Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

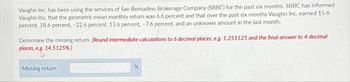

Transcribed Image Text:Vaughn Inc. has been using the services of San Bernadino Brokerage Company (SBBC) for the past six months. SBBC has informed

Vaughn Inc. that the geometric mean monthly return was 6.6 percent and that over the past six months Vaughn Inc. earned 15.6

percent, 18.6 percent, -22.6 percent, 13.6 percent, -7.6 percent, and an unknown amount in the last month.

Determine the missing return. (Round intermediate calculations to 6 decimal places, e.g. 1.251125 and the final answer to 4 decimal

places, e.g. 14.5125 %)

Missing return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Mohammed LLC is a growing consulting firm. The following transactions take place during the current year. A. On June 10, Mohammed borrows $310,000 from a bank to cover the initial cost of expansion. Terms of the loan are payment due in four months from June 10, and annual interest rate of 7%. B. On July 9, Mohammed borrows an additional $120,000 with payment due in four months from July 9, and an annual interest rate of 14%. C. Mohammed pays their accounts in full on October 10 for the June 10 loan, and on November 9 for the July 9 loan. Record the journal entries to recognize the initial borrowings, and the two payments for Mohammed. If an amount box does not require an entry, leave it blank. Round intermediate calculation and final answers to the nearest whole dollar. June 10 July 9 Oct. 10 Nov. 9arrow_forwardAn investment that earns intrest: Any amount deposited does not earn interest for the first month it is in the account. Afterwards, it earns interest at a rate of 1% at the end of every odd month (January, March, May, July, September, November), and 1.5% at the end of every even month (February, April, June, August, October, December). You'd like to make three equal deposits of P to the account on October 1, 2021, February 1, 2022, and April 1, 2022. Determine P so that you have exactly $2000 on July 1, 2022.arrow_forwardProvide all answersarrow_forward

- Sawchuk's Home and Garden Centre in Toronto files monthly HST returns. The purchases on which it paid the HST and the sales on which it collected the HST for the last four months were as follows: (assume HST in Toronto is 13%) Month Purchases ($) Sales ($) May 176,730 313,245 Based on an HST rate of 13%, calculate the HST remittance or refund due for each month Calculate the difference between GST Collected on Sales and GST Paid on Purchases?arrow_forwardIn 2014, Bank A paid 3% interest, compounded daily, on a 8-year CD, while Bank B paid 3% compounded quarterly. a. What are the effective rates for the two CDs? Use 365-day year. b. Suppose $4000 was invested in each of these accounts. Find the compound amount after eight years for each account. ------------------------------------------------------------------------------------------------ a. The effective rate for Bank A is % (round to 3 decimal places) The effective rate for Bank B is % b. For Bank A, the compound amount after 8 years is $ For Bank A, the compound amount after 8 years is $ (round to the nearest cent)arrow_forwardAs loan analyst for Headland Bank, you have been presented the following information. Assets Cash Receivables Inventories Total current assets Other assets Total assets Liabilities and Stockholders' Equity. Current liabilities Long-term liabilities Capital stock and retained earnings Total liabilities and stockholders' equity Annual sales Rate of gross profit on sales Toulouse Co. $122,000 225,000 564,000 911,000 502,000 $1,413,000 $299,000 398,000 716,000 $1,413,000 $964,000 30 % Lautrec Co. $332,000 313,000 541,000 1,186,000 638,000 $1,824,000 $353,000 502,000 969,000 $1,824,000 $1,548,000 40 %arrow_forward

- need both answer.arrow_forwardTo assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year. The amount of working capital The current ratio The acid-test ratio The average collection period (The accounts receivable at the beginning of last year totaled $250,000) The average sales period (The inventory at the beginning of last year totaled $500,000) The operating cycle The total asset turnover. (The total assets at the beginning of last year were $2,420,000) The debt-to-equity ratio The times interest earned ratio The equity multiplier (The total stockholder’s equity at the beginning of last year totaled $1,420,000) Could you please help me answer 7-9?arrow_forwardLush Gardens Co. bought a new truck for $52,000. It paid $4,680 of this amount as a down payment and financed the balance at 3.98% compounded semi-annually. If the company makes payments of $2,000 at the end of every month, how long will it take to settle the loan? years months Express the answer in years and months, rounded to the next payment periodarrow_forward

- Your office supply has a line of credit that charges an annual percentage rate of prime rate plus 3%. Their starting balance on March 1st was $10,600. On March 5th they borrowed $7,500. On March 14th the business made a payment of $3,300 and in March 18th they borrowed $5,300. If the current prime rate is 9% what is the new balance? $26,100.00 $20,276.10 $27,583.43 $18,400.29arrow_forwardSuppose that we observe two comparable properties that have each sold twice within the past two years. Property A sold 24 months ago for $350,000 and Property B sold 18 months ago for $325,000. If the two properties were sold today at $375,000 and $340,000, respectively, estimate the change in market conditions (percentage change in price) per month, assuming we equally weight the two properties in our analysis. Multiple Choice 0.19% 0.28% 0.33%arrow_forwardCanadian Western Bank issued a loan of $59,000 at 4.33% compounded semi- annually. The loan was repaid by payments of $730 at the end of every month. a. How many payments were required to pay off the loan? (Enter a whole number) b. What was the total interest paid in the 4th year? (Enter starting and ending periods as P1 and P2 and the total interest paid as a positive value to the nearest cent.) P1 = P2= = Total interest paid in the 4th year = $ c. What was the size of the final payment? (Enter a positive value to the nearest cent) $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education