Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please do not give solution in image format thanku

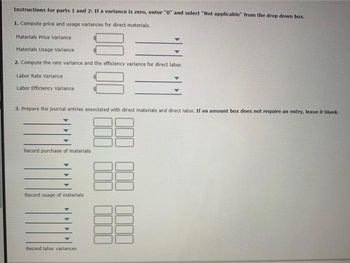

Transcribed Image Text:Instructions for parts 1 and 2: If a variance is zero, enter "0" and select "Not applicable" from the drop down box.

1. Compute price and usage variances for direct materials.

Materials Price Variance

Materials Usage Variance

2. Compute the rate variance and the efficiency variance for direct labor.

Labor Rate Variance

Labor Efficiency Variance

3. Prepare the journal entries associated with direct materials and direct labor. If an amount box does not require an entry, leave it blank.

88

88

Record purchase of materials

Record usage of materials

Record labor variances

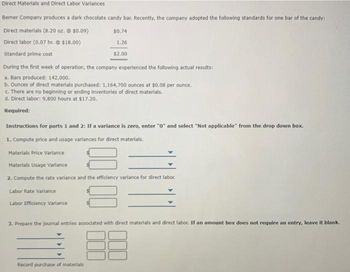

Transcribed Image Text:Direct Materials and Direct Labor Variances

Berner Company produces a dark chocolate candy bar. Recently, the company adopted the following standards for one bar of the candy:

Direct materials (8.20 oz. $0.09)

$0.74

Direct labor (0.07 hr. @ $18.00)

Standard prime cost

1.26

During the first week of operation, the company experienced the following actual results:

a. Bars produced: 142,000.

b. Ounces of direct materials purchased: 1,164,700 ounces at $0.08 per ounce.

$2.00

c. There are no beginning or ending inventories of direct materials.

d. Direct labor: 9,800 hours at $17.20.

Required:

Labor Rate Variance

Labor Efficiency Variance

Instructions for parts 1 and 2: If a variance is zero, enter "0" and select "Not applicable" from the drop down box.

