.

O Force a company to repurchase the shares at a stated amount below

par.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What is a Rights Issue?(a) The sale of rights to a bond coupon. (b) The right of shareholders to have the company buy back their shares. (c) It is where the firm raises additional equity capital after the IPO. (d) It is a sale of priority rights to creditors in the event of the company being wound up.arrow_forward5. Which of the following statements is FALSE? a. In the extreme case, the debt holders take legal ownership of the firm's assets through a process called bankruptcy. b. Equity holders expect to receive dividends and the firm is legally obligated to pay them. c. A firm that fails to make the required interest or principal payments on the debt is in default. d. After a firm defaults, debt holders are given certain rights to the assets of the firm.arrow_forwardIf you short-sell a stock and it pays a dividend while your short sale is open, then O A. You are unaffected (i.e., you do not receive nor do you pay the dividend) B. You have to pay the dividend to the lender OC. You receive the dividendarrow_forward

- A corporate shareholder who receives a constructive dividend cannot apply a dividendsreceived deduction to the distribution. • True O Falsearrow_forwardA company expected to go bankrupt in the near future is considered to be operating under the going-concern assumption. True Falsearrow_forwardDon't give solution in image format..arrow_forward

- To the extent that shares sold during an IPO are discounted from their appropriate price, the proceeds that the issuing firm receives from the IPO are lower than it deserves. Question 21 options: True Falsearrow_forwardIf the market value of a firm becomes less than its book value, it becomes an attractive takeover target.the firm will be delisted by the stock exchange.the Securities and Exchange Commission will not allow it to declare dividends until the market value once again exceeds the book value.the firm will be unable to service its debt.arrow_forwardIf a company has declared bankruptcy, its financial statements likely violate: Multiple Choice O O O O The stable monetary unit assumption. The fair value measurement approach. The going concern assumption. The present value measurement approach.arrow_forward

- Why might a rational investor invest in the stock of a company that pays no dividend?arrow_forwardCorporate shareholders generally receive less favorable tax treatment from a qualifying stock redemption than from a dividend distribution. Question 7 options: True Falsearrow_forwardIn a perfect bankruptcy, a firm becomes bankrupt when all of the following occur, except: Multiple Choice O Assets equal the value of the debt. The value of the equity is zero. O Stockholders turn over control to the bondholders. Bondholders hold assets valued the same as debt owed. Assets equal the value of the equity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education