FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

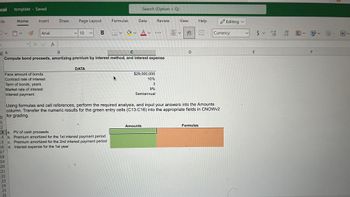

Transcribed Image Text:cel template - Saved

File

D

3

Home

Insert

Arial

X ✓ fx

B Interest payment

9

Face amount of bonds

Contract rate of interest

Term of bonds, years

Market rate of interest

Draw

Page Layout

10

B

DATA

Formulas

0

1

12

13 a. PV of cash proceeds

14 b. Premium amortized for the 1st interest payment period

15

c. Premium amortized for the 2nd interest payment period

16

d. Interest expense for the 1st year

17

18

19

20

21

22

23

24

25

26

Search (Option + Q)

Data

A

B

C

Compute bond proceeds, amortizing premium by interest method, and interest expense

H✓ ✓ A✓

$29,000,000

10%

3

9%

Semiannual

Review

Amounts

..

View

=✓

ab

се

L

D

Using formulas and cell references, perform the required analysis, and input your answers into the Amounts

column. Transfer the numeric results for the green entry cells (C13:C16) into the appropriate fields in CNOWv2

for grading.

furgonetas canon▬▬

Help

Formulas

Editing

Currency

E

$ 5.000

V

.00

→.0

・図・図

F

Transcribed Image Text:<

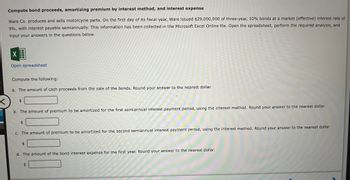

Compute bond proceeds, amortizing premium by interest method, and interest expense

Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $29,000,000 of three-year, 10% bonds at a market (effective) interest rate of

9%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and

input your answers in the questions below.

X

Open spreadsheet

Compute the following:

a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar.

$

b. The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar.

$

c. The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar.

$

d. The amount of the bond interest expense for the first year. Round your answer to the nearest dollar.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer and provide narration for each and every entry with all other work answer in textarrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hitzu Company sold a copier (that costs $6,500) for $13,000 cash with a two-year parts warranty to a customer on August 16 of Year 1. Hitzu expects warranty costs to be 5% of dollar sales. It records warranty expense with an adjusting entry on December 31. On January 5 of Year 2, the copier requires on-site repairs that are completed the same day. The repairs cost $93 for materials taken from the parts inventory. These are the only repairs required in Year 2 for this copier. Exercise 9-13 (Algo) Financlal statement impact of warranty transactions LO P4 Analyze each of the following transactions: (a) the copier's sale; (b) the adjustment to recognize the warranty expense on December 31 of Year 1; and (c) the repairs that occur on January 5 of Year 2. Show each transaction's effect on the accounting equation-specifically, identify the…arrow_forwardeBook Campus Flights takes out a bank loan in the amount of $300,000 on March 1. The terms of the loan include a repayment of principal in ten equal installments, paid annually from March 1. The annual interest rate on the loan is 9 percent, recognized on December 31. A. Compute the interest recognized as of December 31 in year 1. 22,500 B. Compute the principal due in year 1. 280,271. X Feedbak Check My Work A. Remember that the interest formula is principal x rate x time. Interest is a function of time that has passed. Refer to the textbook for examples of the formula applied. B. The principal payment in the first year is a function of the time period served in that yeararrow_forward

- Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $83,000,000 of five-year, 8% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar.arrow_forwardOutstanding Publishing completed the following transactions during 2024: i (Click the icon to view the transactions.) Journalize the transactions (explanations are not required). Round to the nearest dollar. (Record debits first, then credits. Exclude explanations from journal entries.) Oct. 1: Sold a six-month subscription (starting on November 1), collecting cash of $300, plus sales tax of 4%. (Prepare a single compound entry for this transaction.) Credit Date Accounts and Explanation Debit Oct. 1 More info Oct. 1 Nov. 15 Dec. 31 Sold a six-month subscription (starting on November 1), collecting cash of $300, plus sales tax of 4%. Remitted (paid) the sales tax to the state of Tennessee. Made the necessary adjustment at year-end to record the amount of subscription revenue earned during the year. Print Done Xarrow_forwardCompute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $80,000,000 of five-year, 9% bonds at a market (effective) interest rate of 11%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ d. The amount of the bond interest expense for the first…arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardWare Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $37,000,000 of three-year, 11% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. The amount of the bond interest expense for the first year. Do not round intermediate calculations. Round your final answer to the nearest dollar.arrow_forwardHelp me selecting the right answer. Thank youarrow_forward

- 5 0 V File C13 123456 7 89 Home 18 19 20 Insert Arial X ✓ fx Face amount of bonds Contract rate of interest Draw Term of bonds, years Market rate of interest Interest payment Page Layout く 10 Formulas DATA B ✓ ✓ V Data A B C Compute bond proceeds, amortizing discount by interest method, and interest expense Av $80,000,000 9% 5 11% Semiannual Review Amount ... View Ev ab ≡く D Using formulas and cell references, perform the required analysis, and input your answers into the Amount column. Transfer the numeric results for the green entry cells (C13:C16) into the appropriate fields in CNOWv2 10 for gradina. 11 12 13 a. PV of cash proceeds 14 b. Discount amortized for the 1st interest payment period 15 c. Discount amortized for the 2nd interest payment period 16 d. Interest expense for the 1st year 17 Help Formulas Editing ✓ Currency E $ 500 ✓ C →>>arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardOn May 15, 2022, Powell Incorporated obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $478,700. The interest rate charged by the bank was 6.75%. The bank made the loan on a discount basis. Exercise 7-7 (Algo) Part a - Journal entry a-3. Record the journal entry to show the effect of signing the note and the receipt of the cash proceeds on May 15, 2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education