Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

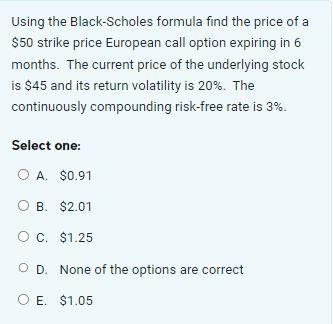

Transcribed Image Text:Using the Black-Scholes formula find the price of a

$50 strike price European call option expiring in 6

months. The current price of the underlying stock

is $45 and its return volatility is 20%. The

continuously compounding risk-free rate is 3%.

Select one:

O A. $0.91

O B. $2.01

O C. $1.25

O D. None of the options are correct

O E. $1.05

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- QUESTION: 2. What is the fair value for a six-month European call option with a strike price of $135 over a stock which is trading at $138.15 and has a volatility of 42.5% when the risk free rate is 1.85% using the two step binomial tree? a) What is the delta of this option? b) What is the probability of an up movement in this stock? c) What is the probability of a down movement in this stock? d) What is the proportional move up for this stock e) What is the proportional move down for this stock f) What would be the value of the put option with the same strike price?arrow_forward2arrow_forwardnot use ai pleasearrow_forward

- Calculate the value of a call option for the following stock. Use the Black-Scholes formula. Time to expiration Standard deviation Exercise price Stock price Annual interest rate Dividend 6 months 50% per year $50 $50 3% 0 (Do not round intermediate calculations. Round your answer to 2 decimal places.) Value of a call optionarrow_forwardCalculate the upper and lower bounds for the price of a 4-month European call option on a non-dividend-paying stock when the stock price is $28, the strike price is $25 and the risk-free rate is 8% p.a. compounded continuously. '0arrow_forward6 Call options with an exercise price of $50 and one year to expiration are available. The market price of the underlying stock is currently $42, but this market price is expected to either decrease to $52 or increase to $37 in a year's time. Assume the risk-free rate is 6%. What is the value of the option? (Do not round Intermediate calculations. Round the final answer to 2 decimal places. Omit any commes and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.) Numeric Response 2:26:13 W حن Search 96 15 園 16 17 5 CH IA ASUS 180/2 8 19 9 10 O 112 IA Bit St Amanat ENG US 6:03 PM 2024-07-09arrow_forwardAssume a stock price of $30.25, risk-free rate of 1 percent, standard deviation of 40 percent, N(d1) value of 0.7976, and an N(d2) value of 0.7089. What is the value of a six-month put with a strike price of $25 given the Black-Scholes option pricing model (rounded to the nearest cent)? $6.49 $0.83 $2.43 $1.12 None of the above are correct.arrow_forwardBlack-Scholes Model Use the Black-Scholes model to find the price for a call option with the following inputs: (1) current stock price is $28, (2) strike price is $34, (3) time to expiration is 6 months, (4) annualized risk-free rate is 6%, and (5) variance of stock return is 0.09. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardAa.1 The current price of stock XYZ is 100. In one year, the stock price will either be 120 or 80. The annually compounded risk-free interest rate is 10%. i. Calculate the no-arbitrage price of an at-the-money European put option on XYZ expiring in one year. ii. Suppose that an equivalent call option on XYZ is also trading in the market at a price of 10. Determine if there is a mis-pricing. If there is a mis-pricing, demonstrate how you would take advantage of the arbitrage opportunity.arrow_forwardGive typing answer with explanation and conclusion 5. A European call option on Home Depot stock has a strike price of $160 and expires in 0.9 years. Home Depot stock has a current market price of $165.99 and the risk-free rate is 4%. What must be the minimum price of the option?arrow_forwardPlease no written by handarrow_forwardCalculate Quick Ratio: AKA the Acid Testarrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education