FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

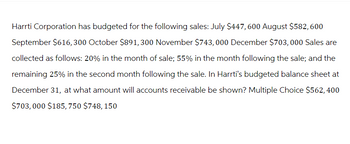

Transcribed Image Text:Harrti Corporation has budgeted for the following sales: July $447, 600 August $582, 600

September $616,300 October $891, 300 November $743, 000 December $703, 000 Sales are

collected as follows: 20% in the month of sale; 55% in the month following the sale; and the

remaining 25% in the second month following the sale. In Harrti's budgeted balance sheet at

December 31, at what amount will accounts receivable be shown? Multiple Choice $562, 400

$703,000 $185, 750 $748, 150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Roberts Enterprises has budgeted sales in units for the next five months as follows: June 4,560 units July 7,400 units August 5,360 units September 6,820 units October 3,760 units Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 456 units. The company needs to prepare a production budget for the second quarter of the year. The total number of units to be produced in July is: Multiple Choice 7,936 units 7,400 units 7,196 units 7,571 unitsarrow_forwardMichard Corporation makes one product and it provided the following Information to help prepare the master budget for the next four months of operations: a. The budgeted selling price per unit is $125. Budgeted unit sales for April, May, June, and July are 7,600, 10,500, 13,800, and 12,900 units, respectively. All sales are on credit. b. Regarding credit sales, 20% are collected in the month of the sale and 80% In the following month. c. The ending finished goods Inventory equals 20% of the following month's sales. d. The ending raw materials Inventory equals 30% of the following month's raw materials production needs. Each unit of finished goods requires 4 pounds of raw materials. The raw materials cost $2.00 per pound. e. Regarding raw materials purchases, 30% are paid for in the month of purchase and 70% In the following month. f. The direct labor wage rate is $25.00 per hour. Each unit of finished goods requires 3.0 direct labor-hours. g. The variable selling and administrative…arrow_forwardAssume the following budgeted information for a merchandising company: Budgeted sales (all on credit) for November, December, and January are $248,000, $218,000, and $209,000, respectively. • Cash collections related to credit sales are expected to be 70% in the month of sale, 30% in the month following the sale. • The cost of goods sold is 70% of sales. • Each month's ending inventory equals 20% of next month's cost of goods sold. • 30% of each month's merchandise purchases are paid in the current month and the remainder is paid in the following month. • Monthly selling and administrative expenses that are paid in cash in the month incurred total $25,000. • Monthly depreciation expense is $9.000. . The budgeted net operating income for December would be: Multiple Choice $40,400 $25,734 $16,734 $31,400arrow_forward

- Kuzma Foods, Inc. has budgeted sales for June and July at $680,000 and $765,000, respectively. Sales are 80% credit, of which 60% is collected in the month of sale and 40% is collected in the following month. What is the budgeted Accounts Receivable balance on July 31? OA. $306,000 OB. $217,600 OC. $612,000 OD. $244,800arrow_forwardS ABC Company's raw materials purchases for June, July, and August are budgeted at $39,000, $29,000, and $54,000, respectively. Based on past experience, ABC expects that 70% of a month's raw material purchases will be paid in the month of purchase and 30% in the month following the purchase. Required: Prepare an analysis of cash disbursements from raw materials purchases for ABC Company for August. Budgeted raw material purchases August cash payments: Current month's purchases Prior month's purchases Total cash payments June July August $ 0arrow_forwardIvanhoe Design provided the following budgeted information for April through July: April May June July Projected sales $112320 $132840 $124200 $142560 Projected merchandise purchases $88560 $99360 $84240 $71280 The cash balance on June 1 is $12960. The company pays 40% of merchandise purchases in the month purchased and 60% in the following month. General operating expenses are budgeted to be $33480 per month of which depreciation is $3240 of this amount. Management pays operating expenses in the month incurred. The company makes loan payments of $4320 per month of which $648 is interest and the remainder is principal. How much are budgeted cash disbursements for June? $111024. $127872. $93312. $68256.arrow_forward

- Wells Company reports the following budgeted sales: September, $53,000; October, $72,000; and November, $87,000. All sales are on credit, and 5% of those credit sales are budgeted as uncollectible. Collection of the remaining 95% of credit sales are budgeted as follows: 60% in the first month after sale and 35% in the second month after sale. Prepare a schedule of cash receipts from sales for November.arrow_forwardDuring June, Tarras Corporation plans to serve 46,000 customers. The company uses the following revenueand cost formulas in its budgeting, where Q is the number of customers served. Revenue:$4.40Q Wages and salaries:$34,600 + $1.67Q Supplies:$0.87Q Insurance:$15,000 Miscellaneous expenses:$5,600 + $0.57Q Required:Prepare the company's planning budget for June. Show all your calculations and you may round youranswers to the nearest dollar.arrow_forwardXYZ Company is preparing its budgeted balance sheet. The budgeted selling price per unit is $45. Budgeted unit sales for July. August, September, October and November are 1,400 units, 2.100 units, 3,400 un 2.700 units and 4,200 units, respectively. All sales are on credit. Regarding credit sales, 30% are collected in the month of the sale, 50% in the month following sales, and the remaining 20% in the second month following sale. The budgeted accounts receivable balance at the end of September is closest to: Select one: O a. $96,750 O b. None of the given answers O c $154,000 O d. $140,000 O e. $126.000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education