FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

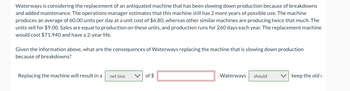

Transcribed Image Text:Waterways is considering the replacement of an antiquated machine that has been slowing down production because of breakdowns

and added maintenance. The operations manager estimates that this machine still has 2 more years of possible use. The machine

produces an average of 60.00 units per day at a unit cost of $6.80, whereas other similar machines are producing twice that much. The

units sell for $9.00. Sales are equal to production on these units, and production runs for 260 days each year. The replacement machine

would cost $71,940 and have a 2-year life.

Given the information above, what are the consequences of Waterways replacing the machine that is slowing down production

because of breakdowns?

Replacing the machine will result in a

net loss

of $

. Waterways

should

keep the old i

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Charlie Corporation is considering buying a new donut maker. This machine will replace an old donut maker that still has a useful life of 6 years. The new machine will cost $3,770 a year to operate, as opposed to the old machine, which costs $4,225 per year to operate. Also, because of increased capacity, an additional 21,700 donuts a year can be produced. The company makes a contribution margin of $0.10 per donut. The old machine can be sold for $8,700 and the new machine costs $31,700. The incremental annual net cash inflows provided by the new machine would be (Ignore income taxes.): Multiple Choice O O O O $455 $2,170 $6,530 $2,625arrow_forwardArtisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $54,000 per year, to solve the problem. With this extra worker, the company could produce and sell 2,900 more units per year. Currently, the selling price per unit is $25.00 and the cost per unit is $7.50. $3.40 1.00 0.40 2.70 $7.50 Direct materials Direct labor Variable overhead Fixed overhead (primarily depreciation of equipment) Total Using the Information provided, calculate the annual financial Impact of hiring the extra worker. Profit $ Increase ✔arrow_forwardoJo sportswear company needs someone to supply it with 4,000 tons of cotton cloth per year to support its manufacturing needs over the next six years, and you’ve decided to bid on the contract. It will cost you $16 million to install the equipment necessary to start production; you’ll depreciate this cost straight-line to $4 million over the project’s life. The market value of the retired machine is $5 million. Your production costs will be $3.2 million per year. You also need an initial investment in net working capital of $1.5 million, which will be fully recovered at the end of the project. If your tax rate is 30 percent and you require a 10 percent return on your investment, what is the lowest bid price per ton you should submit? A. $2,017.49/ton B. $2,451.33/ton C. $1,951.33/ton D. $1,733.77/tonarrow_forward

- Smith Petroleum has spent $204,000 to refine 64,000 gallons of petroleum distillate, which can be sold for $6.20 per gallon. Alternatively, Smith can process the distillate further and produce 53,000 gallons of cleaner fluid. The additional processing will cost $1.80 per gallon of distillate. The cleaner fluid can be sold for $9.30 per gallon. To sell cleaner fluid, Smith must pay a sales commission of $0.10 per gallon and a transportation charge of $0.16 per gallon. Read the requirements. Requirement 1. Fill in the diagram for Smith's alternatives. Joint costs of producing 64,000 gallons of petroleum distillate The Cost of processing further Revenues from selling as is Revenues from processing further Requirement 2. Identify the sunk cost. Is the sunk cost relevant to Smith's decision? is a sunk cost that C differ between the alternatives of selling as is or processing further. Consequently, this sunk cost is ▼to the sell-or-process-further decision.arrow_forwardTempo Company has 20,000 units of its product that were produced at a cost of $300,000. The units were damaged in a rainstorm. Tempo can sell the units as scrap for $40,000, or it can rework the units at a cost of $76,000 and then sell them for $100,000. If Tempo Company reworks the units, incremental income will be.arrow_forwardBig Seats has the capacity to produce 100,000 sofas per year but only produces 80,000 sofas per year. The sale price is $1,000 each. Direct materials equals $100 per sofa, direct labor equals $200 per sofa, and allocated overhead equals $100,000 per year. Buy & Large offers to buy an additional 2,000 sofas but is only willing to pay $800 per sofa. What is the additional operating income (loss) of accepting the offer? ENTER NEGATIVE NUMBERS WITH A "_" SIGN. DO NOT USE PARENTHESES. EXAMPLE: -1000arrow_forward

