FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Warren Marina owns a large marina that contains numerous boat slips of various sizes. Warren contracts with boat owners to provide

slips to house the customers' boats. Lucky Fisher Fleet contracted with Warren to provide space for four of its fishing boats.

The contract specifies that Lucky Fisher's boats will be kept in identified slips in the marina.

Warren has the right to shift the boats to other slips within its marina at its discretion, subject to the requirement to provide 45-

foot slips per boat for a three-year period. Warren frequently rearranges its customers' boats to meet the needs of new contracts.

Costs of reallocating space is low relative to the benefits of being able to accommodate more customers and their specific

requests.

Lucky Fisher paid $22,000 on March 1, 2024, for the first year's accommodations.

⚫ The market rate of interest is 5%.

Required:

Prepare the appropriate entry(s) for Lucky Fisher Fleet at March 1, the commencement of the agreement.

Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Use tables, Excel,

or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

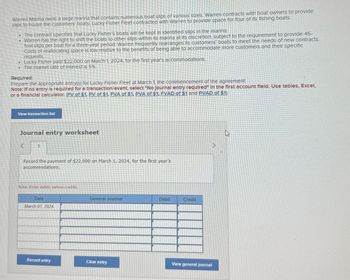

View transaction list

Journal entry worksheet

<

Record the payment of $22,000 on March 1, 2024, for the first year's

accommodations.

Note: Enter debits before credits.

Date

March 01, 2024

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kinnear Plastics manufactures various components for the aircraft and marine industry. Kinnear buys plastic from two vendors: Tappan Corporation and Hill Enterprises. Kinnear chooses the vendor based on price. Once the plastic is received, it is inspected to ensure that it is suitable for production. Plastic that is deemed unsuitable is disposed of. The controller at Kinnear collected the following information on purchases for the past year: Tappan Hill Total purchases (tons) 6,000 10,000 Plastic discarded 120 600 The purchasing manager has just received bids on an order for 290 tons of plastic from both Tappan and Hill. Tappan bid $1,813 and Hill bid $1,786 per ton. Required: Assume that the average quality, measured by the amounts discarded…arrow_forwardAt the start of Year 1, the City Peacock leased 30 computers for use by various officials in school administration and public safety at a total cost of $90,000 per year. The first lease payment is made immediately. The contracts are for five years, the expected life of the computers. After that life period, the city will return them to the lessor. What reporting is appropriate for the city for the first year?arrow_forwardWizardry Corporation's purpose clause in its charter states, "To operate a home-cleaning service business." After a few years of successful operation, Wizardry is offered the challenge of landscaping a neighboring business. If Wizardry accepts the offer, it would be violating its charter under: O a. the estoppel theory. O b. the de facto doctrine. O c. the de jure doctrine. O d. the ultra vires doctrine.arrow_forward

- Warren Marina owns a large marina that contains numerous boat slips of various sizes. Warren contracts with boat owners to provide slips to house the customers’ boats. Lucky Fisher Fleet contracted with Warren to provide space for four of its fishing boats. The contract specifies that Lucky Fisher’s boats will be kept in identified slips in the marina. Warren has the right to shift the boats to other slips within its marina at its discretion, subject to the requirement to provide 45-foot slips per boat for a three-year period. Warren frequently rearranges its customers’ boats to meet the needs of new contracts. Costs of reallocating space is low relative to the benefits of being able to accommodate more customers and their specific requests. Lucky Fisher paid $16,000 on March 1, 2024, for the first year’s accommodations. The market rate of interest is 5%. Required: Prepare the appropriate entry(s) for Lucky Fisher Fleet at March 1, the commencement of the agreement.arrow_forwardSeveral years ago, Grant County was sued by a former County employee for wrongful discharge. Although it was to be contested by the County, at the time of the lawsuit the attorneys believed that the County was likely to lose and the estimated amount of the ultimate judgment would be $100,000. This year, the case was finally settled with a judgment against the County of $150,000, which was paid. Assuming that the County maintains its books and records in a manner to facilitate the preparation of its government-wide financial statements, the entry in the current year should be a. Debit Expenditures $150,000; Credit Cash $150,000. b. Debit Expenses $150,000; Credit Cash $150,000. c. Debit Expenditures $50,000 and Claims Payable $100,000; Credit Cash $150,000. d. Debit Expenses $50,000 and Claims Payable $100,000; Credit Cash $150,000.arrow_forwardRussell Forest Products Limited needed to upgrade a burner at its sawmill in Cochrane, Ontario, to comply with the new air pollution standards. The new burner, which is used to burn the scrap wood from its sawing operations, will not only reduce the amount of pollution, but will supply heat for the plant facility, including the wood dryer. In order to encourage Russell Forest Products Limited in its compliance with the stan- dards, the Province of Ontario extended an interest-free loan of $400,000 on December 31, 2011. The only conditions in obtaining the interest-free loan are that the loan proceeds be applied directly to the construction costs and that the loan be repaid in full on December 31, 2019. RussellForest Products Limited borrowed the remaining funds from the bank for the construction of the burner and will be paying interest at the rate of 7% per year. Instructions (a) Discuss the issues related to obtaining the interest-free loan from the Province of Ontario. (b)…arrow_forward

