FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Vaughn's assets on December 31,2020 are ?

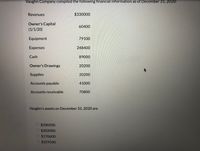

Transcribed Image Text:Vaughn Company compiled the following financial information as of December 31, 2020:

Revenues

$330000

Owner's Capital

(1/1/20)

60400

Equipment

79100

Expenses

248400

Cash

89000

Owner's Drawings

20200

Supplies

20200

Accounts payable

41000

Accounts receivable

70800

Vaughn's assets on December 31, 2020 are

$200200.

$302000.

$170600.

$259100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 5-28 (LO. 4) Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2019. Blue had the following expenses in connection with the project: Salaries Materials Insurance Utilities Cost of inspection of materials for quality control Promotion expenses Advertising Equipment depreciation Cost of market survey + 2019 $500,000 $600,000 90,000 70,000 8,000 11,000 6,000 8,000 7,000 6,000 11,000 18,000 20,000 14,000 0 15,000 8,000 2020 0 The new product will be introduced for sale beginning in July 2021. Determine the amount of the deduction for research and experimen expenditures for 2019, 2020, 2021, and 2022. If necessary, round the annual deduction to the nearest dollar.arrow_forwarda. Determine D'Lake, Green, Divot, recognized gain or loss upon formation of Slicenhook. b. What is D'Lake, Green, Divot, initial tax basis in Slicenhook on January 2, 2022? c. Prepare Slicenhook's opening tax basis balance sheet as of January 2, 2022. Cash__ Land__ Total__ Liabilities__ Tax Capital: D'Lake__ Green__ Divot__ Total__arrow_forwardShun Li sold a capital property on July 31, 2019 for $400,000. She received $100,000 at the time of sale with the balance of $300,000 payable on July 31, 2021. The adjusted cost base of the property was $160,000. The minimum taxable capital gain that Shun Li can report in the 2019 taxation year is: $30,000. $60,000. $120,000. $180,000.arrow_forward

- How do you prepare the depreciation for the year 2026?arrow_forwardMarty has the following net § 1231 results for each of the years shown: Tax Year 2017 2018 2019 2020 Net § 1231 Loss $10,000 3,000 12,000 Net § 1231 Gain What would be the nature of the net gains in 2020? $29,000arrow_forward17. TP had an adjusted basis in her LLC interest of $50,000 immediately before she received a current proportionate distribution of $20,000 cash, unrealized accounts receivable with a basis of 0 and a FMV of $10,000, and real property with a basis of $40,000 and a FMV of $50,000. Her basis in the distributed real property is: a. 0 b. $30,000 c. $20,000 d. $40,000 e. None of the abovearrow_forward

- Prepare a nowchart for MACRS depreciationicost recovery of fixed assets. You may limit your flowchart to tangible personal property falling into the 5 and 7 year classes and roal property used in rental and non-rental classes. For purposes of your flowchart, you should assume that Soction 179 exists as well as any "bonus depreciation" provisions that would apply to 2023 acquisitions. Your flowchart does not need to reflect any limitations applicable to automobiles. You may also ignore any depreciation implications related to: Section 179 bonus depreciation on REAL property Alternate MACRS lives/ methods Alternative Minimum Tax State Income taxes You should base your flowchart on 2023 tax provisions. FORMAT Your fiowchart(s) should be asable reference tool that one could follow to determine the proper treatment for any covered situation.arrow_forwardQuestion 1 For a multifamily acquisition, the seller credit for property tax is $54,356.20. The property tax bill for 2023 is $124,000. What date is the closing set for in 2023? O 6/8/2023 O 6/7/2023 O 6/10/2023 O 6/9/2023 O6/11/2023arrow_forwardQuestion: Compute Mr. Tam’s property tax liability for the year of assessment 2019/20 and 2020/21, assuming that he does not elect for personal assessment for the year. Ignore provisional property tax.arrow_forward

- davubenarrow_forwardExercise 18-19 (Algorithmic) (LO. 3) Elizabeth made taxable gifts of $6,900,000 in 2020 and $8,970,000 in 2022. She paid no gift tax on the 2020 transfer. On what amount is the Federal gift tax computed for the 2022 gift?arrow_forwardTrue/False 7. Interest paid or accrued during 2018 on aggregate acquisition indebtedness of $2 million or less ($1 million or less for married persons filing separate returns) is deductible as qualified residence interest.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education