Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

General accounting

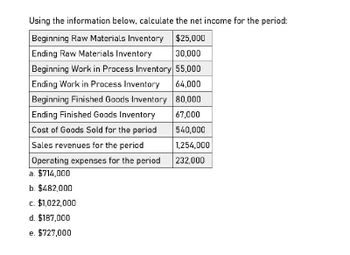

Transcribed Image Text:Using the information below, calculate the net income for the period:

Beginning Raw Materials Inventory

Ending Raw Materials Inventory

$25,000

30,000

Beginning Work in Process Inventory 55,000

Ending Work in Process Inventory

64,000

Beginning Finished Goods Inventory 80,000

Ending Finished Goods Inventory

67,000

Cost of Goods Sold for the period

540,000

1,254,000

Sales revenues for the period

Operating expenses for the period

a. $714,000

232,000

b. $482,000

c. $1,022,000

d. $187,000

e. $727,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cost of goods sold Pine Creek Company completed 200,000 units during the year at a cost of 3,000,000. The beginning finished goods inventory was 25,000 units at 310,000. Determine the cost of goods sold for 210,000 units, assuming a FIFO cost flow.arrow_forwardDuring the year, a company purchased raw materials of $77,321 and incurred direct labor costs of $125,900. Overhead Is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forward

- Using the weighted-average method, compute the equivalent units of production if the beginning inventory consisted of 20,000 units; 55,000 units were started in production; and 57,000 units were completed and transferred to finished goods inventory. For this process, materials are added at the beginning of the process, and the units are 35% complete with respect to conversion.arrow_forwardFrom the following data, determine the Cost of Goods Manufactured for 2020: Accounts Amounts Sales $ 870,000 Direct Materials used 170,000 Direct Labor costs 90,000 Total Overhead costs Work-in-Process inventory, 12-31-2019 Finished Goods inventory, 12-31-2019 Work-in-Process inventory, 12-31-2020 Finished Goods inventory, 12-31-2020 60,000 $ 35,000 $ 40,000 30,000 25,000 Rent, utilities for corporate headquarters building 70,000 A) $315,000 B) $325,000 C) $330,000 D) $340,000arrow_forwardWork in process inventory on December 31 of the current year is $44,000. Work in process inventory increased by 60% during the year. Cost of goods manufactured amounts to $275,000. What are the total manufacturing costs incurred in the current year? a.$233,750 b.$291,500 c.$275,750 d.$302,000 Period costs include a.operating costs that are shown on the income statement when products are sold b.operating costs that are shown on the income statement in the period in which they are incurred c.current liabilities on the balance sheet d.current assets on the balance sheet On the statement of cash flows prepared by the indirect method, the cash flows from operating activities section would include A.amortization of premium on bonds payable. B.receipts from the sale of investments. C.receipts from the issuance of common stock. D.payments for cash dividends.arrow_forward

- 8) Data for a manufacturing company for the year are as follows: Д Finished goods inventory, beginning balance $240,000 Work-in-process inventory, ending balance 100,000 Overapplied manufacturing overhead 50,000 Finished goods inventory, ending balance 260,000 Work-in-process inventory, beginning 130,000 balance Cost of goods manufactured 680,000 What is the company's computed adjusted cost of goods sold? O $610,000 O $640,000 O $710,000 • $740,000arrow_forwardThe cost of goods sold for the year ended December 31, 2021 would be a. 1,500,000 b. 1,650,000 c. 1,610,000 d. 1,480,000arrow_forwardAn excerpt from the last year’s final annual report ofKalamia manufacturing company reported the informationprovided in the table.Compute (a) inventory turnover and (b) weeks of supply,assuming an annual operation of 50 weeks and the cost of goodssold was €5,000,000. CATEGORY PART NO. AVERAGEINVENTORY UNIT VALUEUNITS € Raw materials RSI - 1 200 3RSI - 2 50 2RSI - 3 300 1RSI - 4 100 3, 5 Work-in-process CSI - 1 50 10CSI - 2 250 15 Finished goods FJ - 1 890 70FJ - 2 2000 77FJ - 3 870 90arrow_forward

- Using the information below, compute the raw materials inventory turnover: Raw materials used $ 161,600 Beginning raw materials inventory 20,000 Ending raw materials inventory 22,200arrow_forwardFinancial accountingarrow_forwardRamo Manufacturing reported the following:$850.000RevenueBeginning inventory of direct inaterials, January 1,20,0002015256,000Purchases of direct materialsEnding inventory of direct materials, December 31,18,000201521.000Direct manufacturing labor42,000indirect manufacturing costs2015Beginning inventory of finished goods, January 1,40,000314,000Costs fo goods manufactured2015Ending inventory of finished goods, December 31,45,000150,000Operating costsa) What is Romo's Direct Materials Used? $b) What is Romo's Manufacturing Costs Incurred? $c) What is Romo's Cost of Goods Sold? $You must show work for credit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,