FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:View Policies

Current Attempt in Progress

pport

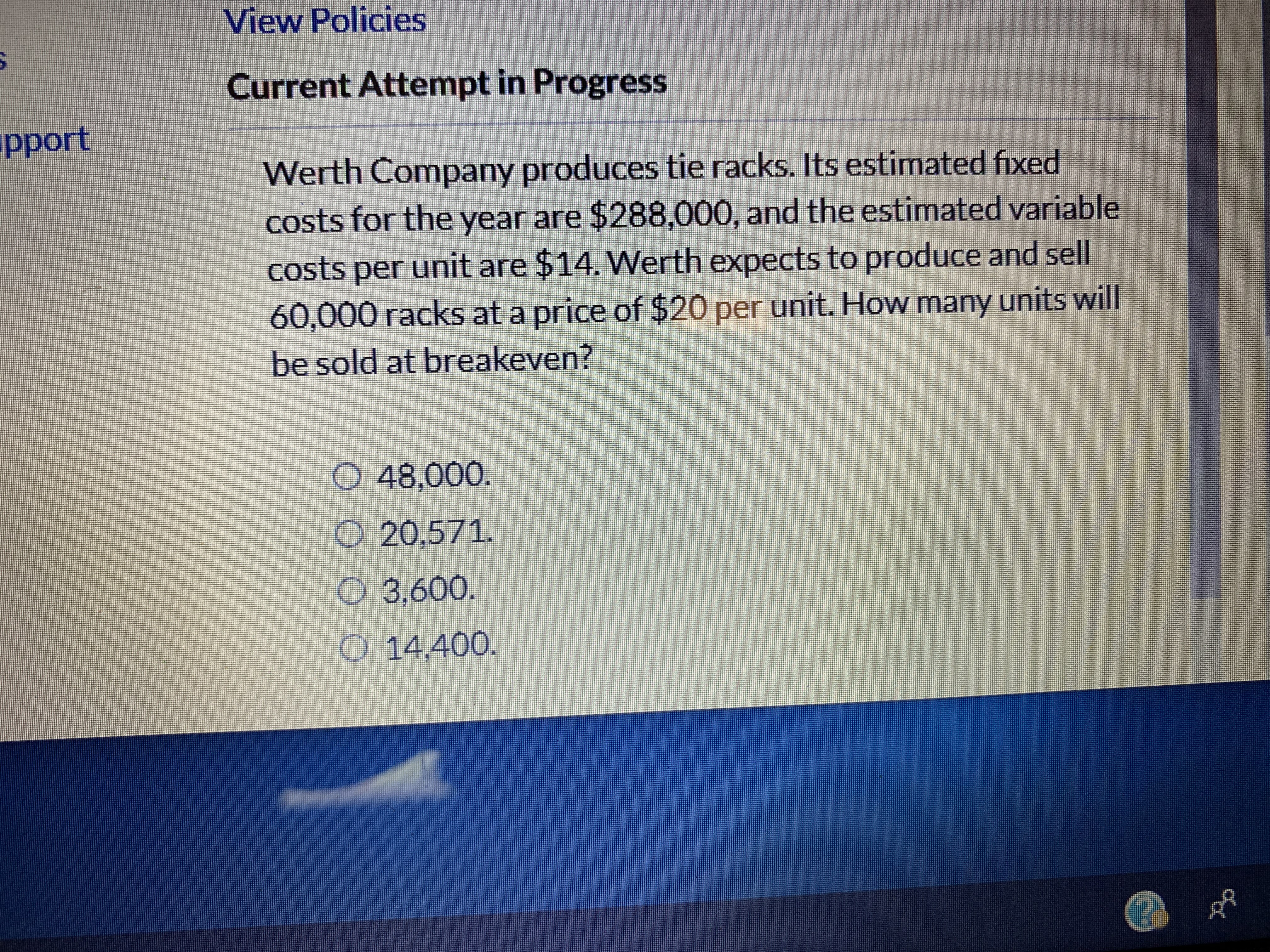

Werth Company produces tie racks. Its estimated fixed

costs for the year are $288,000, and the estimated variable

costs per unit are $14. Werth expects to produce and sell

60,000 racks at a price of $20 per unit. How many units will

be sold at breakeven?

D48,000.

O 20,571.

3,600.

