Calculate stock and bond valuations for PepsiCo. Specifically, the following critical elements must be addressed: Stock Valuation Based on the figures provided from the financial information you prepared for your selected company, calculate each of the following in Part I of the spreadsheet tab: Stock and Bond Valuation: Fill in the yellow highlighted cells with the matching data prepared for your selected company. Identify the new dividend yields if the company increased its dividend per share by $1.75. Identify the dividend yield if the firm doubled its outstanding shares using a stock split. Note that other numbers will be affected by a stock split such as new stock price, actual dividends paid, and number of outstanding shares. Stockholders' equity will not change. Calculate the rate of return on investment based on the data you calculated in Question 1. What effect would each of the calculations you performed have on shareholder value? In other words, suppose the company's goal is to maximize shareholder value. How will each of the situations support or inhibit that goal? To what extent do you feel the company's dividend policies support or hinder its strategies? Bond Issuance PepsiCo. issues a new 10-year bond for $300,000 on October 1, 2023. The bond will mature on October 1, 2033. The future value of this bond is $300,000. The bond was issued at the latest market rate of 5.0% fixed for 10 years, with interest payments paid semiannually. What is the present value of this bond using the four scenarios in Part II of the spreadsheet tab: Stock and Bond Valuation? Calculate the present value of the bond at issuance. Calculate the new present value of the bond if overall rates in the market increase by 2%. Calculate the new present value of the bond if overall rates in the market decrease by 2%. Calculate the present value of the bond if overall rates in the market remain the same as at issuance. How would each of the calculations you performed affect the company's decision to raise capital in this way? Explain for each situation, would bond valuation be a viable option for increasing capital? Assess how bond issuance policies support or hinder company strategies.

Calculate stock and bond valuations for PepsiCo. Specifically, the following critical elements must be addressed: Stock Valuation Based on the figures provided from the financial information you prepared for your selected company, calculate each of the following in Part I of the spreadsheet tab: Stock and Bond Valuation: Fill in the yellow highlighted cells with the matching data prepared for your selected company. Identify the new dividend yields if the company increased its dividend per share by $1.75. Identify the dividend yield if the firm doubled its outstanding shares using a stock split. Note that other numbers will be affected by a stock split such as new stock price, actual dividends paid, and number of outstanding shares. Stockholders' equity will not change. Calculate the rate of return on investment based on the data you calculated in Question 1. What effect would each of the calculations you performed have on shareholder value? In other words, suppose the company's goal is to maximize shareholder value. How will each of the situations support or inhibit that goal? To what extent do you feel the company's dividend policies support or hinder its strategies? Bond Issuance PepsiCo. issues a new 10-year bond for $300,000 on October 1, 2023. The bond will mature on October 1, 2033. The future value of this bond is $300,000. The bond was issued at the latest market rate of 5.0% fixed for 10 years, with interest payments paid semiannually. What is the present value of this bond using the four scenarios in Part II of the spreadsheet tab: Stock and Bond Valuation? Calculate the present value of the bond at issuance. Calculate the new present value of the bond if overall rates in the market increase by 2%. Calculate the new present value of the bond if overall rates in the market decrease by 2%. Calculate the present value of the bond if overall rates in the market remain the same as at issuance. How would each of the calculations you performed affect the company's decision to raise capital in this way? Explain for each situation, would bond valuation be a viable option for increasing capital? Assess how bond issuance policies support or hinder company strategies.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

100%

Calculate stock and bond valuations for PepsiCo.

Specifically, the following critical elements must be addressed:

- Stock Valuation

- Based on the figures provided from the financial information you prepared for your selected company, calculate each of the following in Part I of the spreadsheet tab: Stock and

Bond Valuation :- Fill in the yellow highlighted cells with the matching data prepared for your selected company.

- Identify the new dividend yields if the company increased its dividend per share by $1.75.

- Identify the dividend yield if the firm doubled its outstanding shares using a stock split. Note that other numbers will be affected by a stock split such as new stock price, actual dividends paid, and number of outstanding shares.

Stockholders' equity will not change. - Calculate the

rate of return on investment based on the data you calculated in Question 1.

- What effect would each of the calculations you performed have on shareholder value? In other words, suppose the company's goal is to maximize shareholder value. How will each of the situations support or inhibit that goal?

- To what extent do you feel the company's dividend policies support or hinder its strategies?

- Based on the figures provided from the financial information you prepared for your selected company, calculate each of the following in Part I of the spreadsheet tab: Stock and

- Bond Issuance

- PepsiCo. issues a new 10-year bond for $300,000 on October 1, 2023. The bond will mature on October 1, 2033. The

future value of this bond is $300,000. The bond was issued at the latest market rate of 5.0% fixed for 10 years, with interest payments paid semiannually. What is the present value of this bond using the four scenarios in Part II of the spreadsheet tab: Stock and Bond Valuation?- Calculate the present value of the bond at issuance.

- Calculate the new present value of the bond if overall rates in the market increase by 2%.

- Calculate the new present value of the bond if overall rates in the market decrease by 2%.

- Calculate the present value of the bond if overall rates in the market remain the same as at issuance.

