ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

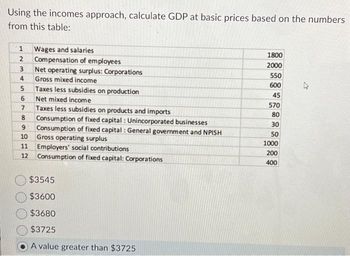

Transcribed Image Text:Using the incomes approach, calculate GDP at basic prices based on the numbers

from this table:

1 Wages and salaries

2

3

4

Compensation of employees

Net operating surplus: Corporations

Gross mixed income

5 Taxes less subsidies on production

Net mixed income

7 Taxes less subsidies on products and imports

8

67

6

9

10

11

12

Consumption of fixed capital: Unincorporated businesses

Consumption of fixed capital: General government and NPISH

Gross operating surplus

Employers' social contributions

Consumption of fixed capital: Corporations

$3545

$3600

$3680

$3725

A value greater than $3725

1800

2000

550

600

45

570

80

30

50

1000

200

400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Part II 1. From the data in the below table, calculate GDP using the expenditure approach: Component Gross investment Personal consumption expenditure Depreciation Government purchases U.S. imports U.S. exports Compensation of employees Amount (billions of dollars) 1300 1475 25 1315 260 249 65arrow_forwardPersonal consumption expenditures $4,750 Exports $810 Federal government spending $1,400 Social Security taxes $600 Depreciation $450 Indirect Business Taxes $550 New Residential Construction $800 Imports $850 Non Residential Investment $300 Corporate Income Taxes $200 Corporate Profits $50 Personal Taxes $800 Business Taxes $1,000 Transfer Payments $700 Part A: In the table above and using the Expenditure Approach calculate the Gross Domestic Product (GDP) in millions of dollars Part B: Now assume that consumers purchase an extra $2000 of goods produced overseas, i.e., the consumption expenditures (from Part A) increase to $6,750. How would this scenario affect the GDP deflator, i.e., increase, decrease, remain unaffected or there is not enough information to tell?arrow_forwardUse the table to answer the questions. Assume firms pay all profits out to resource owners, there is no depreciation, and there are no taxes. 2010 Consumption spending (C) $350 Rent $100 Profit $175 Investment spending (I) $75 Interest $50 Government spending (G) $125 Net exports (NX) $10 Employee compensation $ Enter the value of GDP in 2010. Use the factor income approach to calculate employee compensation in 2010.arrow_forward

- Use the numbers to help calculate the Net GDP(NDP);Green GDP;& Genuine Progress Indicator (GPI). Also explain how they are different and offer an opinion on which one was a better method to measure the performance.arrow_forwardSuppose you are given the following data for a particular economy (unit: Millions of Euros):Gross National Income mp (GNImp) =1650Investment (I) = 220(Iliq) Net investment = 210Private consumption(C) =1100Net External Income (NEI) = 0Net Indirect Taxes (NIT) = 231Public Spending (G) = 363 Calculate: a) Balance of Goods and Services or Net Exports (NX) and Amortizations/Depreciations (A). b) Net National Product at Base Prices (NNPbp) and Net Domestic Product at Base Prices (NDPbp)arrow_forwardWhat is Gross Domestic Product if investment spending is $1,879.99, households receive $170.17 in net interest income, wages equal $13,555.17, rental receipts on land are $1, total business profits before taxes are $1,611.03, and indirect business taxes are $1,329.47? Assume all other types of income and depreciation are zero and that other values for potential components of GDP are unknown for this example. Round your answer to two digits after the decimal.arrow_forward

- GDP minus depreciation is the formula used to calculate a- Net national product b- Gross natioal Product c- Gross Domestic Product d- Natioal incomearrow_forwardCalculate the value of consumption of fixed capital National income = $4000 GDPMP = $5000 Net indirect tax = $300 Net factor income from abroad = $200 All values are in millionarrow_forwardBonus Question: Based on the table below, calculate National income and then GDP using the income approach as per the table below: Description Billions of dollars Compensation of employees 800 Corporate profits 200 Statistical discrepancy 70 Rental Income 400 200 Depreciation 20 Profits of government enterprises 120 Proprietor's incomearrow_forward

- gross private domestic investment $1593 personal taxes 1113 transfer payments 1683 taxes on production & imports 695 corporate income taxes 213 personal consumption expenditures 7304 consumption of fixed capital 1393 US Exports 1059 dividends 434 government purchases 1973 net foreign factor 10 undistributed corporate profit 290 sociual security contributions 748 US imports 1483 statistical discrepency 50 Refer to the accompanying national income data (in billions of dollars) CORPORATE PROFITS are equal to?arrow_forwardProblem Using the following national income accounting data, calculate GDP in this countryarrow_forwardHand written solutions are strictly prohibitedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education