- Accounting SBITAS are accounted for similarly to leases. A city signs a three- year licensing agreement with a soft-ware company for use of a payroll management system in its electrical utility fund. Annual charges are $10,000 per year. It is the policy of the city to use a discount rate of 6 percent to value right- to- use assets when an interest rate is not explicitly stated in a lease or comparable agreement. It also depreciates all capital and similar assets on a straight- line basis. The subscription period runs from January 1, 20X1 through December 31, 20X3, with payment due on January 1 of each of the three years. 1. Prepare a journal entries to record the start of the licensing agreement on January 1, 20X1 in its electrical utility fund (a proprietary fund) as well as the first payment of $10,000. 2. Prepare an entry to record an appropriate journal entry on December 31, 20X1. 3. Prepare an entry to record the second payment of $10,000 on January 1, 20X2.arrow_forwardSand and Sea Resorts owns and operates two resorts in a coastal town. Both resorts are located on a barrier island that is connected to the mainland by a high bridge. One resort is located on the beach and is called the Crystal Coast Resort. The other resort is located on the inland waterway which passes between the town and the mainland; it is called the Harborview Resort. Some key information about the two resorts for the current year is shown below. Harborview Crystal Coast Total Revenue (000s) $ 3,500 $ 6,500 $ 10,000 Square feet 75,000 225,000 300,000 Rooms 60 140 200 Assets (000s) $ 214,000 $ 856,000 $ 1,070,000 The nontraceable operating costs of the resort amount to $4,000,000. By careful study, the management accountant at Sand and Sea has determined that, while the costs are not directly traceable, the total of $4 million could be fairly allocated to the four cost drivers as follows. Cost Driver Amount Allocated Revenue $ 275,000 Square feet…arrow_forwardRiverbed Company manufactures equipment. Riverbed's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $ 200,000 to $ 1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Riverbed has the following arrangement with Winkerbean Inc. Winkerbean purchases equipment from Riverbed fora price of $ 1,100,000 and contracts with Riverbed to install the equipment. Riverbed charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Riverbed determines installation service is estimated to have a standalone selling price of $ 46,000. The cost of the equipment is $ 580,000. Winkerbean is obligated to pay Riverbed the $ 1,100,000 upon the delivery and…arrow_forward

- Video Planet (VP) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer's home entertainment system. VP concludes that the TV, remote, and installation service are separate performance obligations. VP sells the 60-inch TV separately for $1,750, sells the remote separately for $100, and offers the entire package for $1,900. VP does not sell the installation service separately. VP is aware that other similar vendors charge $150 for the installation service. VP also estimates that it incurs approximately $100 of compensation and other costs for VP staff to provide the installation service. VP typically charges 40% above cost on similar sales. Required: 1. to 3. Estimate the stand-alone selling price of the installation service using each of the following approaches. Adjusted market assessment Expected cost plus…arrow_forwardA city government adds streetlights within its boundaries at a total cost of $336,000. These lights should burn for at least 12 years but can last significantly longer if maintained properly. The city develops a system to monitor these lights with the goal that 97 percent will be working at any one time. During the year, the city spends $50,200 to clean and repair the lights so that they are working according to the specified conditions. The city also spends another $87,600 to construct lights for several new streets. a. Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide financial statements. b. Prepare the entries assuming infrastructure assets are capitalized with government using the modified approach on government- wide financial statements. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded…arrow_forwardVikrambhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education