FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

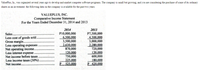

Transcribed Image Text:ValuePlus, In., was organized several years ago to develop and market computer software programs. The company is small but growing, and you are considering the purchase of some of its ordinary

shares as an investment. the following data on the company is available for the past two years:

VALUEPLUS, INC.

Comparative Income Statement

For the Years Ended December 31, 2014 and 2013

2014

2013

P10,000,000

6,500,000

3,500,000

2,630,000

870,000

120,000

750,000

225,000

525.000

P7,500,000

4,500,000

3,000,000

2,280,000

720,000

120,000

600,000

180,000

P 420,000

Sales.....

Less cost of goods sold.

Gross margin..

Less operating expenses

Net operating income..

Less interest expense.

Net income before taxes

Less income taxes (30%).

Net income.

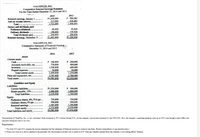

Transcribed Image Text:VALUEPLUS, INC.

Comparative Retained Earnings Statement

For the Years Ended December 31, 2014 and 2013

2014

2013

P1,200,000

525,000

1.725.000

P 980,000

420,000

1400,000

Retained carmings, January 1 ..

Add net income (above).

Total.

Deduct cash dividends paid:

Preference dividends.

Ordinary dividends

Total dividends paid.

Retained earnings, December 31.

60,000

180.000

240,000

PL.485,000

60,000

140,000

200.000

P1.200.000

VALUEPLUS, INC.

Comparative Statement of Financial Position

December 31, 2014 and 2013

2014

2013

Assets

Current assets:

Cash

Accounts receivable, net.

Inventory

Prepaid expenses

Total current assets.

P 100,000

750,000

1,500,000

50.000

2,400,000

2,585.000

P4.985.000

P 200,000

400,000

600,000

50.000

1,250,000

2.700.000

P3.950.000

Plant and equipment, net.

Total assets.

Liabilities and Equity

Liabilities:

Current liabilities

Bonds payable, 12%.

Total liabilities.

Equity:

Preference shares, 8%, P10 par..

Ordinary shares, PS par.

Retained earnings.

Total equity.

Total liabilities and equity

P1,250,000

1.000.000

2,250.000

P 500,000

1.000.000

1.500,000

750,000

500,000

1.485.000

2.735.000

P4.985.000

750,000

500,000

1,200,000

2,450.000

P3,950.000

The president of ValusPlus, Inc, is very concensed. Salas increased by P25 million daring 2014, yat the company's net incoume increased by only P105,000. Also, the company's oparating expanses want up in 2014, aven though a major effort was

launcaed during the year to cut costs.

Requirements:

1. For botia 2013 and 2014, prepare the income statement and the statament of financial positicn in common-size form. (Round computations to cna decimal place.)

2 From your work in () abova, explain to tiae presidant nay the increase in profits was so small in 2014. Were any banefits realized fom the company's cost-cuting efforts? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Under Armour, Incorporated is an American supplier of sportswear and casual apparel. Following are selected financial data for the company for the period 2009 to 2013. Profit margin (%) Retention ratio (%) Asset turnover (X) Financial leverage (X) Growth rate in sales (%) 2009 5.2 100.0 1.6 1.7 18.3 2010 6.1 100.0 1.6 1.7 24.4 2011 6.3 100.0 1.6 1.9 38.6 2012 6.7 100.0 1.6 1.8 24.8 2013 6.7 100.0 1.5 1.9 27.3 a. Calculate Under Armour's annual sustainable growth rate for the years 2009 through 2013. Note: Round your answers to 1 decimal place.arrow_forwardRed Spark Incorporated is interested in assessing the following scenarios on its indicators of profitability. Solve each scenario independently. a. Red Spark has taken significant steps to decrease expenses and expects its net income to increase by $8 million to $68 million. If its profit margin is 5.0%, what will the profit margin be after considering the decreased expenses? b. Red Spark has taken significant steps to decrease expenses and expects its net income to increase by $8 million to $68 million. If its average total assets are $494 million, what will its return on assets be?arrow_forwardGibson Corporation’s balance sheet indicates that the company has $580,000 invested in operating assets. During the year, Gibson earned operating income of $67,280 on $1,160,000 of sales. Required Compute Gibson’s profit margin for the year. Compute Gibson’s turnover for the year. Compute Gibson’s return on investment for the year. Recompute Gibson’s ROI under each of the following independent assumptions:(1) Sales increase from $1,160,000 to $1,392,000, thereby resulting in an increase in operating income from $67,280 to $76,560.(2) Sales remain constant, but Gibson reduces expenses, resulting in an increase in operating income from $67,280 to $69,600.(3) Gibson is able to reduce its invested capital from $580,000 to $464,000 without affecting operating income.arrow_forward

