FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

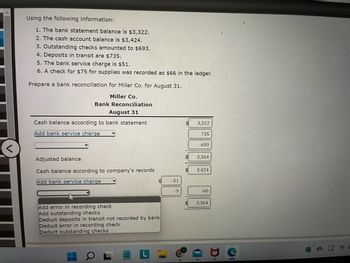

Transcribed Image Text:### Bank Reconciliation Example

Using the following information:

1. The bank statement balance is $3,322.

2. The cash account balance is $3,424.

3. Outstanding checks amounted to $693.

4. Deposits in transit are $735.

5. The bank service charge is $51.

6. A check for $75 for supplies was recorded as $66 in the ledger.

Prepare a bank reconciliation for Miller Co. for August 31.

#### Miller Co.

#### Bank Reconciliation

#### August 31

**Cash balance according to bank statement**

- Bank statement balance: $3,322

- Add deposits in transit: +$735

- Deduct outstanding checks: -$693

**Adjusted balance**: $3,364

**Cash balance according to company's records**

- Cash account balance: $3,424

- Deduct bank service charge: -$51

- Deduct error in recording check: -$9

**Adjusted balance**: $3,364

The graph illustrates the adjustments made to reconcile the bank statement balance and the cash account balance. The final adjusted balances from both the bank and company's records match, confirming the reconciliation accuracy.

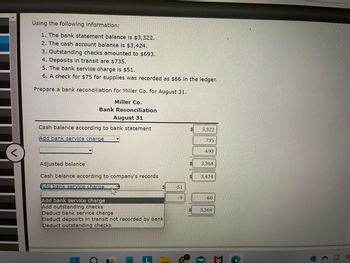

Transcribed Image Text:**Bank Reconciliation for Miller Co. - Educational Example**

**Using the following information:**

1. The bank statement balance is $3,322.

2. The cash account balance is $3,424.

3. Outstanding checks amounted to $693.

4. Deposits in transit are $735.

5. The bank service charge is $51.

6. A check for $75 for supplies was recorded as $66 in the ledger.

**Prepare a bank reconciliation for Miller Co. for August 31.**

---

**Miller Co.**

**Bank Reconciliation**

**August 31**

1. **Cash balance according to the bank statement: $3,322**

2. **Adjustments:**

- **Add deposits in transit:** $735

- **Deduct outstanding checks:** -$693

3. **Adjusted balance:** $3,364

4. **Cash balance according to the company's records: $3,424**

5. **Adjustments:**

- **Deduct bank service charge:** -$51

- **Deduct check error:** -$9 (The check for $75 was recorded as $66, creating a $9 discrepancy)

6. **Adjusted balance:** $3,364

---

### Explanation of the Diagram:

This bank reconciliation statement clarifies the difference between the bank statement balance and the company's cash account records by accounting for several transactions that have not been processed or included by both parties.

- The diagram presents a two-column format; the left column lists the steps and adjustments needed, while the right column shows the corresponding monetary values.

- The first step in the reconciliation process involves adjusting the bank statement balance by adding deposits in transit ($735) and deducting outstanding checks ($693), resulting in an adjusted balance of $3,364.

- The second step adjusts the company’s cash balance by deducting the bank service charge ($51) and the check recording discrepancy ($9), also resulting in an adjusted balance of $3,364.

This example helps learners understand how to align the bank statement balance with the company’s records, ensuring accuracy in financial reporting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information: The bank statement balance is $4,256. The cash account balance is $4,421. Outstanding checks amounted to $878. Deposits in transit are $1,008. The bank service charge is $26. A check for $35 for supplies was recorded as $26 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31. Candace Co.Bank ReconciliationMay 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $fill in the blank 3 fill in the blank 5 Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $fill in the blank 10 fill in the blank 12 Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forwardPROBLEM #4 Lee Co. kept all cash in a checking account. An examination of the accounting records and bank statement for the month of June revealed the following information: "The cash balance per book on June 30 was P8,500,000. A deposit of P1.000,000 that was placed in the bank's night depository on June 30 did not appear on the bank statement. The bank statement showed that on June 30 the bank collected note for the entity and credited the proceeds of P950,000 to the entity's account, net of collection charge P50,000. Checks outstanding on June 30 amounted to P300,000 including a certified check of P100,000. The entity discovered that a check written in June for P200.000 in payment of an account payable had been recorded in the entity's records as P20,000. Included with the June bank statement was NSF check for P250,000 received from a customer on June 26. The bank statement showed a P20,000 service charge for June. 1. What amount should be reported as cash in bank on June 30? 2.…arrow_forwardGunnar Company gathered the following reconciling information in preparing its September bank reconciliation. Calculate the adjusted cash balance per books on September 30. Cash balance per books, September 30 $ 3,114 Deposits in transit 541 Notes receivable and interest collected by bank 831 Bank charge for check printing 37 Outstanding checks 1,438 NSF check 136 a.$2,217 b.$3,011 c.$3,772 d.$2,875arrow_forward