- How would each of the calculations you performed affect the company's decision to raise capital in this way? Explain for each situation, would bond valuation be a viable option for increasing capital?

- Assess how bond issuance policies support or hinder company strategies.

- PepsiCo. issues a new 10-year bond for $300,000 on October 1, 2023. The bond will mature on October 1, 2033. The

Transcribed Image Text:2

3

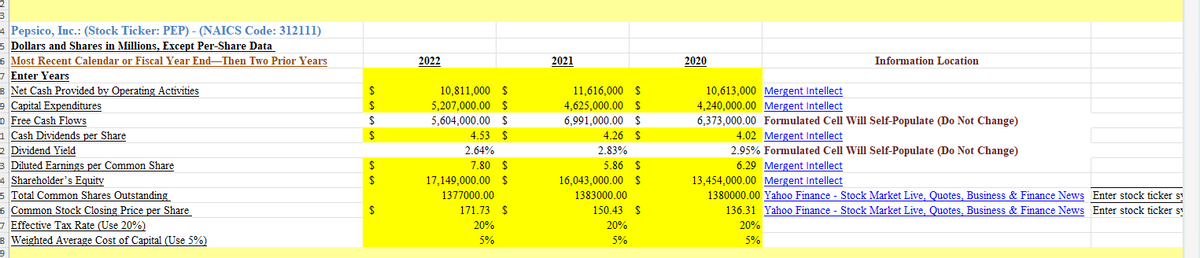

4 Pepsico, Inc.: (Stock Ticker: PEP) - (NAICS Code: 312111)

5 Dollars and Shares in Millions, Except Per-Share Data

6 Most Recent Calendar or Fiscal Year End―Then Two Prior Years

7 Enter Years

8 Net Cash Provided by Operating Activities

9 Capital Expenditures

0 Free Cash Flows

1 Cash Dividends per Share

2 Dividend Yield

3 Diluted Earnings per Common Share

4 Shareholder's Equity

5 Total Common Shares Outstanding

6 Common Stock Closing Price per Share

7 Effective Tax Rate (Use 20%)

8 Weighted Average Cost of Capital (Use 5%)

9

2022

2021

2020

$

10,811,000 $

5,207,000.00 $

5,604,000.00 $

4.53 $

11,616,000 $

4,625,000.00 $

6,991,000.00 $

4.26 $

2.64%

7.80 $

$

17,149,000.00 $

1377000.00

171.73 $

2.83%

5.86 $

16,043,000.00 $

1383000.00

150.43 $

20%

20%

5%

5%

Information Location

10,613,000 Mergent Intellect

4,240,000.00 Mergent Intellect

6,373,000.00 Formulated Cell Will Self-Populate (Do Not Change)

4.02 Mergent Intellect

2.95% Formulated Cell Will Self-Populate (Do Not Change)

6.29 Mergent Intellect

13,454,000.00 Mergent Intellect

1380000.00 Yahoo Finance - Stock Market Live, Quotes, Business & Finance News Enter stock ticker sy

136.31 Yahoo Finance - Stock Market Live, Quotes, Business & Finance News Enter stock ticker sy

20%

5%

Transcribed Image Text:2

3

5.

.

