ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

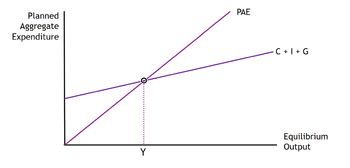

Using the AE model, show the economy in equilibrium. Then, show the impact of an increase in government spending to reduce the

Would the above be considered expansionary or contractionary fiscal policy?

Assume the change in government spending in above is $25 billion dollars and MPC = .95. What will be the change in

Transcribed Image Text:Planned

Aggregate

Expenditure

Y

PAE

C + I + G

Equilibrium

Output

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose real GDP is currently $12.5 trillion and potential real GDP is $13 trillion. If the president and Congress increased government purchases by $500 billion, what would be the result on the economy?arrow_forwardCite the five major demand-side components of GDP. Then, identify the major elements affected by fiscal policy.arrow_forwardThe government spends an additional $926 billion and the marginal propensity to consume is 66%. How much will GDP increase due to this additional government spending? Enter your answer in billions and round to two decimal places.arrow_forward

- Fiscal Policy A closer Look at Fiscal Policy 4. In the 1960's the U.S economy faced inflationary pressures. Assume that in 1968 there was an AD Excess of $190 billion. Assume the MPC-95 (All the following problems require mathematical calculations.) a. What change in government expenditures would you have recommended?arrow_forwardSuppose the economy begins at full employment. Label this starting point as point "1." Then, suppose that a long strike by coal miners reduces the coal supply and increases the price of coal. Show the effects on your graph and label the new equilibrium point "2." Lastly, suppose our government wants the economy to return to full-employment as quickly as possible. Should the government intervene? If so, show the impact of successful fiscal policy on your graph. Label this new equilibrium point "3."arrow_forwardTo enact Contractionary Fiscal Policy, the federal government must be running a budget ___________.arrow_forward

- Which of the following is an appropriate fiscal policy response to a negative GDP gap? a. raise income tax rates b. increase government spending c. raise real interest rates d. lower real interest ratesarrow_forwardThe marginal propensity to expend is 0.5 and there is a recessionary gap of $200. What fiscal policy would you recommend? (Assume mpe = mpc) 0000 Expansionary fiscal policy; increase government expenditures by $100, or cut taxes by $200. Contractionary fiscal policy; decrease government expenditures by $200, or cut taxes by $100. Contractionary fiscal policy; decrease government expenditures by $100, or cut taxes by $200. Expansionary fiscal policy; increase government expenditures by $200, or cut taxes by $100.arrow_forwardHow relevant is the multiplier concept to the implementation of expansionary andcontractionary fiscal policies?arrow_forward

- How relevant is the multiplier concept to the implementation of expansionary and contractionary fiscal policies?arrow_forwardPresident Biden is proposing an increase in the corporate income tax rate from 21% to 28%. Although the corporate tax rate will be higher than it is currently, it is still lower than the corporate tax rate of 35% that had been in place since President Clinton. How will this tax increase affect aggregate expenditures, equilibrium GDP and employment? Part of the reason for this proposal is to offset the increased spending from the last three stimulus packages/checks which increased Federal government's debt. Do you agree with the proposed increase in corporate tax rates? Why or why not? What are some of the costs and benefits of the proposed tax changes? Is this the right time to increase taxes? Why or why not?arrow_forwardWhat are the primary goals of expansionary and contractionary fiscal policies and their effects on unemployment rates, inflation rates, interest rates, private investment, and GDP?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education