FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

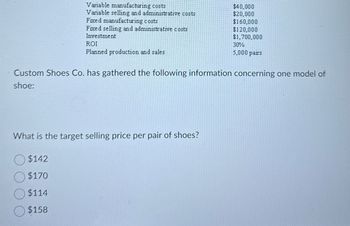

Transcribed Image Text:Variable manufacturing costs

Variable selling and administrative costs

Fixed manufacturing costs

Fixed selling and administrative costs

Investment

ROI

Planned production and sales

$40,000

$20,000

$160,000

$120,000

$1,700,000

30%

5,000 pairs

Custom Shoes Co. has gathered the following information concerning one model of

shoe:

What is the target selling price per pair of shoes?

$142

$170

$114

$158

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Variable Cost Method of Product Pricing Smart Stream Inc. uses the variable cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 10,000 cell phones are as follows: Variable costs per unit: Direct materials Direct labor Factory overhead Selling and administrative expenses Total variable cost per unit $150 Total variable costs 25 40 Variable cost amount per unit 25 $240 Fixed costs: Factory overhead Selling and admin. exp. Smart Stream desires a profit equal to a 30% return on invested assets of $1,200,000. $350,000 140,000 a. Determine the variable costs and the variable cost amount per unit for the production and sale of 10,000 cellular phones. b. Determine the variable cost markup percentage for cellular phones. Round to two decimal places. % c. Determine the selling price of cellular phones. If required, round to the nearest dollar. per cellular phonearrow_forwardM1arrow_forwardnot use ai pleasearrow_forward

- Data related to the expected sales of laptops and tablets for Tech Products Inc. for the current year, which is typical of recent years, are as follows: Products Unit Selling Price Laptops $230 Tablets 420 The estimated fixed costs for the current year are $402,500. Unit Variable Cost $160 200 Why is it so different? The break-even point is heavily toward the product with the Sales Mix Required: 1. Determine the estimated units of sales of the overall (total) product, E, necessary to reach the break-even point for the current year. units units 30% 2. Based on the break-even sales (units) in part (1), determine the unit sales of both laptops and tablets for the current year. Laptops: Tablets: units 70% 3. Assume that the sales mix was 70% laptops and 30% tablets. Determine the estimated units of sales of the overall product necessary to reach the break-even point for the current year. units in this scenario than in part (1) because the sales mix is weighted contribution margin per unit…arrow_forwardSouthampton Electronics manufactures a range of portable heaters. Most of the output is exported. Sales Selling price Contribution margin ratio Margin of safety percentage The variable expense per unit is: Select one: O A. £10.00 per unit O B. £17.50 per unit O C. £7.50 per unit O D. £15.00 per unit 12,000 units £25 per unit 40% 30%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education