FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Question:

Compute Mr. Tam’s property tax liability for the year of assessment 2019/20 and 2020/21, assuming that he does not elect for personal assessment for the year. Ignore provisional property tax.

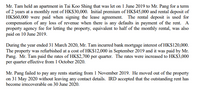

Transcribed Image Text:Mr. Tam held an apartment in Tai Koo Shing that was let on 1 June 2019 to Mr. Pang for a term

of 2 years at a monthly rent of HK$30,000. Initial premium of HK$45,000 and rental deposit of

HK$60,000 were paid when signing the lease agreement. The rental deposit is used for

compensation of any loss of revenue when there is any defaults in payment of the rent. A

property agency fee for letting the property, equivalent to half of the monthly rental, was also

paid on 10 June 2019.

During the year ended 31 March 2020, Mr. Tam incurred bank mortgage interest of HK$120,000.

The property was refurbished at a cost of HK$12,000 in September 2019 and it was paid by Mr.

Pang. Mr. Tam paid the rates of HKS2,700 per quarter. The rates were increased to HK$3,000

per quarter effective from 1 October 2020.

Mr. Pang failed to pay any rents starting from 1 November 2019. He moved out of the property

on 31 May 2020 without leaving any contact details. IRD accepted that the outstanding rent has

become irrecoverable on 30 June 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is a condition a taxpayer must meet to claim injuries spouse? The spouse: A. Didn't claim a refundable tax credit on the joint return. B. Is required to pay the past-due amount. C. Must file married filing separately. D. Received and reported income on a joint return.arrow_forwardIf an individual itemizes deductions on his or her tax return, he or she may: a. deduct the gross unreimbursed medical expenses paid for the year b. deduct the net unreimbursed medical expenses paid for the year c. deduct 80% of the gross unreimbursed medical expenses paid for the year d. deduct 80% of the net unreimbursed medical expenses paid for the yeararrow_forwardWhich of the toliowing types of interest is not taxable in the year it is posted to the taxpayer's account? Select one O a Interest on a savings account OD interest on an investment account Oc Imterest on an IRA O d. interest on ife insurance proceeds remaining with the insurance companyarrow_forward

- The general rule is that someone who inherits property has a tax basis in that property equal to its FMV on the date of the decedent’s death. But there are two exceptions to this rule. Explain both of them briefly.arrow_forwardSelect one of choices (estate tax, inheritance tax, and gift tax) for the blank. ( ) is a tax on the right to receive property from a decedent. ( ) is a tax levied on the right to transfer property during a taxpayer’s lifetime. ( ) is a tax that imposed on the right to pass property at death. ( ) is imposed on transfers made during the owner’s life time. ( ) is imposed on the transferor at death. ( ) is imposed on the recipient.arrow_forwardWhich taxpayer would be able to deduct the entire amount of their investment interest expense on Schedule A (Form 1040), Itemized Deductions? o Jenny. She had an investment interest expense of $800 and taxable investment income of $900. o Mark. He had an investment interest expense of $1,200 and taxable investment income of $1,100. o Nancy. She had an investment interest expense of $1,900 and taxable investment income of $1,350. o Peter. He had an investment interest expense of $1,400. He had taxable investment income of $1,200 and nontaxable investment income of $300. (The $300 of nontaxable investment income was from municipal bond interest.)arrow_forward

- dentify the rule that determines whether a taxpayer must include in income a refund of an amount deducted in a previous year: Multiple Choice tax refund rule. constructive receipt return of capital principle. tax benefit rule. None of the choices are correctarrow_forwardWhich of the following statements is incorrect? Assume that the rental activity is classified as ‘production-of-income.’ If the taxpayer sells the rental property later at a loss, the loss will be treated as a capital loss (i.e., $3,000/$1,500 deduction limit in the current year). An amount that would have been paid in an arm’s-length transaction is considered a reasonable amount as deduction. Payment (except for medical or educational expense) of another person’s obligation does not result in a tax deduction for the payer. Regarding the start-up costs, if the new business is in the same line of business as the existing one and if the new business is not launched, then none of the start-up costs are deductible. Payments for a speeding ticket are nondeductible. HELParrow_forwardRequired information [The following information applies to the questions displayed below.] In 2021, Sheryl is claimed as a dependent on her parents' tax return. Her parents report taxable income of $500,000 (married filing jointly). Sheryl did not provide more than half her own support. What is Sheryl's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. (Leave no answer blank. Enter zero if applicable.) a. She received $7,500 from a part-time job. This was her only source of income. She is 16 years old at year-end. Tax liability $arrow_forward

- A(n) Dora Burch files her 2022 income tax return on March 2, 2023. She receives an original notice of assessment dated June 3, 2023. However, on December 28, 2023, she receives a reassessment indicating that she owes a substantial amount of additional tax. She would like to object to this reassessment. What is the latest date for her to file a notice of objection? She does not carry on a business. (Ignore the business sells goods that it effect of leap year if applicable.) purchases in finished form for resale. March 2, 2024. April 30, 2024. March 28, 2024. Shy December 28, 2024.arrow_forwardRequired: Calculate Augustine's income tax liability for the year ended 30 June 2020, if he is treated as carrying on a trade in respect of his motor car activities.arrow_forwarda taxpayer’s spouse died on march 31, 2020. he has no qualifying child. which status should the taxpayer elect when filing his 2020 tax return? a. qualifying widow(er). b. married filing jointly. c. single. d. married filing separately.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education