Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

please provide correct answer General accounting question

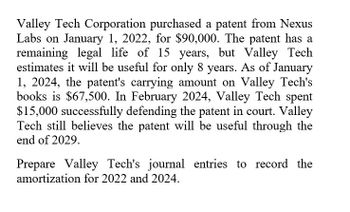

Transcribed Image Text:Valley Tech Corporation purchased a patent from Nexus

Labs on January 1, 2022, for $90,000. The patent has a

remaining legal life of 15 years, but Valley Tech

estimates it will be useful for only 8 years. As of January

1, 2024, the patent's carrying amount on Valley Tech's

books is $67,500. In February 2024, Valley Tech spent

$15,000 successfully defending the patent in court. Valley

Tech still believes the patent will be useful through the

end of 2029.

Prepare Valley Tech's journal entries to record the

amortization for 2022 and 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Munabhaiarrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 2020, when it was acquired at a cost of $21.6 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the beginning of 2024. Required: Prepare the year-end journal entry for patent amortization in 2024. No amortization was recorded during the year. Record amortization expensearrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight-line basis since 2020, when it was acquired at a cost of $27.0 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the beginning of 2024. Required: Prepare the year-end journal entry for patent amortization in 2024. No amortization was recorded during the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answer in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.5). 1 No > Answer is complete but not entirely correct. Event General Journal 1 Amortization expense Patent Debit Credit 7,500,000.00 7,500,000.00arrow_forward

- Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the patent on a straight- line basis since 2020, when it was acquired at a cost of $20.7 million at the beginning of that year. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the beginning of 2024. Required: Prepare the year-end journal entry for patent amortization in 2024. No amortization was recorded during the year Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answer in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.5).arrow_forwardOn January 3, 2012, the July Company spent P196,000 to apply for and obtain a patent on a newly developed product. The patent had an estimated useful life of 10 years. At the beginning of 2014, the company spent P28,000 in successfully prosecuting an attempted infringement of the patent.. At the beginning of 2017, the company purchased for P60,000 a patent that was expected to prolong the life of its original patent by 5 years. On July 1, 2020, a competitor obtained rights to a patent that made the company's patent obsolete. REQUIRED: Prepare journal entries to record the transactions relative to the patents from January 3, 2012 to July 1, 2020, inclusive.arrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the $19.80 million cost of the patent on a straight-line basis since it was acquired at the beginning of 2020. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the end of 2024 (before adjusting and closing entries). What is the appropriate adjusting entry for patent amortization in 2024 to reflect the revised estimate? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50). View transaction list Journal entry worksheet < 1 Record the adjusting entry for patent amortization in 2024. Note: Enter debits…arrow_forward

- On January 1, 2020, Blessed Company purchased a Patent for P280,000. The asset has a legal life of 10 years but due to rapidly changing technology, Blessed estimates a useful life of only 7 years. On January 1, 2022, Blessed is uncertain that the process can actually be made economically feasible, and decides to write down the patent. The future cash inflows expected from the patent will be P40,000 per year for the remaining life of the patent. The present value of these cash flows, discounted at 12% market interest rate, is P144,200. The fair value less cost to sell is P130,000.arrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized thepatent on a straight-line basis since 2014, when it was acquired at a cost of $9 million at the beginning of thatyear. Due to rapid technological advances in the industry, management decided that the patent would benefit thecompany over a total of six years rather than the nine-year life being used to amortize its cost. The decision wasmade at the beginning of 2018.Required:Prepare the year-end journal entry for patent amortization in 2018. No amortization was recorded during the year.arrow_forwardOn January 1, 2017, Jayjay Company, a large company, purchased a patent for a new consumer product for P4,800,000. At the time of purchase, the patent was valid for 10 years. However, the patent's useful life was estimated to be only 8 years due to a competitive nature of the product. On December 31, 2020, the product was permanently withdrawn from sale under government order because of a potential health hazard in the product. What amount should Jayjay Company charge against income during 2020, assuming amortization is recorded at the end of the such year? a. P600,000 b. P3,000,000 c. P3,360,000 d. P3,600,000arrow_forward

- How to get the 630,000 answer?arrow_forward! Required information [The following information applies to the questions displayed below.] Bethany incurred $20,800 in research and experimental costs for developing a specialized product during July 2023. Bethany went through a lot of trouble and spent $10,400 in legal fees to receive a patent for the product in August 2025. Bethany expects the patent to have a remaining useful life of 10 years. Note: Do not round intermediate calculations. b. How much patent amortization expense would Bethany deduct in 2025? Deductible patent amortization expensearrow_forwardOrtiz Box Company purchased a patent on a box - folding machine for $160,000 on July 1, 2012. The useful life was estimated at 20 years. There were 19 years remaining on the patent when it was purchased. In early 2019, the CEO of Ortiz noted a decrease, industry - wide, in the demand for folded boxes. The CEO estimated that the patent had a remaining useful life of 5 years. An impairment analysis was done as of June 30, 2019. Expected annual cash flows over the next 5 years were estimated at $20,000. The discount rate used by Ortiz is 5%. How much amortization expense was recognized by Ortiz in 2019 and 2020, respectively? Select one: a. $4,211 b. $7,330 c. $ 7,818 d. $12,870 e. $12, 659arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning