FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

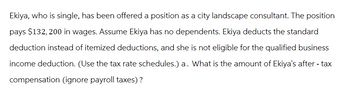

Transcribed Image Text:Ekiya, who is single, has been offered a position as a city landscape consultant. The position

pays $132, 200 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard

deduction instead of itemized deductions, and she is not eligible for the qualified business

income deduction. (Use the tax rate schedules.) a. What is the amount of Ekiya's after-tax

compensation (ignore payroll taxes)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select the best answer. An example of investment income that would be subject to the net investment income tax is: O A. Rental and royalty income O B. Tax-exempt interest O C. Wages O D. Self-employment income Submit Answersarrow_forwardPlease discuss the deductibility of real property taxes.arrow_forwardhow to calculate someones adjusted basis in taxarrow_forward

- Illumination Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year Budgeted costs of operating the plant for 2,000 to 3,000 hours: Fixed operating costs per year Variable operating costs Budgeted long-run usage per year Flashlight Division Night Light Division Practical capacity $500,000 OA. $500,000 B. $625.000 OC. $600,000 D. $650,000 $500 per hour 2,000 hours 1,000 hours 4,000 hours Assume that practical capacity is used to calculate the allocation rates Actual usage for the year by the Flashlight Division was 1,500 hours and by the Night Light Division was 800 hours If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Night Light Division?arrow_forward. What is the 'low income tax offset' (LITO)? What is the maximum LITO amount payable toeligible taxpayers? PLEASE PUT 3 REFERENCESarrow_forwardA tax that requires a higher-income person to pay a higher percentage of his or her income in taxes is called a ____ tax. a. proportional b. progressive c.marginal d. regressivearrow_forward

- Define the term payroll taxes.arrow_forwardCould I get the entire answer please? Earnings before taxes, net income and taxes?arrow_forwardWhich is a factor in determining federal income tax withheld? A. Level of wages B. Marital status C. Number of dependents D. Pay period E. All of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education