ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

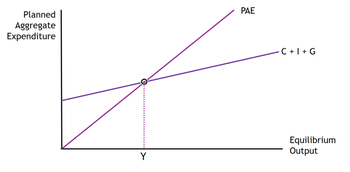

Using the AE model, show the economy in equilibrium. Then, show the impact of an increase in taxes to reduce inflation.

Would the above be considered expansionary or contractionary fiscal policy?

Assume the change in taxes above is $15 billion dollars and MPC = .90. What will be the change in GDP?

Transcribed Image Text:Planned

Aggregate

Expenditure

Y

PAE

C+I+G

Equilibrium

Output

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose the president is successful in passing a $5 billion tax increase. Assume that taxes are fixed, the economy is closed, and the marginal propensity to consume is 0.75. What happens to equilibrium GDP? There is a $20 billion increase in equilibrium GDP. There is a $20 billion decrease in equilibrium GDP. There is a $15 billion increase in equilibrium GDP. There is a $15 billion decrease in equilibrium GDP.arrow_forwardSuppose the economy begins at full employment. Label this starting point as point "1." Then, suppose that a long strike by coal miners reduces the coal supply and increases the price of coal. Show the effects on your graph and label the new equilibrium point "2." Lastly, suppose our government wants the economy to return to full-employment as quickly as possible. Should the government intervene? If so, show the impact of successful fiscal policy on your graph. Label this new equilibrium point "3."arrow_forwardWhich of the following is an appropriate fiscal policy response to a negative GDP gap? a. raise income tax rates b. increase government spending c. raise real interest rates d. lower real interest ratesarrow_forward

- The marginal propensity to expend is 0.5 and there is a recessionary gap of $200. What fiscal policy would you recommend? (Assume mpe = mpc) 0000 Expansionary fiscal policy; increase government expenditures by $100, or cut taxes by $200. Contractionary fiscal policy; decrease government expenditures by $200, or cut taxes by $100. Contractionary fiscal policy; decrease government expenditures by $100, or cut taxes by $200. Expansionary fiscal policy; increase government expenditures by $200, or cut taxes by $100.arrow_forwardPresident Biden is proposing an increase in the corporate income tax rate from 21% to 28%. Although the corporate tax rate will be higher than it is currently, it is still lower than the corporate tax rate of 35% that had been in place since President Clinton. How will this tax increase affect aggregate expenditures, equilibrium GDP and employment? Part of the reason for this proposal is to offset the increased spending from the last three stimulus packages/checks which increased Federal government's debt. Do you agree with the proposed increase in corporate tax rates? Why or why not? What are some of the costs and benefits of the proposed tax changes? Is this the right time to increase taxes? Why or why not?arrow_forwardUsing the AE model, show the economy in equilibrium. Then, show the impact of an increase in government spending to reduce the unemployment rate.Would the above be considered expansionary or contractionary fiscal policy?Assume the change in government spending in above is $25 billion dollars and MPC = .95. What will be the change in GDP?arrow_forward

- in another economy, the MPC = 4/5, government needs to increase expenditures $20 to complete a project, but it does not want to increase debt so it increases taxes $20 also. What, if any, will be the change in output generated by this balanced - budget expenditure scenario?arrow_forwardPlease solve step by step and quickarrow_forwardThe graph below depicts an economy where a decline in aggregate demand has caused a recession. Assume the government decides to conduct fiscal policy by increasing government purchases to reduce the burden of this recession. Fiscal Policy Price Level 160 LRAS AS 140 120 100 80 60 40 20 0 AD 1 AD 80 160 240 320 400 480 560 640 720 800 Real GDP (billions of dollars) Instructions: Enter your answers as a whole number. a. How much does aggregate demand need to change to restore the economy to its long-run equilibrium? $ billion b. If the MPC is 0.6, how much does government purchases need to change to shift aggregate demand by the amount you found in part a? EA billion Suppose instead that the MPC is 0.75. c. How much does aggregate demand and government purchases need to change to restore the economy to its long-run equilibrium? Aggregate demand needs to change by $ billion and government purchases need to change by $ billion.arrow_forward

- Suppose the government implements contractionary fiscal policy. As a result, the inflation rate will likely _____ and the real growth rate will likely _____ in the short run. Rise or fall?arrow_forwardWhich of the following is an example of fiscal policy? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Electing a new member of Congress. Changing G or changing T. C Increasing the amount of money in circulation. d Charging a higher interest rate on mortgages.arrow_forwardConsider the following model: Y=C+I+G, C=c(Y-T), I=i(Y,r) Analyze the effects of expansionary and contractionary fiscal policies and indicate them on a graph.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education