ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

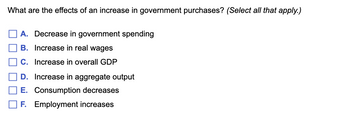

Transcribed Image Text:What are the effects of an increase in government purchases? (Select all that apply.)

A. Decrease in government spending

B. Increase in real wages

C. Increase in overall GDP

D. Increase in aggregate output

E. Consumption decreases

F. Employment increases

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- List the 3 major revenue sources and 3 major expenditures in the 2022-2023 U.S. budget.How much (approximate %) of the budget is NOT mandatory, interest or defense spending.What is meant by the term “mandatory” in this context? How do you think that this realistically affects efforts to balance the budget?.arrow_forward5. Allocation of government expenditures Federal and local governments tax and spend. The following pie charts show the allocation of federal and local government expenditures in 2016. Interest 11% Federal All other 12% Health 30% O True O False Pensions and Income Security 33% National Defense 14% Highways 6.0% State and Local All other 31% Education 33% Health and Public Welfare (includes health and welfare and social services, not disability) 30% (Source: Bureau of Economic Analysis, "Government Current Expenditures by Function," National Income and Product Accounts Tables, www.bea.gov.) True or False: You can validly conclude from these pie charts that local governments do not spend enough on highways.arrow_forwardIdentify the word, concept, or expression most closely related to the word, concept, or expression below: 1. Short-run effect of an increased number of Canadians vacationing and shopping at home. Choose one of the following: product prices fall and output rises, product prices fall and output falls, product prices rise and output falls, product prices rise and output rises, prices remain unchanged and output rises, product rises and output remains unchanged 2. Short-run effect of increased government spending on infrastructure. Choose one of the following: product prices fall and output rises, product prices fall and output falls, product prices rise and output falls, product prices rise and output rises, prices remain unchanged and output rises, product rises and output remains unchanged 3. Short-run effect of a large increase in commodity (input) prices for businesses. Choose one of the following: product prices fall and output rises, product prices fall and output falls, product…arrow_forward

- a What is the total value of government spending? b What is the value of total consumer spending? c What is the country's total GDP?arrow_forwardQuestion 3 pleasearrow_forwardYou are told that taxes in this economy are equal to 100. What is the value of autonomous consumption? Planned Government Net Exports Aggregate Change in Real GDP (Y) Consumption (C) Investment (1') Purchases (G) (NX) Expenditures (AE) Inventories 1500 1100 250 1600 1175 100 1700 1250 1800 1900 2000 75 Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 50 75 100 d. 125arrow_forward

- 6. Changes in taxes The following graph plots an aggregate demand curve. Using the graph, shift the aggregate demand curve to depict the impact that a tax hike has on the economy. ? PRICE LEVEL 8 1:30 120 110 100 8 90 80 70 0 Sunnore the no 10 20 30 OUTPUT Aggregate Demand 40 50 Aggregate Demandarrow_forwardplease solvearrow_forward2. Calculating the debt to GDP ratio Suppose the following statistics characterize the financial health of the hypothetical economy Spendia at the end of 2017: • Gross domestic product (GDP) is equal to $100 billion. • The national debt is equal to $130 billion. • The government has a budget deficit of $7 billion. • The debt ceiling in Spendia is set at $148 billion. The following calculations help you see how the ratio of debt to GDP changes from one year to the next. Complete the first row of the following table by computing the ratio of national debt to GDP. Suppose that nominal GDP remains at $100 billion in 2018, and again the government runs a budget deficit of $7 billion. For simplicity, assume the interest rate on the national debt is 0%, and no payments are being made to reduce the debt. Calculate national debt and the debt-to-GDP ratio in 2018. Enter these values in the second row of the following table. Year 2017 2018 GDP National Debt (Billions of dollars) (Billions of…arrow_forward

- (25) Which of the following is an example of fiscal policy? Select one: a. A change in tax rates. b. A change in the money supply. c. A change in interest rates. d. A change in the inflation rate. (26) If the number of employed persons in a country equals 24 million, the number of unemployed persons equals 8 million, and the number of persons over age 16 in the population equals 40 million, the unemployment rate equals ________. Select one: a. 25% b. 18% c. 32%arrow_forward9. Using the expenditure approach, government expenditures include a) defense and nondefense federal, state, and local government expenditures. b) only nondefense federal government expenditures. c) federal government expenditures and transfer payments. d) only state and local government expenditures. e) residential investment and state and local government expenditures.arrow_forwardSolve it correctly please. I will rate accordingly.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education