FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

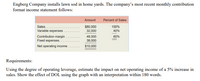

Transcribed Image Text:Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution

format income statement follows:

Amount

Percent of Sales

Sales...

$80,000

32,000

100%

Variable expenses

40%

Contribution margin

Fixed expenses..

48,000

38,000

60%

Net operating income .

$10,000

Requirements:

Using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in

sales. Show the effect of DOL using the graph with an interpretation within 180 words.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- • Use the below information to fill out the income statement and answer the questions 4-10 below: Selling Price per Unit Number of Units Total Dollars Sales Revenue $40.00 Variable Costs |600,000 Contribution Margin Fixed Costs 240,000 Net Income If OPEARATING LEVERAGE is 5 4. What is Net Income ?arrow_forwardA firm's degree of combined leverage (DCL) is equal to its degree of operating leverage.___leverage (DFL) Oa Plus Ob. Minus Oc Divided by Od Multiplied byarrow_forwardUse the following information about Rat Race Home Security, Inc. to answer the questions: Average selling price per unit $324. Variable cost per unit $187 Units sold 449 Fixed costs $8,589 Interest expense 17,204 Based on the data above, what will be the resulting percentage change in earnings per share of Rat Race Home Security, Inc. if they expect operating profit to change 4.2 percent? (You should calculate the degree of financial leverage first). (Write the percentage sign in the "units" box).arrow_forward

- Given the following data: Average operating assets $1,152,000 Total liabilities 65,280 Sales 384,000 Contribution margin 230,400 Net operating income 103,680 Return on investment (RCOI) is:arrow_forwardThe following income statement applies to Finch Company for the current year: Income Statement Sales revenue (480 units × $30) $ 14,400 Variable cost (480 units × $15) (7,200 ) Contribution margin 7,200 Fixed cost (4,000 ) Net income $ 3,200 Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leverage measure computed in Requirement a to determine the amount of net income that Fincharrow_forwardGive me answer within 45 min I will give positive rating immediately.....arrow_forward

- What was the amount that you originally invested if a 48% ROI results in a return of $24,756?arrow_forwardWhich will create the most favorable effect in gross profit? A. 10% increase in selling price B. 10% decrease in cost price C. 10% increase in both selling price and cost price D. 20% decrease in selling and administrative expensesarrow_forward1. Call(35) = $9.12, Call(40) = $6.22, Call(45)= $4.08. Using MS Excel, create profit tables and graphs separately for each long call and then create a single chart showing profit for each long call on the same graph, clearly label each profit curve.arrow_forward

- The initial analysis should include the following: The ratio equation The calculation of the ratio using the equation and the pre-assigned Quick Study or Exercise from the textbook. Use the result in a sentence; i.e. For every dollar invested in assets the company is earning 22.4 cents or 22.4% in net income. Then explain whether this is a good result or a result that needs improving. The original post should include at least 7 sentencesarrow_forwardAdams Inc. has the following data, rRF = 5%, RPm = 6% and Beta = 1.05. What is the firms cost of common from reinvested earning using CAPM? (11.30%, 12.72%, 11.64%, 11.99%, and 12.35%)arrow_forwardTom Company reports the following data: Sales Variable costs Fixed costs Determine Tom Company's operating leverage. Round your answer to one decimal place. $156,332 81,532 30,800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education