Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

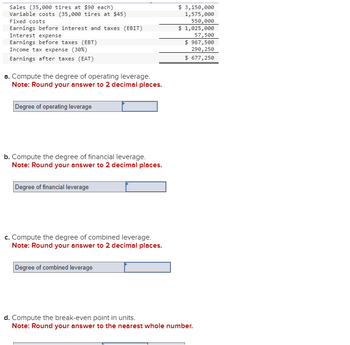

Transcribed Image Text:Sales (35,000 tires at $90 each)

Variable costs (35,000 tires at $45)

Fixed costs

Earnings before interest and taxes (EBIT)

Interest expense

Earnings before taxes (EBT)

Income tax expense (30%)

Earnings after taxes (EAT)

a. Compute the degree of operating leverage.

Note: Round your answer to 2 decimal places.

Degree of operating leverage

b. Compute the degree of financial leverage.

Note: Round your answer to 2 decimal places.

Degree of financial leverage

c. Compute the degree of combined leverage.

Note: Round your answer to 2 decimal places.

Degree of combined leverage

$ 3,150,000

1,575,000

550,000

$ 1,025,000

57,500

$ 967,500

290,250

$ 677,250

d. Compute the break-even point in units.

Note: Round your answer to the nearest whole number.

Expert Solution

arrow_forward

Step 1

The following formulas are used to calculated first three subparts.

Degree of operating leverage(DOL) =

Where, Contribution = Sales - Variable cost

Degree of financial leverage(DFL) =

Degree of combined leverage(DCL) =

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following income statement for Larry & Harry drug stores: Revenue - 90mm Variable costs- 48mm Interest on debt- 6mm Depreciation- 0 mm It’s tax rate is 25% and the book value of its equity is 150mm. What is L&H’s coverage ratio? A) 0.18 B) 5.25 C) 6 D) 7 E) 8 F)15arrow_forwardplease solve for A1 and Barrow_forwardaaaarrow_forward

- The following CVP income statements are available for Wildhorse Corp. and Blossom, Inc. Wildhorse Corp. Blossom, Inc. Sales revenue $854,000 $854,000 * Variable costs 396,500 228,750 Contribution margin 457,500 625,250 Fixed costs 305,000 472,750 Net income $152,500 $152,500 (a) Compute the degree of operating leverage for each company. (Round answers to 1 decimal place, e.g. 15.5.) Degree of Operating Leverage Wildhorse Blossomarrow_forwardSales revenue is $11,250,000 Variable expenses is $2,500,000 Total expenses is $8,750,000 Operating income is $2,5000,000 How would you find the degree of operating leverage?arrow_forwardAssume Hayworth corp. has an operating leverage of 5.39 and a financial leverage of 1.53. How much would the EPS of Hayworth corp. increase if sales increased by 0.23? Instruction: Round to three decimal placesarrow_forward

- Consider the following summary modified income statement for Tech Inc.: Sales $593,000 Variable Operating Costs 252,000 Contribution Margin $341,000 Fixed Operating Costs 121,000 Operating Income $220,000 Interest Expense 26,000 Net Income $194,000 Calculate Tech's degree of operating leverage. A В C E 1 2 Degree of Operating Leverage = 4 5 7 8 9 10 3. 6.arrow_forwardIf financial leverage of a firm is 4, Interest 6,00,000, Operating Leverage is 3, Variable cost to sales is 66.66%, Income tax rate is 30%, Number of Equity Shares 1, 00, 000. Calculate fixed cost and EPS of the firms. (For your reference, OL = Contribution/EBIT; FL = EBIT/EBT and CL = OL*FL)arrow_forwardUsing the Van Accessible data from Table 5–4: Calculate the degree of operating leverage (DOL). Calculate the degree of financial leverage (DFL). Calculate the degree of combined leverage (DCL). Explain what DOL, DFL, and DCL mean.arrow_forward

- AutoSave OFF 096DCEP… CB Draw Page Layout Home Insert X [ ✓ Paste B35 A Arial A 1 Chapter 5: Applying Excel 2 3 Data 4 Unit sales 5 Selling price per unit 6 Variable expenses per unit 7 Fixed expenses BIU - fx =B31/833 49 50 30 Variable expenses varable 31 Contribution margin 32 Fixed expenses 33 Net operating income 11 12 Compute the CM ratio and variable expense ratio 13 Selling price per unit 14 Variable expenses per unit 15 Contribution margin per unit 16 17 CM ratio 18 Variable expense ratio 19 20 Compute the break-even point 21 Break-even in unit sales 22 Break-even in dollar sales 23 24 Compute the margin of safety 25 Margin of safety in dollars 26 Margin of safety percentage 27 28 Compute the degree of operating leverage 29 Sales 34 35 Degree of operating leverage 36 37 38 39 40 41 42 43 44 45 46 47 48 Ready T 8 9 Enter a formula into each of the cells marked with a ? below 10 Review Problem: CVP Relationships Chapter 5 Form V esc ✓ 10 1 + LO Accessibility: Good to go @ 2…arrow_forwardDetermining Missing Items in Return Computation One item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 19 % 10 % (a) (b) 16 % 0.75 33 % (c) X 1.5 12 % 20 % (d) (e) 15 % 1.8 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) (b) % (c) (d) (e) %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education