O 14,400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Break-Even Sales Currently, the unit selling price of a product is $7,520, the unit variable cost is $4,400, and the total fixed costs are $23,400,000. A proposal is being evaluated to increase the unit selling price to $8,000. a. Compute the current break-even sales (units). units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant. unitsarrow_forwardBreak-Even Sales Currently, the unit selling price of a product is $390, the unit variable cost is $320, and the total fixed costs are $1,176,000. A proposal is being evaluated to increase the unit selling price to $440. a. Compute the current break-even sales (units) units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased to the proposed $440, and all costs remain constant unitsarrow_forwardContribution Margin Ratio, Break-Even Sales Revenue, Sales Revenue for Target Profit Schylar Pharmaceuticals, Inc., plans to sell 120,000 units of antibiotic at an average price of $25 each in the coming year. Total variable costs equal $960,000. Total fixed costs equal $7,200,000. Required: 1. What is the contribution margin per unit? Round your answer to the nearest cent. What is the contribution margin ratio? Round your answer to two decimal places. (Express as a decimal-based answer rather than a whole percent amount.) fill in the blank 2 2. Calculate the sales revenue needed to break even. Round your answer to the nearest dollar. 3. Calculate the sales revenue needed to achieve a target profit of $205,000. Round your answer to the nearest dollar. 4. What if the average price per unit increased to $26.50? Recalculate the following: a. Contribution margin per unit. Round your answer to the nearest cent. b. Contribution margin ratio. Enter your answer as a decimal value (not a…arrow_forward

- 36arrow_forwardYear Unit Sales 1 73,000 2 86,000 3 105,000 4 97,000 5 67,000 Production of the implants will require $1,500,000 in networking capital to start. It is expected that networking capital requirements are not changing over the life of the project. Total fixed costs are $3,300,000 per year,variable production costs are $225 per unit, and the units are priced at $375 each. The equipment needed to begin production has an installed cost of$16,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as a seven-year MACRS property. In five years, this equipment can be sold for about 20 percent of the acquisition cost. The tax rate is 21 percent and the required returns is 18 percent. Based on these preliminary estimates, a) What is theNPV of the project? b) What is the IRR? USE EXCEL AND SHOW WORKINGarrow_forwardTarget Costing Instant Image Inc. manufactures color laser printers. Model J20 presently sells for $460 and has a product cost of $230, as follows: Direct materials $175 Direct labor 40 Factory overhead 15 Total $230 It is estimated that the competitive selling price for color laser printers of this type will drop to $400 next year. Instant Image has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 15 minutes per unit. 2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $20 per unit. 3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Forty percent of the direct labor and 48% of the factory overhead are related to running injection molding machines.…arrow_forward

- Break-Even Analysis Feet-First Industries plans to sell 7,750 sleds at $60 each in the coming year. Variable cost is 60 percent of the sales price. Fixed factory overhead equals $44,540 and fixed selling and administrative expense equals $34,780. a. Calculate the units that Feet-First must sell in order to break even. 0 b. Calculate the sales revenue that Feet-First must earn to break even by using the contribution margin. $ 0 c. Confirm your answer in requirement b, by muliplying the number of break-even units in requirement a by the unit sales price. $ 0arrow_forwardBreak-even sales Currently, the unit selling price of a product is $270, the unit variable cost is $220, and the total fixed costs are $520,000. A proposal is being evaluated to increase the unit selling price to $300. a. Compute the current break-even sales (units).fill in the blank 1 of 1 units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant.fill in the blank 1 of 1 unitsarrow_forwardBreak-Even Sales Currently, the unit selling price of a product is $220, the unit variable cost is $180, and the total fixed costs are $384,000. A proposal is being evaluated to increase the unit selling price to $240. a. Compute the current break-even sales (units). units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased to the proposed $240, and all costs remain constant. unitsarrow_forward

- Current Attempt in Progress Pharoah Company estimates that variable costs will be 55% of sales, and fixed costs will total $1,401,750. The selling price of the product is $7. Calculate the break-even point in units and dollars. Break-even point Break-even point unitsarrow_forwardA4arrow_forwardBreak-Even Sales Currently, the unit selling price of a product is $220, the unit variable cost is $180, and the total fixed costs are $288,000. A proposal is being evaluated to increase the unit selling price to $240. a. Compute the current break-even sales (units). units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased and all costs remain constant. unitsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education