2

3

+

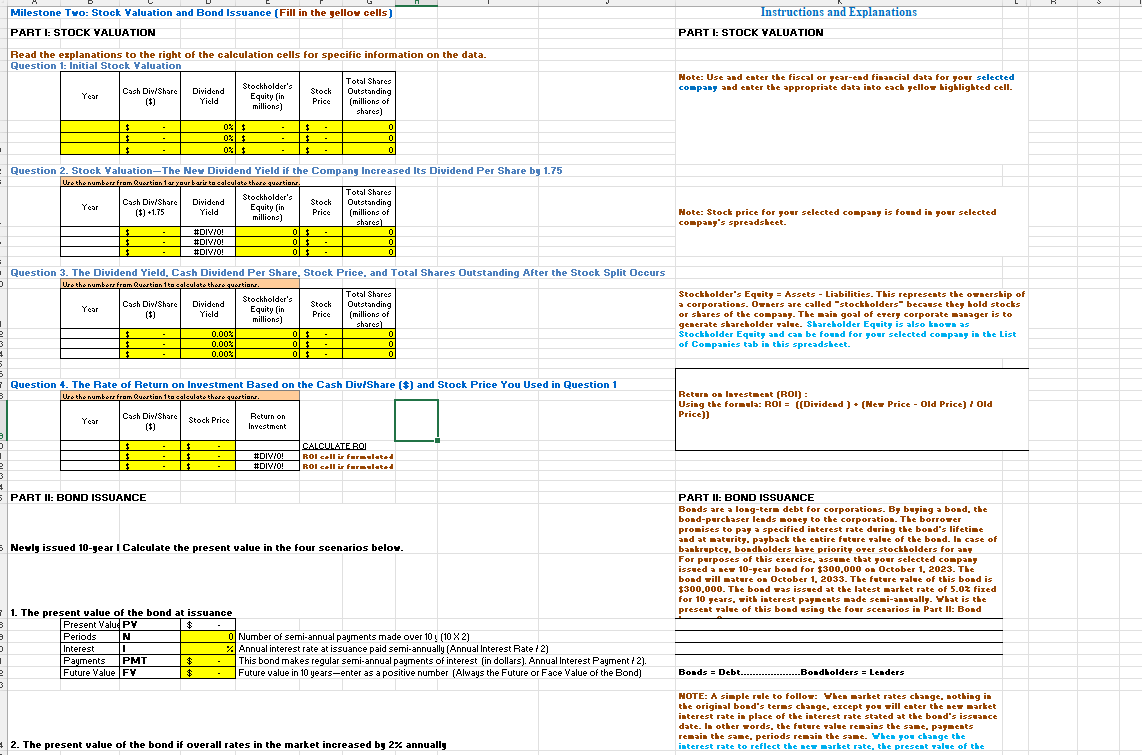

Milestone Two: Stock Valuation and Bond Issuance (Fill in the yellow cells)

PART I: STOCK VALUATION

Read the explanations to the right of the calculation cells for specific information on the data.

Question 1: Initial Stock Valuation

Stockholder's

Year

Cash Div/Share

($)

Dividend

Yield

Equity (in

Stock

Price

Total Shares

Outstanding

(millions of

millions)

shares)

0% $

$

Instructions and Explanations

PART I: STOCK VALUATION

Note: Use and eater the fiscal or year-end financial data for your selected

company and enter the appropriate data into each yellow highlighted cell.

$

$

$

0% $

0% $

$

$

-

0

0

0

Question 2. Stock Valuation-The New Dividend Yield if the Company Increased Its Dividend Per Share by 1.75

Use the numbers from Question 1 as your baris to calculate those questions.

Year

Cash Div/Share

($) +1.75

Dividend

Yield

Stockholder's

Equity (in

millions)

Stock

Price

Total Shares

Outstanding

(millions of

shares)

#DIV/0!

#DIV/0!

#DIV/O!

0$

-

0 $

0 $

-

0

0

0

$

$

$

Question 3. The Dividend Yield, Cash Dividend Per Share, Stock Price, and Total Shares Outstanding After the Stock Split Occurs

Use the numbers from Question 1 to calculate those questions.

Cash Div/Share

Year

($)

$

$

$

Stockholder's

Dividend

Yield

Equity (in

millions)

Stock

Total Shares

Outstanding

Price (millions of

shares)

0.00%

0.00%

0.00%

0$

0$

0

0t

-

-

0

0

Note: Stock price for your selected company is found in your selected

company's spreadsheet.

Stockholder's Equity = Assets - Liabilities. This represents the ownership of

a corporations. Owners are called "stockholders" because they hold stocks

or shares of the company. The main goal of every corporate manager is to

generate shareholder value. Shareholder Equity is also known as

Stockholder Equity and can be found for your selected company in the List

of Companies tab in this spreadsheet.

Question 4. The Rate of Return on Investment Based on the Cash Div/Share ($) and Stock Price You Used in Question 1

Use the numbers from Question 1 to calculate those questions.

Return on

Investment

Year

Cash Div/Share

($)

Stock Price

$

-

$

$

-

$

$

$

CALCULATE ROJ

-

#DIV/0!

#DIV/0!

ROI call is formulated

ROI call is formulated

Return on Investment (ROI):

Using the formula: ROI = ((Dividend ) + (New Price - Old Price) / Old

Price))

PART II: BOND ISSUANCE

Newly issued 10-year | Calculate the present value in the four scenarios below.

PART II: BOND ISSUANCE

Bonds are a long-term debt for corporations. By buying a bond, the

bond-purchaser leads money to the corporation. The borrower

promises to pay a specified interest rate during the bond's lifetime

and at maturity, payback the entire future value of the bond. In case of

bankruptcy, bondholders have priority over stockholders for any

For purposes of this exercise, assume that your selected company

issued a new 10-year bond for $300,000 on October 1, 2023. The

boad will mature on October 1, 2033. The future value of this bond is

$300,000. The bond was issued at the latest market rate of 5.0% fixed

for 10 years, with interest payments made semi-annually. What is the

present value of this bond using the four scenarios in Part II: Bond

1. The present value of the bond at issuance

$

Present Value PV

Periods

N

0

Interest

||

Payments

PMT

$

2

Future Value FY

$

3.

-

0 Number of semi-annual payments made over 10 (10 X 2)

Annual interest rate at issuance paid semi-annually (Annual Interest Rate / 2)

This bond makes regular semi-annual payments of interest (in dollars). Annual Interest Payment/2).

Future value in 10 years-enter as a positive number (Always the Future or Face Value of the Bond)

Bonds Debt..

42. The present value of the bond if overall rates in the market increased by 2% annually

..Bondholders = Leaders

NOTE: A simple rule to follow: When market rates change, nothing in

the original bond's terms change, except you will enter the new market

interest rate in place of the interest rate stated at the bond's issuance

date. In other words, the future value remains the same, payments

remain the same, periods remain the same. When you change the

interest rate to reflect the new market rate, the present value of the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College