FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

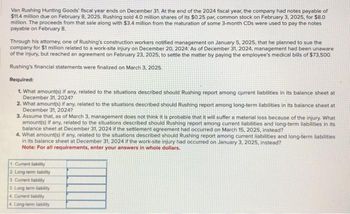

Transcribed Image Text:Van Rushing Hunting Goods' fiscal year ends on December 31. At the end of the 2024 fiscal year, the company had notes payable of

$11.4 million due on February 8, 2025. Rushing sold 4.0 million shares of its $0.25 par, common stock on February 3, 2025, for $8.0

million. The proceeds from that sale along with $3.4 million from the maturation of some 3-month CDs were used to pay the notes

payable on February 8.

Through his attorney, one of Rushing's construction workers notified management on January 5, 2025, that he planned to sue the

company for $1 million related to a work-site injury on December 20, 2024: As of December 31, 2024, management had been unaware

of the injury, but reached an agreement on February 23, 2025, to settle the matter by paying the employee's medical bills of $73,500.

Rushing's financial statements were finalized on March 3, 2025.

Required:

1. What amount(s) if any, related to the situations described should Rushing report among current liabilities in its balance sheet at

December 31, 2024?

2. What amount(s) if any, related to the situations described should Rushing report among long-term liabilities in its balance sheet at

December 31, 2024?

3. Assume that, as of March 3, management does not think it is probable that it will suffer a material loss because of the injury. What

amount(s) if any, related to the situations described should Rushing report among current liabilities and long-term liabilities in its

balance sheet at December 31, 2024 if the settlement agreement had occurred on March 15, 2025, instead?

4. What amount(s) if any, related to the situations described should Rushing report among current liabilities and long-term liabilities

in its balance sheet at December 31, 2024 if the work-site injury had occurred on January 3, 2025, instead?

Note: For all requirements, enter your answers in whole dollars.

1. Current liability

2. Long-term liability.

3. Current liability

3. Long term liability

4. Current liability

4. Long-term liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Krause Corporation issued $2,300,000, 10-year, 6% bonds for $2,231,000 on January 1, 2022. Interest is paid semiannually on January 1 and July 1. The corporation uses the straight-line method of amortization. Krause's fiscal year ends on December 31. The amount of discount amortization on July 1, 2022, would be OA. $138,000. OB. $69,000. OC. $6,900. OD. $3,450.arrow_forwardRandy Mining Co. is expanding its operations in northern Ontario. On December 21, 2018, thecompany issued $570,000 of 5%, seven-year bonds for $538,181. Interest is paid annually onDecember 31. The market rate of interest is 6%. The company uses the effective interest ratemethod. Required:Prepare the journal entries for December 31, 2019 and 2020.arrow_forwardCotton Candy Company purchased $1,500,000 of 10% bonds of Caramel Company on January 1, 2024, paying $1,410,375. The bonds mature January 1, 2031; interest is payable each July 1 and January 1. The discount of $89,625 provides an effective yield of 11%. For the year ended December 31, 2024, Cotton Candy Companys income statement will report interest revenue from the Caramel Company bonds ofarrow_forward

- On January 1, 2022, Huff Co. sold P1,000,000 of its 10% bonds for P885,296 to yield 12%. Interest is payable semiannually on January 1 and July 1. What amount should Huff report as interest expense for the six months ended June 30, 2022? a.) P44,266 b.) P50,000 c.) P53,118 d.) P60,000arrow_forwardAt January 1, 2024, Clayton Hoists Incorporated owed Third BancCorp $20 million, under a 10% note due December 31, 2025. Interest was paid last on December 31, 2022. Clayton was experiencing severe financial difficulties and asked Third BancCorp to modify the terms of the debt agreement. After negotiation Third BancCorp agreed to do the following: Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) • Forgive the interest accrued for the year just ended. • Reduce the remaining two years' interest payments to $1 million each. • Reduce the principal amount to $19 million. Required: 1-3. Prepare the journal entries by Third BancCorp necessitated by the restructuring of the debt at January 1, 2024, December 31, 2024 and December 31, 2025. Note: Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers…arrow_forwardOn January 1, 2021, Glanville Company sold goods to Otter Corporation. Otter signed an installment note requiring payment of $21,500 annually for five years. The first payment was made on January 1, 2021. The prevailing rate of interest for this type of note at date of issuance was 10%. Glanville should record sales revenue in January 2021 of: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $107,500 $81,502 $89,652 None of these answer choices are correct.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education