Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

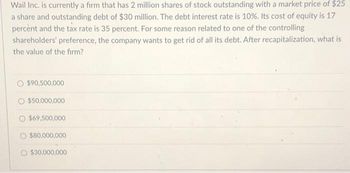

Transcribed Image Text:Wail Inc. is currently a firm that has 2 million shares of stock outstanding with a market price of $25

a share and outstanding debt of $30 million. The debt interest rate is 10%. Its cost of equity is 17

percent and the tax rate is 35 percent. For some reason related to one of the controlling

shareholders' preference, the company wants to get rid of all its debt. After recapitalization, what is

the value of the firm?

$90,500,000

$50,000,000

$69,500,000

O $80,000,000

$30,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 12. Ernesto, Ine has projected average earnings every year of Php 100,000,000. Debt to Equity Ratio is 3:1 After tax cost of debt is 5% while the cost of equity is 10%. The Board of Directors of the company decided to sell the company for 1,000,000,000 computes for the Economic Value Added (EVA). a) Php 37,500,000.00 b) Php 50,000,000.00 c) Php 0 d) Php 25,000,000.00arrow_forwardA firm with sales of $1,000,000, net profits after taxes of $60,000, total assots of $1,500,000, and totol liabilities of $750,000 has a return on equity ot Select one: O a. 15 percent. b. 20 percent. c. 4 percent. O d. 8 percent. e. None of the abovearrow_forwardABC Corp is a manufacturing company with the following information: 1, Financial Statements: Net Income: $10 million Depreciation: 55 million Capital Expenditures (CapEx): $8 million Changes in Working Capital. $2 million (increase) 2. Balance Sheet Total Debt: $40 million (long-term debt) Total Equity: $60 million Total Assets $100 million 3. Market information: Risk Free Rate: 3% Market Risk Premium: 5% Comparable Companies Unlevered Beta 1.0 (overage of industry peers) Tax Rate: 30% Current Stock Price: $25 per share Number of Shares Oustanding 4 million 4. Assumptions: Terminal Growth Rate: 5% Long-term WACC: 0.25% less than the Initial WACC Questions: a. Calculate the Free Cash Flow to the Firm (FCFF) for ABC Corp for the next five years. b. Determine the Cost of Equily using the Capital Asset Pricing Model (CAPM) with unleverted bela. c. Cakulate the Levered Beta for ABC Corp by using the industry average unlovered beta and the company's capital structure d. Calculate the Cost of…arrow_forward

- Question: Barette Consulting currently has no debt in its capital structure, has $500 million of total assets, and its basic earning power is 15%. The CFO is contemplating a recapitalization where it will issue debt at a cost of 10% and use the proceeds to buy back shares of the company's common stock, paying book value. If the company proceeds with the recapitalization, its operating income, total assets, and tax rate will remain unchanged. Which of the following is most likely to occur as a result of the recapitalization? a. The ROA would remain unchanged. b. The basic earning power ratio would decline. c. The basic earning power ratio would increase. d. The ROE would increase. e. The ROA would increase.arrow_forwardWhat is the company's WACC if it has the following capital structure and 40% tax rate? 7.5% Market Value Required rate of return Bond $60,000,000 4% Preferred Stock $60,000,000 6% Common Stock $120,000,000 10% O 6.67% O 9.4% 7.1%arrow_forwardHelpp me plssarrow_forward

- 6 Please show work in Excel format, thanks!arrow_forwardA5 6e DEF Company is comparing three different capital structures. Plan A is an all-equity plan and would result in 1000 shares of stock. Plan B would result in 700 shares of stock and $13,500 in debt. Plan C would result in 800 shares of stock and $9000 in debt. The firm’s EBIT will be $10,000 per year until infinity. The interest rate on the debt is 12%. e. Ignoring taxes, what is the break-even EBIT that will cause the EPS on Plan B to be equal to the EPS on Plan C?arrow_forward2. Conspicuous Consumption Ine, a prominent consumer products firm is debating Whether or not to convert its all-equity capital structure to one that is 35 percent debt. Currently. there are 8,000 shares outstanding and the prise per share is $70. EBIT is expected to remain at $30,000 per year forever, the interest rate on new debt is 8 percent and there are no taxes. A. Ms. Brown,a shareholder of the firm .owns 100shares of stock .what is her cashi flow under the current capital structure, assuming the firm has a dividend payout rate of 100 percent? B. What will Ms. Brown's cash flow be under the proposed capital structure of the firm? Assume that she keeps all 100 of her shares. C. Suppose the company does convert, but MS Brown prefers the current all-equity capital structure. Show how she could unlever her shares of stock to Recreate the original capital structure. D. Using your answer to part (C) explain why the company's choice of capital Structure is irrelevant.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education