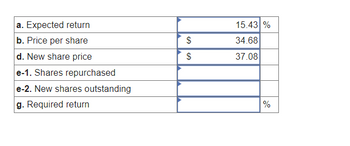

Warsaw Manufacturing, Incorporated, plans to announce that it will issue $2.05 million of perpetual debt and use the proceeds to repurchase common stock. The bonds will sell at par with a coupon rate of 6 percent. The company is currently all-equity and worth $6.52 million with 188,000 shares of common stock outstanding. After the sale of the bonds, the company will maintain the new capital structure indefinitely. The annual pretax earnings of $1.29 million are expected to remain constant in perpetuity. The tax rate is 22 percent. a. What is the expected return on the company’s equity before the announcement of the debt issue? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the price per share of the company's equity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is the company’s stock price per share immediately after the repurchase announcement? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) e-1. How many shares will the company repurchase as a result of the debt issue? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) e-2. How many shares of common stock will remain after the repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) g. What is the required return on the company’s equity after the restructuring? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

|

Warsaw Manufacturing, Incorporated, plans to announce that it will issue $2.05 million of perpetual debt and use the proceeds to repurchase common stock. The bonds will sell at par with a coupon rate of 6 percent. The company is currently all-equity and worth $6.52 million with 188,000 shares of common stock outstanding. After the sale of the bonds, the company will maintain the new capital structure indefinitely. The annual pretax earnings of $1.29 million are expected to remain constant in perpetuity. The tax rate is 22 percent. |

| a. |

What is the expected return on the company’s equity before the announcement of the debt issue? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) |

| b. | What is the price per share of the company's equity? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| d. | What is the company’s stock price per share immediately after the repurchase announcement? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| e-1. | How many shares will the company repurchase as a result of the debt issue? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| e-2. | How many shares of common stock will remain after the repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| g. | What is the required return on the company’s equity after the restructuring? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) |

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 7 images