Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

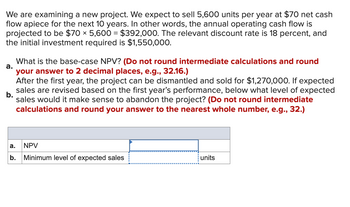

Transcribed Image Text:We are examining a new project. We expect to sell 5,600 units per year at $70 net cash

flow apiece for the next 10 years. In other words, the annual operating cash flow is

projected to be $70 × 5,600 = $392,000. The relevant discount rate is 18 percent, and

the initial investment required is $1,550,000.

What is the base-case NPV? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

After the first year, the project can be dismantled and sold for $1,270,000. If expected

sales are revised based on the first year's performance, below what level of expected

b.

sales would it make sense to abandon the project? (Do not round intermediate

calculations and round your answer to the nearest whole number, e.g., 32.)

a.

a.

NPV

b. Minimum level of expected sales

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A project has an initial cost of $55,000, expected net cash inflows of $14,000 per year for 6 years, and a cost of capital of 11%. What is the project's NPV? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardNPV and IRR Benson Designs has prepared the following estimates for a long-term project it is considering. The initial investment is $17,950, and the project will yield cash inflows of $3,000 per year for 9 years. The firm has a cost of capital of 8%. a. Determine the net present value (NPV) for the project. b. Determine the internal rate of return (IRR) for the project. c. Would you recommend that the firm accept or reject the project?arrow_forwardA project that will provde annual cash flows of $3,000 for nine years costs $10,000 today. a. At a required return of 10 percent, what is the NPV of the project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. At a required return of 28 percent, what is the NPV of the project? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. At what discount rate would you be indifferent between accepting the project and rejecting it? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. NPV b. NPV c. Discount rate %arrow_forward

- Kindly help me with this problem i will definitely ratearrow_forwardConsider a project with free cash flows in one year of $106,89 or $112,37, with each outcome being equally likely. The initial investment required for the project is $60,35, and the project's cost of capital is 0,20%. What is the NPV of this project?arrow_forwardKeuka Corporation is considering a project that costs $1 million and will produce benefits for 5 years. The first year cash inflow can be rather accurately estimated at $240,000, measured in today's dollars. If the actual first-through fifth-year cash flows are assumed to be the same size ($240,000), what would the NPV of the investment be if the appropriate discount rate is 15% ? Round to the nearest whole number. If the answer is negative, put your answer in parentheses. NPV = Sarrow_forward

- Consider a project with free cash flow in one year of $139,138 or $187,005, with either outcome being equally likely. The initial investment required for the project is $110,000, and the project's cost of capital is 23%. The risk-free interest rate is 7%. (Assume no taxes or distress costs.) a. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all-equity firm. The equity holders will receive the cash flows of the project in one year. How much money can be raised in this way that is, what is the initial market value of the unlevered equity? c. Suppose the initial $110,000 is instead raised by borrowing at the risk-free interest rate. What are the cash flows of the levered equity, and what is its initial value according to M&M? a. What is the NPV of this project? The NPV is $ 22578. (Round to the nearest dollar.) b. Suppose that to raise the funds for the initial investment, the project is sold to…arrow_forwardYou are evaluating a project that will cost $543,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.9% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company?arrow_forwardYour company is considering a capital project that will require a net initial investment of $244,978. The project is expected to have a 7- year life and will generate an annual net cash inflow of $40,860. Using the present value tables, what is the internal rate of return? (Round answers to O decimal places, e.g. 25.) Click here to view the factor table. Internal Rate of Return %arrow_forward

- A project that will provide annual cash flows of $2,600 for nine years costs $10,700 today? a. At a required return 12%, what is the NPV of the project? (DO NOT ROUND INTERMEDIATE CALCULATIONS AND ROUND YOUR ANSWER TO 2 DECIMAL PLACES) b. At a required return of 28%, what is the NPV of the project? (DO NOT ROUND INTERMEDIATE CALCULATIONS AND ROUND YOUR ANSWER TO 2 DECIMAL PLACES) c. At what discount rate would be indifferent between accepting the project and rejecting it? (DO NOT ROUND INTERMEDIATE CALCULATIONS AND ROUND YOUR ANSWER TO 2 DECIMAL PLACES) Could someone please help me solve this in excel?arrow_forwardYou are evaluating a project that will cost $502,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.7% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you take the project since the NPV is will not willarrow_forwardA project that will provde annual cash flows of $3,050 for nine years costs $10,200 today. a. At a required return of 11 percent, what is the NPV of the project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. At a required return of 27 percent, what is the NPV of the project? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. At what discount rate would you be indifferent between accepting the project and rejecting it? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. NPV b. NPV c. Discount rate %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education