FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

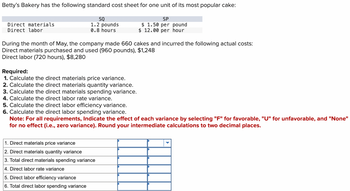

Transcribed Image Text:Betty's Bakery has the following standard cost sheet for one unit of its most popular cake:

Direct materials

Direct labor

SQ

1.2 pounds

0.8 hours

SP

$ 1.50 per pound

$ 12.00 per hour

During the month of May, the company made 660 cakes and incurred the following actual costs:

Direct materials purchased and used (960 pounds), $1,248

Direct labor (720 hours), $8,280

Required:

1. Calculate the direct materials price variance.

2. Calculate the direct materials quantity variance.

3. Calculate the direct materials spending variance.

4. Calculate the direct labor rate variance.

5. Calculate the direct labor efficiency variance.

6. Calculate the direct labor spending variance.

Note: For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None"

for no effect (i.e., zero variance). Round your intermediate calculations to two decimal places.

1. Direct materials price variance

2. Direct materials quantity variance

3. Total direct materials spending variance

4. Direct labor rate variance

5. Direct labor efficiency variance

6. Total direct labor spending variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- FOOD Industries employs a standard cost system. FOOD has established the following PER UNIT standards for the prime costs of its product XYZ frozen desserts line: Standard Quantity Standard Price/ Rate Standard Cost of DM/ DL per unit per KG/ DLH Direct Materials 8kg %241.80 per KG $414.40 Direct Labour 0.25 DLH (15 minutes) $8.00 per DLH $2.00 Total Cost 16.40 During November, the company purchased 142,500 KG of direct materials at a total cost of $285,000. The total factory wages for November were $37,800. The company manufactured 19,000 units of XYZ during November using 142,500 kg of direct materials and 5,000 direct labour hours. Required: SHOW ALL CALCULATIONS 1. Compute the direct materials a) flexible budget, b) price and c) quantity variance for November. 2. Compute the direct labour a) flexible budget, b) rate and c) efficiency variance for November. 15 3cerarrow_forwardMiguez Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 2.3 liters $ 7.00 per liter $ 16.10 Direct labor 0.7 hours $ 22.00 per hour $ 15.40 Variable overhead 0.7 hours $ 2.00 per hour $ 1.40 The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for September is: Multiple Choice $3,675 F $3,528 U $3,528 F $3,675 Uarrow_forwardParker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Quantity Standard Price (Rate) Standard Unit Cost Direct materials (plastic) 12 sq ft. $ 1.45 per sq. ft. $ 17.40 Direct labor 0.3 hr. $ 11.90 per hr. 3.57 Variable manufacturing overhead (based on direct labor hours) 0.3 hr. $ 2.30 per hr. 0.69 Fixed manufacturing overhead ($461,000 ÷ 922,000 units) 0.50 Parker Plastic had the following actual results for the past year: Number of units produced and sold 1,160,000 Number of square feet of plastic used 12,000,000 Cost of plastic purchased and used $ 16,800,000 Number of labor hours worked 320,000 Direct labor cost $ 3,744,000 Variable overhead cost $ 1,100,000 Fixed overhead cost $ 377,000 Required:Calculate Parker Plastic’s direct labor rate and efficiency variances. (Do not round intermediate calculations. Indicate the…arrow_forward

- RRarrow_forwardYyarrow_forwardBetty’s Bakery has the following standard cost sheet for one unit of its most popular cake: SQ SP Direct materials 1.2 pounds $1.50 per pound Direct labor 0.8 hours $12.00 per hour During the month of May, the company made 620 cakes and incurred the following actual costs: Direct materials purchased and used (920 pounds), $1,196 Direct labor (680 hours), $7,820 Calculate the direct materials price variance. Calculate the direct materials quantity variance. Calculate the direct materials spending variance. Calculate the direct labor rate variance. Calculate the direct labor efficiency variance. Calculate the direct labor spending variance.arrow_forward

- Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Quantity Standard Price (Rate) Standard Unit Cost Direct materials (plastic) 12 sq ft. $ 1.00 per sq. ft. $ 12.00 Direct labor 0.25 hr. $ 12.80 per hr. 3.20 Variable manufacturing overhead (based on direct labor hours) 0.25 hr. $ 2.00 per hr. 0.50 Fixed manufacturing overhead ($559,200 ÷ 932,000 units) 0.60 Parker Plastic had the following actual results for the past year: Number of units produced and sold 1,260,000 Number of square feet of plastic used 12,500,000 Cost of plastic purchased and used $ 11,250,000 Number of labor hours worked 330,000 Direct labor cost $ 4,026,000 Variable overhead cost $ 1,480,000 Fixed overhead cost $ 387,000 Required:Calculate Parker Plastic’s variable overhead rate and efficiency variances and its over- or underapplied variable overhead.…arrow_forwardAmber Company produces iron table and chair sets. During October, Amber's costs were as follows: Actual purchase price Actual direct labor rate $2.70 per pound $7.90 per hour $ 2.50 per pound 1,010,000 pounds 21,000 1,215,000 pounds 14,000 1,040,000 pounds $5,880 F Standard purchase price Standard quantity for sets produced Standard direct labor hours allowed Actual quantity purchased in October Actual direct labor hours Actual quantity used in October Direct labor rate variance Required: 1. Calculate the total cost of purchases for October. 2. Compute the direct materials price variance based on the actual quantity purchased. 3. Calculate the direct materials quantity variance based on the actual quantity used. 4. Compute the standard direct labor rate for October. 5. Compute the direct labor efficiency variance for October. Complete this question by entering your answers in the tabs below.arrow_forwardMiguez Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead Standard Quantity or Hours 4.0 liters 0.7 hours 0.7 hours Standard Price or Rate $ 8.70 per liter $ 39.00 per hour $ 3.70 per hour Standard Cost Per Unit $ 34.80 $ 27.30 $ 2.59 The company budgeted for production of 4,300 units in September, but actual production was 4,200 units. The company used 7,140 liters of direct material and 1,850 direct labor-hours to produce this output. The company purchased 7,500 liters of the direct material at $8.90 per liter. The actual direct labor rate was $41.10 per hour and the actual variable overhead rate was $3.60 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for September is: Multiple Choice О $294 F О О о $185 U $185 F $294 Uarrow_forward

- rpóration makes a product with the following standards for direct labor and variable overhead: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct labor 0.3 hours $ 14.00 per hour $ 5.00 per hour $ 4.20 $ 1.50 Variable overhead 0.3 hours In November the company's budgeted production was 5,300 units, but the actual production was 5,100 units. The company used 1,650 direct labor-hours to produce this output. The actual variable overhead cost was $7,590. The company applies variable overhead on the basis of direct labor-hours. The variable overhead efficiency variance for November is: Multiple Choice $552 F $600 U $552 U $600 Farrow_forwardCaro Manufacturing has two production departments, Machining and Assembly, and two service departments, Maintenance and Cafeteria. Direct costs for each department and the proportion of service costs used by the various departments for the month of August follow: Department Machining Assembly Maintenance Cafeteria Direct Costs $115,000 65,000 54,000 43,000 Required A Required B Proportion of Services Used by Machining Maintenance Cafeteria 0.7 From Service department costs Maintenance Cafeteria Total Costs 0.2 Required: Use the step method to allocate the service costs, using the following: a. The order of allocation starts with Maintenance. b. The allocations are made in the reverse order (starting with Cafeteria). 0.5 0.1 Complete this question by entering your answers in the tabs below. Maintenance Cafeteria Assembly The order of allocation starts with Maintenance. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) To 0.3 0.2 Machining…arrow_forwardBatCo makes baseball bats. Each bat requires 1.00 pounds of wood at $18 per pound and 0.35 direct labor hour at $30 per hour. Overhead is assigned at the rate of $60 per direct labor hour.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education