Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

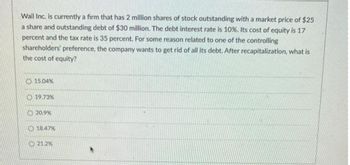

Transcribed Image Text:Wail Inc. is currently a firm that has 2 million shares of stock outstanding with a market price of $25

a share and outstanding debt of $30 million. The debt interest rate is 10%. Its cost of equity is 17

percent and the tax rate is 35 percent. For some reason related to one of the controlling

shareholders' preference, the company wants to get rid of all its debt. After recapitalization, what is

the cost of equity?

15.04%

19.73%

20.9%

18.47%

21.2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Pennewell Publishing Inc. (PP) is a zero growth company. It currently has zero debt and its earnings before interest and taxes (EBIT) are $80,000. PP's current cost of equity is 10%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. Refer to Exhibit 16.1. Assume that PP is considering changing from its original capital structure to a new capital structure with 35% debt and 65% equity. This results in a weighted average cost of capital equal to 9.4% and a new value of operations of $510,638. Assume PP raises $178,723 in new debt and purchases T-bills to hold until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase? A) $45.90 B) $48.12 C) $51.06 (D) $53.33 (E) $58.75arrow_forwardAppliances, Inc. has no debt outstanding, and its financial position is given by the following data: Assets (market value = book value) $5,000,000 EBIT $800,000 Cost of equity 12% Stock price $10 Shares outstanding 500,000 Tax rate 25% The firm is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 20% debt based on market values, its cost of equity will increase to 13% to reflect the increased risk. Bonds can be sold at a cost of 6%. Appliance, Inc. is a no-growth firm. Hence, all its earnings are paid out as dividends. Earnings are expected to be constant over time. As a creditor, you are concerned about the company’s ability to repay its debt and interest. What is the new times interest earned?arrow_forwardManshukharrow_forward

- n Tina Black's Fabrics is currently an all equity firm that has 15,000 shares of stock outstanding at a market price of $12.50 a share. Company management has decided to issue $60,000 worth of debt and use the funds to repurchase shares of the outstanding stock at the market price. The interest rate on the debt will be 7%. Ignoring taxes, what is the earnings per share (EPS) at the break-even level of earnings before interest and taxes (EBIT)? O A. O B. O D. $1.143 O C. $1.500 SOE. $1.125 $0.875 $0.667 27/arrow_forward6 Please show work in Excel format, thanks!arrow_forwardVanMannen Foundations, Inc. (VF)VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. EBIT = $80,000 Growth = 0% Orig cost of equity, rs = 10.0% No. of shares = 10,000 Price per share = $60.00 Tax rate = 25% Refer to the data for VanMannen Foundations, Inc. (VF). Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below. If this plan were carried out, what would be VF's new WACC and its new value of operations? New interest rate = rd = 6.00% New cost of equity = rs = 10.75% New Debt/Value = wd = 20% New Equity/Value = ws = 80% Whic one is correct? WACC Value a. 10.10%…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education