FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

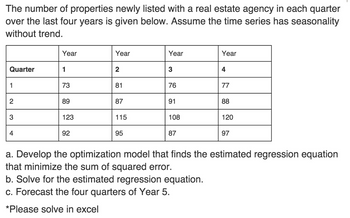

Transcribed Image Text:The number of properties newly listed with a real estate agency in each quarter

over the last four years is given below. Assume the time series has seasonality

without trend.

Quarter

1

2

3

4

Year

1

73

89

123

92

Year

2

81

87

115

95

Year

3

76

91

108

87

Year

4

77

88

120

97

a. Develop the optimization model that finds the estimated regression equation

that minimize the sum of squared error.

b. Solve for the estimated regression equation.

c. Forecast the four quarters of Year 5.

*Please solve in excel

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- More real estate Consider the Albuquerque home sales from Exercise 29 again. The regression analysis gives the model Price = 47.82 + 0.061 Size. a) Explain what the slope of the line says about housing prices and house size. b) What price would you predict for a 3000-square-foot house in this market? c) A real estate agent shows a potential buyer a 1200-square- foot home, saying that the asking price is $6000 less than what one would expect to pay for a house of this size. What is the asking price, and what is the $6000 called?arrow_forward1) The simple interest for an investment is jointly proportional to the time and the principal. After one quarter (3 months), the interest on a principal of $5000 is $43.75 a) Write an equation relating the interest ,principal and time b) Find the interest after three quarters 2) The Kinetic energy E of an object varies jointly with the object mass m and the square of the object velocity v .An object with a mass of 50 kilograms traveling at 16 meters per second has a kinetic energy of 6400 joules . a) Write an equation relating the interest ,principal and time b) What is the kinetic energy of an object with a mass of 70 kilograms traveling at 20 meters per second?arrow_forwardAnswer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote. how long will it take $833.00 to accumulate to $1033.00 at 3% p.a. compounded quarterly? state your answer in years and months (from 0 to 11 ml tbs) the investment will take _____ years and ____ months to maturearrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardFull explanation plsarrow_forwardPlease complete this practice problem by using the 2 images below. Please write cleary and everything in order. Thank youarrow_forward

- Round to the nearest whole number .arrow_forwardSky High Partners is evaluating a high-rise office building to add to its investment portfolio. To calculate a value, Sky High plans to use the income approach, based on the following estimates: Gross potential yearly rental income Estimated vacancy rate Yearly operating costs Market capitalization rate a. Compute the net operating income (NOI) for the building. Net operating income $ Valuation $ 890,000 2.75% $ 417,000 14% 448,525 b. Using the income approach, calculate the value for the office building. Note: Round your answer to the nearest whole number.arrow_forwardPerform a present worth (PW)-based evaluation of the two alternatives below using a spreadsheet. The after-tax minimum acceptable rate of return (MARR) is 8% per year, Modified Accelerated Cost Recovery System (MACRS) depreciation applies, and Te=40%. The (GI -OE) estimate is made for the first 3 years; it is zero in year 4 when each asset is sold. Alternative First Cost, $ Salvage Value, Year 4, $ GI-OE, $ per Year Recovery Period, Years X -8,000 0 3,500 3 Y -13,000 2,000 5,000 3 The PW for alternative X is determined to be $ The PW for alternative Yis determined to be $ Alternative (Click to select) is selected.arrow_forward

- Answer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote.arrow_forwardplease help!!!!!arrow_forwardSuppose that Project A has a life of 6 years and Project B has a life of 4 years. How many times (after the initial project life) would each project need to be repeated in order to conduct an analysis with the replacement change approach? O a. Project A would need to be repeated 5 times and Project B would need to be repeated 3 times b. Project A would need to be repeated 3 times and Project B would need to be repeated 5 times. c. Project A would need to be repeated twice and Project B would need to be repeated twice. O d. Project A would need to be repeated once and Project B would need to be repeated twice. e. Project A would need to be repeated once and Project B would need to be repeated once. O 1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education