- Prepare a bank reconcilation going from balance per bank and balance per book to correct cash balance. Outstanding checks from the June reconcilation cleared the bank in July.arrow_forwardKaren Lansbury Company deposits all receipts and makes all payments by check. The following information is available from the cash records. June 30 Bank Reconciliation Balance per bank $25,200 Add: Deposits in transit 5,544 Deduct: Outstanding checks (7,200 ) Balance per books $23,544 Month of July Results Per Bank Per Books Balance July 31 $31,140 $33,300 July deposits 16,200 20,916 July checks 14,400 11,160 July note collected (not included in July deposits) 5,400 July bank service charge 54 July NSF check from a customer, returned by the bank (recorded by bank as a charge) 1,206 (a) Prepare a bank reconciliation going from balance per bank and balance per book to correct cash balance.arrow_forwardQuestion Content Area Using the following information: The bank statement balance is $5,065. The cash account balance is $5,459. Outstanding checks amounted to $866. Deposits in transit are $1,191. The bank service charge is $60. A check for $34 for supplies was recorded as $25 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31. Candace Co. Bank Reconciliation May 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $- Select - - Select - Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $- Select - - Select - Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forward

- Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31, $32,110. Cash balance according to the bank statement at July 31, $31,350. Checks outstanding, $2,870. Deposit in transit, not recorded by bank, $4,150. A check for $170 in payment of an account was erroneously recorded in the check register as $710. Bank debit memo for service charges, $20. a. Prepare a bank reconciliation, using the format shown in Exhibit 14. Mathers Co. Bank Reconciliation July 31 Cash balance according to bank statement $fill in the blank dd438e08e013025_1 fill in the blank dd438e08e013025_3 fill in the blank dd438e08e013025_5 Adjusted balance $fill in the blank dd438e08e013025_6 Cash balance according to company's records $fill in the blank dd438e08e013025_7 fill in the blank dd438e08e013025_9 fill in the blank dd438e08e013025_11 Adjusted…arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31, $22,240. Cash balance according to the bank statement at July 31, $23,450. Checks outstanding, $4,510. Deposit in transit, not recorded by bank, $3,630. A check for $590 in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $30. Journalize the entries that should be made by the company, part (A) Error and part (B) Service Charge. a. July 31 b. July 31arrow_forwardBank Reconciliation The following data were accumulated for use in reconciling the bank account of Kaycee Sisters Inc. for August 20Y9: a. Cash balance according to the company's records at August 31, $28,730. b. Cash balance according to the bank statement at August 31, $30,200. c. Checks outstanding, $5,830. d. Deposit in transit, not recorded by bank, $4,680. e. A check for $590 in payment of an account was eroneously recorded by Kaycee Sisters Inc. as $950. f. Bank debit memo for service charges, $40. Prepare a bank reconciliation, using the format shown in Exhibit 12. Kaycee Sisters Inc. Bank Reconciliation August 31, 20Y9 Cash balance according to bank statement Adjusted balance Cash balance according to Kaycee Sisters Inc. $ Adjusted balancearrow_forward

- Sal's Surf Shop deposits all receipts in the bank and makes all payments by check. On July 31 the cash account had a balance of $6,105.42. The bank statement on July 31 reported a balance of $4,146.46. Upon comparing the bank statement to the books, the following items were found. а. A bank debit memo issued for an NSF check from a customer of $21.25. b. A bank credit memo issued for interest of $8.50 earned during the month. С. During the evening of July 31, a deposit of $1,948.25 was made, which is not shown on the bank statement. d. A bank debit memo issued for $18.50 for bank service charges. е. Checks for the amounts of $34.00, $17.85, and $93.25 were written during July but have not yet been received by the bank. f. The reconciliation from the previous month, June, showed outstanding checks of $260.80. One of these checks in the amount of $7.38 has not yet been received by the bank. g. After comparing the canceled checks to the bank statement, it was discovered that a check…arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: 1. Cash balance according to the company's records at July 31, $17,410. 2. Cash balance according to the bank statement at July 31, $18,430. 3. Checks outstanding, $3,530. 4. Deposit in transit, not recorded by bank, $2,840. 5. A check for $590 in payment of an account was erroneously recorded in the check register as $950. 6. Bank debit memo for service charges, $30. Journalize the entries that should be made by the company, part (A) Error and part (B) Service Charge. a. July 31 Cash |X Accounts Payable b. July 31 Miscellaneous Expense Feedback Cash Check My Work Keep in mind that the company needs to journalize any adjusting items in the company section of the bank reconciliation, decrease Cash. If the company made an error that understates cash in the company section, the journal adjustment woularrow_forwardBank reconciliation and entries Beeler Furniture Company deposits all cash receipts each Wednesday and Friday in a night depository after banking hours. The data required to reconcile the bank statement as of June 30 have been taken from various documents and records and are reproducedmas follows. The sources of the data are printed in capital letters. All checks were written for payments on account. CASH ACCOUNT: Balance as of June 1 $9,317.40 CASH RECEIPTS FOR MONTH OF JUNE $9,223.76 DUPLICATE DEPOSIT TICKETS: Date and amount of each deposit in June: Beeler Furniture Company Bank Reconciliation May 31 20Y2 Cash balance according to bank statement $ 9,447.20 Add deposit for May 31, not recorded by bank 690.25 Deduct outstanding checks: No. 731 $162.15 736 345.95 738 251.40 739 60.55 820.05 Adjusted balance $ 9,317.40 Cash balance according to company's records $ 9,352.50 Deduct bank service charges 35.10…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education