FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

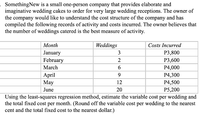

Transcribed Image Text:SomethingNew is a small one-person company that provides elaborate and

imaginative wedding cakes to order for very large wedding receptions. The owner of

the company would like to understand the cost structure of the company and has

compiled the following records of activity and costs incurred. The owner believes that

the number of weddings catered is the best measure of activity.

Мonth

Weddings

Costs Incurred

January

February

3

Р3,800

Р3,600

March

P4,000

P4,300

April

Мay

9.

12

P4,500

June

20

P5,200

Using the least-squares regression method, estimate the variable cost per wedding and

the total fixed cost per month. (Round off the variable cost per wedding to the nearest

cent and the total fixed cost to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please use the two images below to solve this practice problem. Write clearly Thank youarrow_forwardMore real estate Consider the Albuquerque home sales from Exercise 29 again. The regression analysis gives the model Price = 47.82 + 0.061 Size. a) Explain what the slope of the line says about housing prices and house size. b) What price would you predict for a 3000-square-foot house in this market? c) A real estate agent shows a potential buyer a 1200-square- foot home, saying that the asking price is $6000 less than what one would expect to pay for a house of this size. What is the asking price, and what is the $6000 called?arrow_forwardRahularrow_forward

- The number of properties newly listed with a real estate agency in each quarter over the last four years is given below. Assume the time series has seasonality without trend. Quarter 1 2 3 4 Year 1 73 89 123 92 Year 2 81 87 115 95 Year 3 76 91 108 87 Year 4 77 88 120 97 a. Develop the optimization model that finds the estimated regression equation that minimize the sum of squared error. b. Solve for the estimated regression equation. c. Forecast the four quarters of Year 5. *Please solve in excelarrow_forwardFor the following two alternatives, if the MARR is 10% per year (a)which one has a shorter payback period (b) which one do you select if you use the PW analysis. (c) is your selection different in (a) and (b)? Why? (d) use Spreadsheet to solve a and b. Alternative A: initial cost = $300,000 Revenue = $60,000 Alternative B: initial costs = $300,000 Revenue starts from n=1 at $10,000 and increases by $15,000 per year The expected life is 10 years for each alternative.arrow_forwardIn this part of the project, you will be purchasing the home you chose in the Budget Project. You will need to obtain a loan from a financial institution since you cannot pay cash for your home. You will be researching three different loan scenarios and determining which loan option best fits your situation and needs. Purchase price of the home you chose from the Budget Project: ________$431,873______ Part 1: Financing your home Loan Scenario 1: In this scenario, your financial institution is offering you a 30-year fixed mortgage with a 20% down payment at a 3.43% fixed rate. Determine the following: Calculate the down payment for this loan. How much will you need to finance from the bank for this loan? What is your monthly payment? Use technology or the monthly payment formula in your text to get the monthly payment for this loan. What is the total cost of the loan over 30 years? How much of this cost is interest? What is the total you will expect to pay at closing for this loan…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education