FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

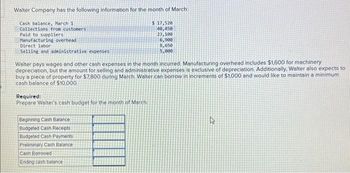

Transcribed Image Text:Walter Company has the following information for the month of March:

$ 17,520

40,450

23,100

Cash balance, March 1

Collections from customers

Paid to suppliers

Manufacturing overhead

Direct labor

Selling and administrative expenses

Walter pays wages and other cash expenses in the month incurred. Manufacturing overhead includes $1,600 for machinery

depreciation, but the amount for selling and administrative expenses is exclusive of depreciation. Additionally, Walter also expects to

buy a piece of property for $7.800 during March. Walter can borrow in increments of $1,000 and would like to maintain a minimum

cash balance of $10,000.

Required:

Prepare Walter's cash budget for the month of March.

6,900

8,650

5,000

Beginning Cash Balance

Budgeted Cash Receipts

Budgeted Cash Payments

Preliminary Cash Balance

Cash Borrowed

Ending cash balance

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June $155,600 $192,800 $213,600 Manufacturing costs* Insurance expense** 880 Depreciation expense 2,180 Property tax expense*** 590 *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $880 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. 880 2,180 590 880 2,180 590 The cash payments expected for Finch Company in the month of May are O a. $183,500 O b. $144,600 Oc. $38,900 O d. $222,400arrow_forwardA company began operations in March with cash and common stock of $36,000. The company made $582,000 in net income in its first month. It performed print jobs for customers and billed these customers $900,000. The company collected half of its receivables by the end of the month. The company had a cost of goods sold of $162,000 paid for in cash and $6,000 inventory left over at the end of the month. The company's employees earned wages but those are not paid until the first of April. This was the company’s only liability. How would I calculate the income statement and balance sheet for the end of March?arrow_forwardJake’s Roof Repair has provided the following data concerning its costs: Fixed Costper Month Cost perRepair-Hour Wages and salaries $ 20,900 $ 15.00 Parts and supplies $ 7.60 Equipment depreciation $ 2,730 $ 0.55 Truck operating expenses $ 5,750 $ 1.60 Rent $ 4,650 Administrative expenses $ 3,870 $ 0.70 For example, wages and salaries should be $20,900 plus $15.00 per repair-hour. The company expected to work 2,900 repair-hours in May, but actually worked 2,800 repair-hours. The company expects its sales to be $48.00 per repair-hour. Required: Compute the company’s activity variances for May.arrow_forward

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: June $201,000 Manufacturing costs" Insurance expense** April May $157,200 $197,600 970 970 2,200 420 2,200 420 970 Depreciation expense Property tax expense*** "Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $970 a month; however, the insurance is paid four times yearly in the first month of the quarter, (.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of May are O&$187.500 b. $39,300 Oe5148,200 Od $226,800 2,200 420arrow_forwardWyckam Manufacturing Incorporated has provided the following estimates concerning its manufacturing costs: Direct materials Direct labor Supplies Utilities Depreciation Insurance Fixed Cost per Month $ 42,100 $ 1,200 $ 14,600 $ 11,400 For example, utilities should be $1,200 per month plus $0.25 per machine-hour. The company expects to work 4,000 machine- hours in June. Note that the company's direct labor is a fixed cost. Direct materials Direct labor Cost per Machine- Hour $ 5.50 Required: Prepare the company's planning budget for June. Wyckam Manufacturing Incorporated Planning Budget for Manufacturing Costs For the Month Ended June 30 Supplies Utilities Depreciation Insurance Total manufacturing cost $ 0.30 $ 0.25arrow_forwardWalter Company has the following information for the month of March: Cash balance, March 1 Collections from customers Paid to suppliers Manufacturing overhead Direct labor Selling and administrative expenses $ 17,220 39,450 22,900 6,700 8,550 4,800 Walter pays wages and other cash expenses in the month incurred. Manufacturing overhead includes $1,500 for machinery depreciation, but the amount for selling and administrative expenses is exclusive of depreciation. Additionally, Walter also expects to buy a piece of property for $7,600 during March. Walter can borrow in increments of $1,000 and would like to maintain a minimum cash balance of $11,000. Required: Prepare Walter's cash budget for the month of March. Beginning Cash Balance Budgeted Cash Receipts Budgeted Cash Payments Preliminary Cash Balance Cash Borrowed Ending cash balancearrow_forward

- The following represents the financial information for Plaza Plastics for May and June: May June Sales revenue $ 747,000 $ 540,000 Costs Scrap $ 2,000 $ 1,710 Process inspection 2,880 1,760 Quality training 23,780 11,720 Product testing equipment 5,180 4,340 Field testing 8,420 6,320 Warranty repairs 3,380 3,080 Rework 19,780 16,670 Preventive maintenance 16,220 8,570 Legal expense for warranty claims 7,820 4,340 Materials inspection 11,300 11,180 Required: Classify these items into Prevention, Appraisal, Internal failure, or External failure costs. Calculate the ratio of the prevention, appraisal, internal failure, and external failure costs to sales for May and Junearrow_forwardUsing the following information. a. Beginning cash balance on March 1, $81,000. b. Cash receipts from sales, $305.000. c. Cash payments for direct materials, $130.000. d. Cash payments for direct labor. $79,000. e. Cash payments for overhead, $38.00. f. Cash payments for sales commissions, $7000 g. Cash payments for interest, $130 (1% of beginning loan balance of $13,000) h. Cash repayment of loan, $13.000. Prepare a cash budget for March for Gado Company. GADO COMPANY Cash Budget March Total cash available Less: Cash payments for Total cash payments $4 Loan activity Loan balance, end of month %24 K Prev earcharrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: May $198,000 April $156,000 a. $49,500 b. $252,000 c. $202,500 d. $153,000 Manufacturing costs* Insurance expense** Depreciation expense Property tax expense*** *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $900 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments for Finch Company expected in the month of June are 900 1,850 500 900 1,850 June 500 $204,000 900 1,850 500 Previous Nextarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education