- Kleino Inc reported the following segment breakdown. Using Vertical Analysis, which segment diminished as a percentage of the overall business in the most recent year? Segment Recent Year Prior Year (in millions) (in millions) Small Business $2,994 $2,539 Consumer 2464 2201 Strategic Partner 508 440 Total Revenues $5,966 $5, 180 Group of answer choices a) None of the above. b) Consumer c)Small Business D)All of the above e)Strategic Partnerarrow_forwardBelow is a major portion of the income statements of KTA Inc. for 2020 and 2021: Sales Cost of Sales Gross Margin 2020 P80,000 50,000 P30,000 2021 P97,200 72,000 P25,200 The firm sold its sole product for P8/unit during 2020. Even though the sales units increased by 20% during 2021, the gross margin declined. Disappointed with the results, the owner asked for your assistance in analyzing the cause of the gross margin decline. Percentage increase (decrease) in unit cost. A. 20% C. (44%) B. (20%) D. 44%arrow_forward(Related to Checkpoint 4.3) (Profitability analysis) Last year the P. M. Postem Corporation had sales of $405,000, with a cost of goods sold of $112,000. The firm's operating expenses were $125,000, and its increase in retained earnings was $76,440. There are currently 21,000 shares of common stock outstanding, the firm pays a $1.56 dividend per share, and the firm has no interest-bearing debt. a. Assuming the firm's earnings are taxed at 35 percent, construct the firm's income statement. b. Compute the firm's operating profit margin. a. Assuming the firm's earnings are taxed at 35%, construct the firm's income statement. Complete the income statement below: (Round to the nearest dollar.) Income Statement Revenues Cost of Goods Sold Gross Profit Operating Expenses Net Operating Income Interest Expense Earnings before Taxes Income Taxes Net Income GA SA ...arrow_forward

- Suppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Price-to-cash-flow Inventory turnover Debt-to-equity Ratios Calculated Year 1 Year 2 1.40 0.98 2.80 2.24 0.40 0.32 Year 3 0.78 1.79 0.26 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. A decline in the inventory turnover ratio could likely be explained by operational difficulties that the company faced, which led to duplicate orders placed to vendors. A decline in the inventory…arrow_forwardAnswer Pleasearrow_forwardNeed Answerarrow_forward

- Ready Electronics is facing stiff competition from imported goods. Its operating income margin has been declining steadily for the past several years. The company has been forced to lower prices so that it can maintain its market share. The operating results for the past 3 years are as follows: Year 1 Year 2 Year 3 Sales 14,500,000 9,500,000 9,000,000 Operating income 1,200,000 1,145,000 945,000 Average assets 15,000,000 15,000,000 16,750,000 For the coming year, Ready's president plans to install a JIT purchasing and manufacturing system. She estimates that inventories will be reduced by 70% during the first year of operations, producing a 20% reduction in the average operating assets of the company, which would remain unchanged without the JIT system. She also estimates that sales and operating income will be restored to Year 1 levels because of simultaneous reductions in operating expenses and selling prices. Lower selling prices will allow Ready to expand its market share. 1.…arrow_forwardPROBLEM 11-17 Return on Investment (ROI) and Residual Income LO11-1, LO11-2 Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Ending Balance Balance Assets Cash $ 140,000 $ 120,000 Accounts receivable 450,000 530,000 Inventory 320,000 380,000 Plant and equipment, net 680,000 620,000 Investment in Buisson, S.A. 280,000 170,000 250,000 Land (undeveloped) 180,000 Total assets $2,020,000 $2,100,000 Liabilities and Stockholders' Equity Accounts payable. $ 360,000 $ 310,000 Long-term debt Stockholders' equity 1,500,000 1,500,000 160,000 290,000 Total liabilities and stockholders' equity $2,020,000 $2,100,000 Joel de Paris, Inc. Income Statement Sales $4,050,000 Operating expenses Net operating income 3,645,000 405,000 Interest and taxes: Interest expense $150,000 Таx expense 110,000 260,000 Net income $ 145,000 The company paid dividends of $15,000 last year. The "Investment in Buisson, S.A.," on the balance sheet represents an…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education