FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Washington’s engineers have found a way to reduce equipment manufacturing time. The new method would cost an additional $500 per unit and would allow Washington to manufacture 30 additional units a year. Should Washington implement the new method? Show your calculations.

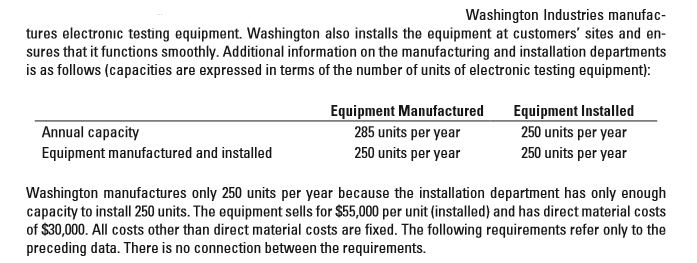

Transcribed Image Text:Washington Industries manufac-

tures electronic testing equipment. Washington also installs the equipment at customers' sites and en-

sures that it functions smoothly. Additional information on the manufacturing and installation departments

is as follows (capacities are expressed in terms of the number of units of electronic testing equipment):

Annual capacity

Equipment manufactured and installed

Equipment Manufactured

285 units per year

250 units per year

Equipment Installed

250 units per year

250 units per year

Washington manufactures only 250 units per year because the installation department has only enough

capacity to install 250 units. The equipment sells for $55,000 per unit (installed) and has direct material costs

of $30,000. All costs other than direct material costs are fixed. The following requirements refer only to the

preceding data. There is no connection between the requirements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are considering two different methods of constructing a new warehouse. The first method uses prefabricated building segments, would have an initial cost of $4.8 million, would have annual maintenance costs of $100,000 and would last for 25 years. The second alternative would employ a new carbon fibre panel technology, would have an initial cost of $6 million would have maintenance costs of $525,000 every ten years and is expected to last 40 years. Both buildings are in CCA class 1 (CCA rate of 4%). The salvage value for each would be 25% of initial cost. The firm uses a 15% cost of capital and it has a 38% tax rate. Calculate the NPV for each machine using the six step approach (nearest dollar without dollar sign ($) or comma eg 15000) Negative cash flow is -15000): What is the NPV for Alternative A? What is the NPV for Alternative B? What is the EAC for Alternative A? What is the EAC for Alternative B?arrow_forwardBilly Bob's Crab & Oyster Shack wants to reduce the cost of labour by replacing some labour with machines. If Billy Bob's were to purchase a machine to shuck the oysters, it can save $50,000 a year for 10 years. The new machine will cost $650,000 and it will be worth $50,000 at the end of the 10 year period. The firm believes it will need $10,000 in spare parts inventory (increase in NWC), which it can sell for the $5,000 at the end of the project. The machine has a 20% CCA rate and the firm has a 15% tax rate. If they want a 20% return on their investment what is the NPV? Round your answer to the nearest dollar, no dollar sign, no commas, put negative sign if needed.arrow_forwardPlease show all equations and work as needed. Make the correct answer clear. If possible, please type work so it can be copied. Thank you.arrow_forward