1. Compute price and usage variances for direct materials.

Materials Price Variance

Materials Usage Variance

2. Compute the rate variance and the efficiency variance for direct labor.

Record purchase of materials

3. Prepare the journal entries associated with direct materials and direct labor. If an amount box does not require an entry, leave it blank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zoller Company produces a dark chocolate candy bar. Recently, the company adopted the following standards for one bar of the candy: During the first week of operation, the company experienced the following actual results: a. Bars produced: 143,000. b. Ounces of direct materials purchased: 901,200 ounces at 0.21 per ounce. c. There are no beginning or ending inventories of direct materials. d. Direct labor: 11,300 hours at 17.30.arrow_forwardGenuine Spice Inc. began operations on January 1 of the current year. The company produces 8-ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in 12-bottle cases for 100 per case. There is a selling commission of 20 per case. The January direct materials, direct labor, and factory overhead costs are as follows: DIRECT MATERIALS Cost Behavior Units per Case Cost per Unit Direct Materials Cost per Case Cream base Variable 100 ozs. 0.02 2.00 Natural oils Variable 30ozs. 0.30 9.00 Bottle (8-OZ-) Variable 12 bottles 0.50 6.00 17.00 DIRECT LABOR Department Cost Behavior Time per Case Labor Rate per Hour Direct Labor Cost per Case Mixing Variable 20 min. 18.00 6.00 Filling Variable 5 14.40 1.2 25 min. 7.20 FACTORY OVERHEAD Cost Behavior Total Cost Utilities Mixed 600 Facility lease Fixed 14,000 Equipment depreciation Fixed 4,300 Supplies Fixed 660 19,560 Part ABreak-Even Analysis The management of Genuine Spice Inc. wishes to determine the number of cases required to break even per month. The utilities cost, which is part of factory overhead, is a mixed cost. The following information was gathered from the first six months of operation regarding this cost: Month Case Production Utility Total Cost January 500 600 February 800 660 March 1,200 740 April 1,100 720 May 950 690 June 1,025 705 Instructions 1. Determine the fixed and variable portions of the utility cost using the high-low method. 2. Determine the contribution margin per ease. 3. Determine the fixed costs per month, including the utility fixed cost from part (1). 4. Determine the break-even number of cases per month. Part BAugust Budgets During July of the current year, the management of Genuine Spice Inc. asked the controller to prepare August manufacturing and income statement budgets. Demand was expected to be 1,500 cases at 100 per case for August. Inventory planning information is provided as follows: Finished Goods Inventory: Cases Cost Estimated finished goods inventory, August 1 300 12,000 Desired finished goods inventory, August 31 175 7,000 Materials Inventory: Cream Base (ozs.) Oils (ozs.) Bottles (bottles) Estimated materials inventory, August 1 250 290 600 Desired materials inventory, August 31 1,000 360 240 There was negligible work in process inventory assumed for either the beginning or end of the month; thus, none was assumed. In addition, there was no change in tile cost per unit or estimated units per case operating data from January. Instructions 5. Prepare the August production budget. 6. Prepare the August direct materials purchases budget. 7. Prepare the August direct labor budget. Round the hours required for production to the nearest hour. 8. Prepare the August factory overhead budget. 9. Prepare the August budgeted income statement, including selling expenses. Part CAugust Variance Analysis During September of the current year, the controller was asked to perform variance analyses for August. The January operating data provided the standard prices, rates, times, and quantities per case. There were 1,500 actual cases produced during August, which was 250 more cases than planned at the Beginning of the month. Actual data for August were as follows: Actual Direct Materials Price per Unit Actual Direct Materials Quantity per Case Cream base 0.016 per oz. 102 ozs. Natural oils 0.32 per oz. 31 ozs. Bottle (8 oz.) 0.42 per bottle 12.5 bottles Actual Direct Labor Rate Actual Direct Labor Time per Case Mixing 18.20 19.50 min. Filling 14.00 5.60 min. Actual variable overhead 305.00 Normal volume 1,600 cases The prices of the materials were different than .standard due to fluctuations in market prices. The standard quantity of materials used per case was an ideal standard. The Mixing Department used a higher grade labor classification during the month, thus causing the actual labor rale to exceed standard. The Filling Department used a lower grade labor classification during the month, thus causing the actual labor rate to be less titan standard. Instructions 10. Determine and interpret the direct materials price and quantity variances for the three materials. 11. Determine and interpret the direct labor rate and time variances for the two departments. Round hours to the nearest hour. 12. Determine and interpret the factory overhead controllable variance. 13. Determine and interpret the factory overhead volume variance. 14. Why are the standard direct labor and direct materials costs in the calculations for parts (10) and (11) based on the actual 1,500-case production volume rather than the planned 1,250 cases of production used in the budgets for parts (6) and (7)?arrow_forwardJameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forward

- Algers Company produces dry fertilizer. At the beginning of the year, Algers had the following standard cost sheet: Algers computes its overhead rates using practical volume, which is 54,000 units. The actual results for the year are as follows: a. Units produced: 53,000 b. Direct materials purchased: 274,000 pounds at 2.50 per pound c. Direct materials used: 270,300 pounds d. Direct labor: 40,100 hours at 17.95 per hour e. Fixed overhead: 161,700 f. Variable overhead: 122,000 Required: 1. Compute price and usage variances for direct materials. 2. Compute the direct labor rate and labor efficiency variances. 3. Compute the fixed overhead spending and volume variances. Interpret the volume variance. 4. Compute the variable overhead spending and efficiency variances. 5. Prepare journal entries for the following: a. The purchase of direct materials b. The issuance of direct materials to production (Work in Process) c. The addition of direct labor to Work in Process d. The addition of overhead to Work in Process e. The incurrence of actual overhead costs f. Closing out of variances to Cost of Goods Soldarrow_forwardDoogan Corporation makes a product with the following standard costs: Standard Quantity or Standard Price or Hours Rate Direct materials Direct labor Variable overhead 9.0 grams e.4 hours $ 3.60 per gram $36.00 per hour $ 8.60 per hour e.4 hours The company produced 6,800 units in January using 40.910 grams of direct material and 2.540 direct labor-hours. During the month, the company purchased 46,000 grams of the direct material at $3.30 per gram. The actual direct labor rate was $35.30 per hour and the actual varlable overhead rate was $8.40 per hour. The company applies varlable overhead on the basis of direct labor-hours. The direct materials purchases varlance is computed when the materials are purchased. The varlable overhead rate varlance for January is:arrow_forwardTharaldson Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Standard Price or Cost Per Rate Unit $ 3.00 per ounce $ 17.00 per hour $ 6.00 per hour Direct materials 7.3 ounces $21.90 $ 3.40 $ 1.20 Direct labor e.2 hours Variable overhead e.2 hours The company reported the following results concening this product in June. 2,700 units 2,800 units 18,500 ounces Originally budgeted output Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours 21,600 ounces 480 hours $ 42,100 $ 12,700 $ 3,350 Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost The company applies varlable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materlals are purchased. The labor rate varlance for June is:arrow_forward

