Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

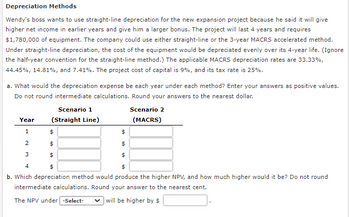

Transcribed Image Text:Depreciation Methods

Wendy's boss wants to use straight-line depreciation for the new expansion project because he said it will give

higher net income in earlier years and give him a larger bonus. The project will last 4 years and requires

$1,780,000 of equipment. The company could use either straight-line or the 3-year MACRS accelerated method.

Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4-year life. (Ignore

the half-year convention for the straight-line method.) The applicable MACRS depreciation rates are 33.33%,

44.45%, 14.81%, and 7.41%. The project cost of capital is 9%, and its tax rate is 25%.

a. What would the depreciation expense be each year under each method? Enter your answers as positive values.

Do not round intermediate calculations. Round your answers to the nearest dollar.

Year

1

2

Scenario 1

(Straight Line)

3

$

$

$

$

$

$

4

$

$

b. Which depreciation method would produce the higher NPV, and how much higher would it be? Do not round

intermediate calculations. Round your answer to the nearest cent.

The NPV under [-Select-

will be higher by $

Scenario 2

(MACRS)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Pear Orchards is evaluating a new project that will require equipment of $249,000. The equipment will be depreciated on a 5-year MACRS schedule. The annual depreciation percentages are 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, and 11.52 percent, respectively. The company plans to shut down the project after 4 years. At that time, the equipment could be sold for $67,100. However, the company plans to keep the equipment for a different project in another state. The tax rate is 21 percent. What aftertax salvage value should the company use when evaluating the current project?.arrow_forwardFun Land is considering adding a miniature golf course to its facility. The course would cost $75000, would be depreciated on a straight line basis over its 4-year life, and would have a zero salvage value. The estimated income from the golfing fees would be $40000 a year with $12000 of that amount being variable cost. The fixed cost would be $6000. In addition, the firm anticipates an additional $15000 in revenue from its existing facilities if the course is added. The project will require $7000 of net working capital, which is recoverable at the end of the project. What is the net present value of this project at a discount rate of 12 percent and a tax rate of 35 percent? $19,812.09 $20,360.22 $15,429.48 $13,199.40 $24,738.41arrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $162, 000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $102,000, variable costs of $27, 500, and fixed costs of $12,100. The project will also require net working capital of $2,700 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 12 percent. What is the net present value of this project?arrow_forward

- Ben is looking at a new computer system with an installed cost of $560000. This cost will be depreciated straight - line to zero over the project's five year life, at the end of which the computer system can be scrapped for $85000. The computer system will save the company $165000 per year in pretax operatiing costs, and the system requires an initial investment in net working capital of $ 29000. If the tax rate is 34 percent and the discount rate is 10 percent, what is the NPV of this project?arrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $157,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44 45 percent, 14 81 percent, and 7.41 percent, respectively. The project will have annual sales of $98,000, variable costs of $27,400, and fixed costs of $12,000. The project will also require net working capital of $2,600 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 10 percent. What is the net present value of this project? Multiple Choice $3112 $3.395 $16.360 56718 $4.645arrow_forwardYour firm needs a machine which costs $120,000, and requires $33,000 in maintenance for each year of its 5 year life. After 5 years, this machine will be replaced. The machine falls into the MACRS 5-year class life category. Assume a tax rate of 35 percent and a discount rate of 15 percent. What is the depreciation tax shield for this project in year 5?arrow_forward

- The Oviedo Company is considering the purchase of a new machine to replace an obsolete one. The machine being used for the operation has a book value and a market value of zero. However, the machine is in good working order and will last at least another 10 years. The proposed replacement machine will perform the operation so much more efficiently that Oviedo's engineers estimate that it will produce after-tax cash flows (labor savings) of $6,000 per year. The after-tax cost of the new machine is $30,000, and its economic life is estimated to be 10 years. It has zero salvage value. The firm's WACC is 10%, and its marginal tax rate is 25%. Should Oviedo buy the new machine? Oviedo (should or Should not) purchase the new machine.arrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $189,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $126,000, variable costs of $33,700, and fixed costs of $12,700. The project will also require net working capital of $3,300 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 9 percent. What is the net present value of this project? ASAP, PLEASEarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education