- You have been asked to determine the most financially advantageous option for a new Product Packaging machine. It has been determined by the Marketing Department that product packaging actually makes a difference in the anticipated Yearly Revenue generated by this product and have been provided below. The director now wants an annual worth analysis performed on the two final designs based on a shortened project life of only 9 years. Compare the alternatives at the MARR of 10% per year. (all dollar values are in thousands) Packaging Packaging Machine Design Machine Design A B First Cost, $ -900 -1,500 AOC, $ per year -200 -300 Salvage value, $ (after 7 years of use) 200 Salvage value, $ (after 3 years of use) 100 Salvage value, $ (after 2 years of use) 20 50 Annual revenue, $ per year 800 900 Life, years 3 7 AW ($K per year) for one full life 268.312 312.967 cycle AW for a particle life of 2 years ($K 90.953 -240.476 per year) Assuming that the AW values for Designs A and B provided in…arrow_forward"I'm not sure we should lay out $335,000 for that automated welding machine," said Jim Alder, president of the Superior Equipment Company. "That's a lot of money, and it would cost us $91,000 for software and installation, and another $56,400 per year just to maintain the thing. In addition, the manufacturer admits it would cost $54,000 more at the end of three years to replace worn-out parts." "I admit it's a lot of money," said Franci Rogers, the controller. "But you know the turnover problem we've had with the welding crew. This machine would replace six welders at a cost savings of $121,000 per year. And we would save another $8,200 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 18% required rate of return." "I'm still not convinced," countered Mr. Alder. "We can only get $20,500 scrap value out of our old welding equipment if we sell it now, and in six years the new machine will…arrow_forwardA computerized machining center has been proposed for a small tool manufacturing company. If the new system, which costs $125,000, is installed, it will generate annual revenues of $100,000 and will require $20,000 in annual labor, $12,000 in annual material expenses, and another $8,000 in annual overhead (power and utility) expenses. A loan of $100,000 is borrowed from the bank for installation of the machining center which is repaid by equal annual repayments in 5 years at an interest rate of 8% compounded quarterly. Note that there is a working-capital requirement of $23,331 in year 0 and full recovery of the working capital at the end of year 5 for the machining center. The machining center would be classified as a seven-year MACRS property. If the asset is held for eight years, we can depreciate a seven-year property in respective percentages of 14.29%, 24.49%, 17.49%, 12.49%, 8.93%, 8.92%, 8.93%, and 4.46%. The company expects to phase out the facility at the end of five years,…arrow_forward

- NEED help with this Questionarrow_forwardCalculate the NPV based upon the following facts: Bob has just completed the development of a better face shield for health workers. The new product is expected to produce annual revenues of $230,000. Bob requires an investment in an advanced 3D Printer costing $30,000. The project has an expected life of 5 years. The 3D printer will have a $20,000 salvage value at the end of 5 years. Working capital is expected to increase by $80,000 which Bob will recover at the end of the products life cycle. Annual operating expenses are estimated at $200,000. The required rate of return is 4%.arrow_forwardWendell’s Donut Shoppe is investigating the purchase of a new $40,000 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $5,200 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,000 dozen more donuts each year. The company realizes a contribution margin of $2.40 per dozen donuts sold. The new machine would have a six-year useful life. Required: 4. In addition to the data given previously, assume that the machine will have a $10,515 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your final answer to the nearest whole percentage.)arrow_forward

- “I’m not sure we should lay out $350,000 for that automated welding machine,” said Jim Alder, president of the Superior Equipment Company. “That’s a lot of money, and it would cost us $94,000 for software and installation, and another $60,000 per year just to maintain the thing. In addition, the manufacturer admits it would cost $57,000 more at the end of three years to replace worn-out parts.” “I admit it’s a lot of money,” said Franci Rogers, the controller. “But you know the turnover problem we’ve had with the welding crew. This machine would replace six welders at a cost savings of $124,000 per year. And we would save another $8,500 per year in reduced material waste. When you figure that the automated welder would last for six years, I’m sure the return would be greater than our 15% required rate of return.” “I’m still not convinced,” countered Mr. Alder. “We can only get $22,000 scrap value out of our old welding equipment if we sell it now, and in six years the new machine…arrow_forwardplease asnwer correctly: Your company has been approached to bid on a contract to sell 5,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $3.4 million and will be depreciated on a straight-line basis to a zero salvage value. Production will require an investment in net working capital of $395,000 to be returned at the end of the project, and the equipment can be sold for $325,000 at the end of production. Fixed costs are $595,000 per year, and variable costs are $85 per unit. In addition to the contract, you feel your company can sell 12,300, 14,600, 19,200, and 11,600 additional units to companies in other countries over the next four years, respectively, at a price of $180. This price is fixed. The tax rate is 23 percent, and the required return is 10 percent. Additionally, the president of the company…arrow_forwardplease show work i need to learn this. Cameron Industries is purchasing a new chemical vapor depositor in order to make silicon chips. It will cost $7,000,000 to buy the machine and $10,000 to have it delivered and installed. Building a clean room in the plant for the machine will cost an additional $3 million. The machine is expected to raise revenues by $3,000,000 per year, starting at the end of the first year, with associated costs (other than depreciation) of $1 million for each of those years. The machine is expected to have a working life of six years and will be depreciated over those six years. The marginal tax rate is 20%. What are the incremental free cash flows associated with the new machine in year 2? O $1,168,333 $831,667 $1,833,667 $1,165,000 O $665,334arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education