- Novak Fashions needs to replace a beltloop attacher that currently costs the company $58,000 in annual cash operating costs. This machine is of no use to another company, but it could be sold as scrap for $3,128. Managers have identified a potential replacement machine, Euromat's Model HD-435. The HD-435 is priced at $93,000 and would cost Novak Fashions $38,000 in annual cash operating costs. The machine has a useful life of 8 years, and it is not expected to have any salvage value at the end of that time. Click here to view the factor table.arrow_forwardSunland Inc. manufactures snowsuits. Sunland is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased 5 years ago at a price of $1.8 million; six months ago, Sunland spent $55,000 to keep it operational. The existing sewing machine can be sold today for $244,395. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 2 3 4 5 6 7 $389,500 400,400 410,500 425,400 O 433,000 435,400 436,600 The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value expected to be $379,200. This new equipment would require maintenance costs of $98,000 at the end of the fifth year. The cost of capital is 9%. Click here to view PV table. Use the net present value method to determine the following: (If net present value is negative then enter with negative signi preceding the number eg.-45 or…arrow_forwardDanford Company, a manufacturer of farm equipment, currently produces 20,000 units of gas filters per year for use in its lawn-mower production. The costs, based on the previous year's production, are reported below. It is anticipated that gas-filter production will last five years. If the company continues to produce the product in-house, annual direct material costs will increase $3000/year (For example, annual material costs during the first production year will be $63,000.) Direct labor will also increase by $5000/year. However, variable overhead costs will increase at the rate of $2000/year and the fixed overhead will remain at its current level over the next five years. John Holland Company has offered to sell Danford 20,000 units of gas filters for $25 per unit. If Danford accepts the offer, some of the manufacturing facilities currently used to manufacture the filter could be rented to a third party for $35,000 per year. The firm's interest rate is known to be 15%. What is the…arrow_forward

- McSwing Inc. has decided to sell a new line of golf clubs. They will sell for $925 per set and have a variable cost of $480 per set. The company has determined that they will sell 75,000 units per year for the next 5 years. The fixed cost each year will be $14 million dollars. The company has to spend $1 million dollars on R&D for the club as a one time expense. The plant and equipment required will cost $50 million and will depreciate straight line to zero over five years. The expected salvage value of the plant and equipment is $3 million dollars. The new clubs will require an increase in net working capital of $3.5 million. The tax rate is 23% and the cost of capital is 14%. Calculate NPV. Based on this information, will you do the project?arrow_forwardBarron Chemical uses a thermoplastic polymer to enhance the appearance of certain RV panels. The initial cost of one process was $126,000 with annual costs of $48,000. Revenues are $78,000 in year 1, increasing by $1000 per year. A salvage value of $23,000 was realized when the process was discontinued after 8 years. What rate of return did the company make on the process? The rate of return made by the company isarrow_forwardJ. Smythe, Incorporated, manufactures fine furniture. The company is deciding whether to introduce a new mahogany dining room table set. The set will sell for $6,130, including a set of eight chairs. The company feels that sales will be 2,600, 2,750, 3,300, 3,150, and 2,900 sets per year for the next five years, respectively. Variable costs will amount to 48 percent of sales and fixed costs are $1,880,000 per year. The new tables will require inventory amounting to 13 percent of sales, produced and stockpiled in the year prior to sales. It is believed that the addition of the new table will cause a loss of 550 tables per year of the oak tables the company produces. These tables sell for $4,200 and have variable costs of 43 percent of sales. The inventory for this oak table is also 13 percent of sales. The sales of the oak table will continue indefinitely. J. Smythe currently has excess production capacity. If the company buys the necessary equipment today, it will cost $16,000,000.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education