- Handerson Corporation makes a product with the following standard costs: Standard Quantity Standard Price or or Hours 8.5 kilos Rate Direct materials $46.00 r kilo $ 20.00 per hour $ 6.00 per hour Direct labor 0.4 hours Variable overhead 0.4 hours The company reported the following results concerning this product in August. Actual output 3,200 units 29,030 kilos 31,600 kilos 1,160 hours $ 195,920 $ 22,736 $ 7,540 Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is cor purchased. The labor efficiency variance for August is:arrow_forwardBetty's Bakery has the following standard cost sheet for one unit of its most popular cake: Direct materials Direct labor SQ 1.2 pounds 0.8 hours SP $ 1.50 per pound $ 12.00 per hour During the month of May, the company made 660 cakes and incurred the following actual costs: Direct materials purchased and used (960 pounds), $1,248 Direct labor (720 hours), $8,280 Required: 1. Calculate the direct materials price variance. 2. Calculate the direct materials quantity variance. 3. Calculate the direct materials spending variance. 4. Calculate the direct labor rate variance. 5. Calculate the direct labor efficiency variance. 6. Calculate the direct labor spending variance. Note: For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round your intermediate calculations to two decimal places. 1. Direct materials price variance 2. Direct materials quantity variance 3. Total direct…arrow_forwardBetty's Bakery has the following standard cost sheet for one unit of its most popular cake: Direct materials Direct labor SQ 1.2 pounds 0.8 hours SP $ 1.50 per pound $ 12.00 per hour During the month of May, the company made 660 cakes and incurred the following actual costs: Direct materials purchased and used (960 pounds), $1,248 Direct labor (720 hours), $8,280 Required: 1. Calculate the direct materials price variance. 2. Calculate the direct materials quantity variance. 3. Calculate the direct materials spending variance. 4. Calculate the direct labor rate variance. 5. Calculate the direct labor efficiency variance. 6. Calculate the direct labor spending variance. Note: For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round your intermediate calculations to two decimal places. 1. Direct materials price variance 2. Direct materials quantity variance 3. Total direct…arrow_forward

- Accounting silmon corporation makers a product with the following standard costs:arrow_forwardBullseye Company manufactures dartboards. Its standard cost information follows: Standard Price (Rate) Standard Quantity 2.50 sq. ft. 1 hrs. $2.90 per sq. ft. $11.00 per hr. $ 0.40 per hr. Direct materials (cork board) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($68,250+ 195,000 units) Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard used Cost of corkboard used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost Required 1 Required 2 Required 3. 1 hrs. Complete this question by entering your answers in the tabs below. Direct Materials Price Variance Direct Materials Quantity Variance Direct Materials Spending Variance Required: 1. Calculate the direct materials price, quantity, and total spending variances for Bullseye. 2. Calculate the direct labor rate, efficiency, and total spending variances for…arrow_forwardLandram corporation makes solve the question and given answer accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,