FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

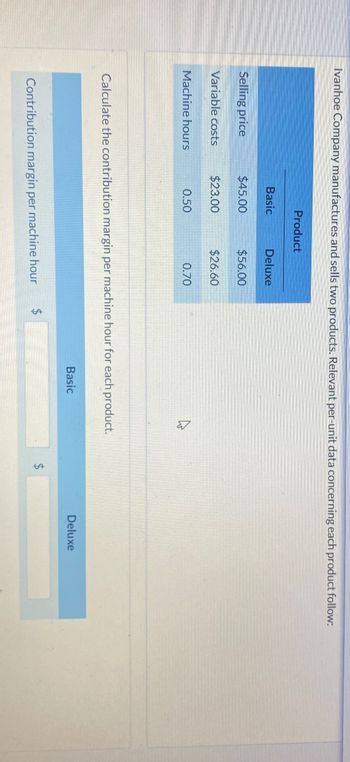

Transcribed Image Text:Ivanhoe Company manufactures and sells two products. Relevant per-unit data concerning each product follow:

Selling price

Variable costs

Machine hours

Product

Basic

$45.00

$23.00

0.50

Deluxe

$56.00

$26.60

0.70

Calculate the contribution margin per machine hour for each product.

Contribution margin per machine hour

$

Basic

$

Deluxe

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardA tile manufacturer has supplied the following data: Boxes of tiles produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income a. b. $ $ What is the company's unit contribution margin? $0.86 per unit $2.35 per unit $4.10 per unit $1.75 per unit C. d. 520,000 2,132,000 650,000 $ 464,000 $ 260,000 $ 312,000 $ 446,000arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Edge Company produces two models of its product with the same machine. The machine has a capacity of 154 hours per month. The following information is available. Selling price per unit Variable costs per unit Contribution margin per unit Machine hours per unit Maximum unit sales per month Required: Contribution margin per unit 노래 Contribution margin per machine hour Standard Hours dedicated to the production of each product Units produced for most profitable sales mix Contribution margin per unit Total contribution margin $ 140 55 1. Determine the contribution margin per machine hour for each model. Product Contribution Margin Hours dedicated to the production of each product Units produced for most profitable sales mix Contribution margin per unit Total contribution margin $85 1 hour 500 units Deluxe $ 170 102 $ 68 2 hours 200 units Standard 2. How many units of each model should the company produce? How much total contribution margin does this mix produce per month? Standard Deluxe…arrow_forwardEdgewater Enterprises manufactures two products. Information follows: Product A Product B Sales price $ 12.00 $ 15.25 Variable cost per unit $ 6.20 $ 6.90 Product mix 30% 70% M6-17 [LO 6-6] es Required: Calculate Edgewater's weighted-average contribution margin per unit. Note: Round your intermediate calculations and final answer to 2 decimal places. Weighted average CM per unitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education