Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

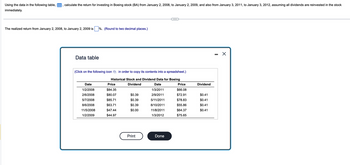

Transcribed Image Text:Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock

immediately.

The realized return from January 2, 2008, to January 2, 2009 is %. (Round to two decimal places.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Historical Stock and Dividend Data for Boeing

Dividend

Date

1/3/2011

2/9/2011

5/11/2011

8/10/2011

11/8/2011

1/3/2012

Date

1/2/2008

2/6/2008

5/7/2008

8/6/2008

11/5/2008

1/2/2009

Price

$84.35

$80.07

$85.71

$63.71

$47.44

$44.97

$0.39

$0.39

$0.39

$0.00

Print

Done

Price

$66.08

$72.91

$78.83

$55.86

$64.37

$75.65

Dividend

$0.41

$0.41

$0.41

$0.41

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A stock has had the following year-end prices and dividends: Year Price 1 $65.08 71.95 77.75 64.02 74.61 87.25 23456 Dividend $.75 .80 .86 .95 1.02 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Arithmetic average return Geometric average return % %arrow_forwardA company has an issue of preferred stock outstanding that pays a $2.30 dividend every year in perpetuity. If this issue currently sells for $41.82 per share, what is the required rate of return? Please use a HP 10bii+ Financial Calculatorarrow_forwardBlack Bear Bike Corp. manufactures mountain bikes and distributes them through retail outlets in California, Oregon, and Washington. Black Bear Bike Corp. has declared the following annual dividends over a six-year period ended December 31 of each year: Year 1, $42,500; Year 2, $18,000; Year 3, $223,500; Year 4, $178,000; Year 5, $222,000; and Year 6, $222,000. During the entire period, the outstanding stock of the company was composed of 50,000 shares of cumulative preferred 2% stock, $80 par, and 100,000 shares of common stock, $4 par. Required: 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears on January 1, Year 1. Summarize the data in tabular form. If required, round your per share answers to two decimal places. If the amount is zero, please enter "0". Preferred Dividends Common Dividends Total Year Dividends Total Per Share Total Per Share Year 1 $42,500 $ Year 2 18,000 Year 3…arrow_forward

- Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. (Click on the following icon in order to copy its contents into a spreadsheet.) Return for the entire period is%. (Round to two decimal places.) Date Jan 1 Feb 5 May 14. Aug 13 Nov 12 Dec 31 Price $33.36 $32.91 $28.75 $33.35 $37.94 $42.86 Dividend $0.17 $0.18 $0.19 $0.18arrow_forwardYou own a stock that had total returns of -1.3, 14.23, 5.52, 12.72, -7.71, 17.54, 5.06 (all in percent) over the last seven years. What is the arithmetic average return for this stock? Answer as a percentage to two decimals (if you get -0.0435, you should answer -4.35).arrow_forwardPractice Help, please.arrow_forward

- Suppose a stock had an initial price of $60 per share, paid a dividend of $.60 per share during the year, and had an ending share price of $72. Compute the percentage total return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Total Return:arrow_forwardSuppose a stock had an initial price of $84 per share, paid a dividend of $1.50 per share during the year, and had an ending share price of $71.50. a. Compute the percentage total return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What was the capital gains yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward1. Calculate the value of a preferred stock with a fixed annual dividend of $2.45, assuming a discount rate of 9.5%. Solve the problem two different ways: first by using the algebraic formula for a constant dividend preferred stock, then by using the built-in Excel function PV. hint: Use the Preferred Stock example in the posted DDM Excel Examples file as a guide. Feel free to copy the worksheet and make the minor necessary changes to answer this question. 2. Calculate the value of a stock with an expected annual dividend of $2.00 next year and estimated annual dividend growth of 2% per year indefinitely. Assume a discount rate of 8%. Solve the problem two different ways: first by using the algebraic formula for the Gordon Growth Model, then by using Excel to calculate and sum the dividends and their respective present values for the next 150 years. hint: Use the PV Const Growth Dividend example in the posted DDM Excel Examples file as a guide. Feel free to copy the worksheet and make…arrow_forward

- Treasury stock should be reported Group of answer choices in the Investments and Funds section of the balance sheet. as a deduction from total stockholders’ equity on the balance sheet. as a current asset only if it will be sold within the next year or the operating cycle, whichever is longer. as a current asset only if it will be sold within the next year or the operating cycle, whichever is shorter.arrow_forwardAt the beginning of the year, you purchased a share of stock for $51.64. Over the year the dividends paid on the stock were $3.26 per share. Calculate the return if the price of the stock at the end of the year is $50.24. (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places. (e.g., 32.16))arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period in the attached image: A. What was the risk premium on common stock in each year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Risk Premium 2013 % 2014 % 2015 % 2016 % 2017 % b. What was the average risk premium? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education