FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ved

Help

Save & Exit

10

eBook

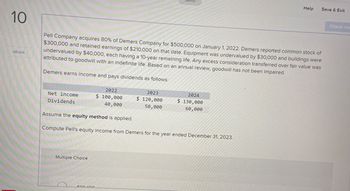

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2022. Demers reported common stock of

$300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were

undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was

attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.

Demers earns income and pays dividends as follows:

Net income

Dividends

2022

$ 100,000

40,000

2023

$ 120,000

50,000

2024

$ 130,000

60,000

Assume the equity method is applied.

Compute Pell's equity income from Demers for the year ended December 31, 2023.

Multiple Choice

.........

600.100.

Check my

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forward2-McKinney Company acquires an 60% interest in its Sandstone for a purchase price of $1.000,000. The excess of the purchase price over the book value of the Sandstone’s Stockholders’ Equity is allocated to a building (in PPE, net) that is worth $212,250 more than its book value, an unrecorded Patent that the parent valued at $125,000, and Goodwill of $348,417, 60% of which is allocated to the parent. The parent and the Sandstone report the following balance sheets on the acquisition date: McKinney Sandstone McKinney Sandstone Cash $1,500,000 $300,000 Current Liabilities $750,000 $300,000 Accounts receivable 1,597,500 240,000 Long-term Liabilities 1,268,222 410,000 Inventory 2,689,550 275,000 Common Stock 235,000 75,000 Equity Investment 1,000,000 APIC 5,472,211 156,000 PPE, net 6,008,510 876,000 Retained Earnings 5,070,127 750,000…arrow_forward3 Franklin purchases 40 percent of Johnson Company on January 1 for $500,000. Although Franklin did not use it, this acquisition gave Franklin the ability to apply significant influence to Johnson's operating and financing policies. Johnson reports assets on that date of $1,400,000 with liabilities of $500,000. One building with a seven-year remaining life is undervalued on Johnson's books by $140,000. Also, Johnson's book value for its trademark (10-year remaining life) is undervalued by $210,000. During the year, Johnson reports net income of $90,000 while declaring dividends of $30,000. What is the Investment in Johnson Company balance (equity method) in Franklin's financial records as of December 31? Skipped References Multiple Choice $507,600. $516,000. $513,900. $504,000.arrow_forward

- A5arrow_forwardim.2arrow_forwardSue Inc. acquires 80% of lan Co. for $500,000 on January 2, 2024. lan reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired. lan Co. earns income and pays dividends as follows: 2024 2025 Net income $ 100,000 $120,000 $130,000 Dividends 40,000 50,000 60,000 Assume the equity method is applied. Compute the non-controlling interest in lan at December 31, 2024. O $135,600. $137,000. O $112,000. $100,000. 2026 O $118,600.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education