FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

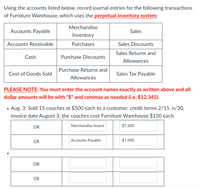

Using the accounts listed below, record

| Accounts Payable | Merchandise Inventory | Sales |

| Purchases | Sales Discounts | |

| Cash | Purchase Discounts | Sales Returns and Allowances |

| Cost of Goods Sold | Purchase Returns and Allowances | Sales Tax Payable |

PLEASE NOTE: You must enter the account names exactly as written above and all dollar amounts will be with "$" and commas as needed (i.e. $12,345).

- Aug. 3: Sold 15 couches at $500 each to a customer, credit terms 2/15, n/30, invoice date August 3; the couches cost Furniture Warehouse $150 each.

DR CR -

DR CR - Aug. 8: Customer returned 2 couches for a full refund. The merchandise was in sellable condition at the original cost.

DR CR -

DR CR - Aug. 15: Customer found 4 defective couches but kept the merchandise for an allowance of $1,000.

DR CR - Aug. 18: Customer paid their account in full with cash.

DR DR or CR? CR

Transcribed Image Text:Using the accounts listed below, record journal entries for the following transactions of Furniture Warehouse, which uses the **perpetual inventory system**:

| Accounts Payable | Merchandise Inventory | Sales |

|------------------|------------------------|-------|

| Accounts Receivable | Purchases | Sales Discounts |

| Cash | Purchase Discounts | Sales Returns and Allowances |

| Cost of Goods Sold | Purchase Returns and Allowances | Sales Tax Payable |

**PLEASE NOTE:** You must enter the account names exactly as written above and all dollar amounts will be with "$" and commas as needed (i.e. $12,345).

- **Aug. 3:** Sold 15 couches at $500 each to a customer, credit terms 2/15, n/30, invoice date August 3; the couches cost Furniture Warehouse $150 each.

**Journal Entry:**

- **DR** | Merchandise Inventory | $7,500

- **CR** | Accounts Payable | $7,500

---

(Additional space for further entries is provided, including initial debits and credits for augmenting these entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please try to do all the tabs thank youarrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardInstructions In this assignment you will record eight transactions related to the sale and purchase of merchandise. You will record each transaction according to the procedures of a periodic inventory system. You will record each transaction according to the procedures of a perpetual inventory system. Include the date for each transaction. Include a brief explanation for each entry similar to the sample entry example. Please skip a line between each transaction entry. You may use the journals provided or create your own journals. If you create your own journals they must have a date column, description column, a debit column and a credit column. You may hand write the journal entries or type them. Transactions to Record Sample Ace Company issues a $200 Sales Allowance to a customer who received damaged merchandise purchased in Feb from Ace. Mar 1 Ace Company sells merchandise totaling $1,500 on account with terms 2/15, n/30, FOB destination. Cost of goods is…arrow_forward

- Use the following purchases journal to record the transactions. (If a box is not used in the journal leave the box empty; do not select any information and do not enter a zero. Abbreviation used: Supp. = Supplies) a (Click the icon to view the transactions.) Purchases Journal Page 6 Other Accounts DR Vendor Post. Accounts Merchandise Office Account Post. Date Account Credited Terms Ref. Payable CR Inventory DR Supp. DR Title Ref. Amount 2024 Oct. More Info Oct. 1 Purchased merchandise inventory on account with credit terms of 2/10, n/30 from Milk Co., $2.700, Oct. 11 Purchased office supplies on account from Book Co., $400. Terms were n/EOM. Oct. 24 Purchased furniture on account with credit terms of 4/10, n/60 from Slip Co., $1,600. Print Donearrow_forwardCreate General Journal entriesarrow_forwardThe Inventory module window has journal icons for Select one: O a. inventory sales and inventory purchases b. item assembly and inventory adjustments O c. inventory sales and inventory adjustments O d. all of the above Show Transcribed Text You should use the adjustments journal to record - Select one: O a. adjustments to inventory purchase prices from the supplier as an allowance for damages O b. adjustments to inventory sale prices to customers as an allowance for damages c. adjustments to inventory in stock for damaged goods O d. all of the abovearrow_forward

- Required information [The following information applies to the questions displayed below.] Nix'lt Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances (Nix'lt uses the perpetual inventory system). Merchandise inventory т. Nix, Capital T. Nix, Withdrawals Sales Sales discounts $ 46,800 133,300 7,000 163,600 4,700 $ 4,700 110,400 12,100 41,500 5,000 Sales returns and allowances Cost of goods sold Depreciation expense Salaries expense Miscellaneous expenses A physical count of its July 31 year-end inventory discloses that the cost of the merchandise inventory still available is $44,750.arrow_forwardPrepare the journal entries to record the following transactions on Blossom Company’s books using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) (a) On March 2, Kingbird Company sold $850,000 of merchandise to Blossom Company on account, terms 2/10, n/30. The cost of the merchandise sold was $500,000. (b) On March 6, Blossom Company returned $100,000 of the merchandise purchased on March 2. The cost of the merchandise returned was $60,000. (c) On March 12, Kingbird Company received the balance due from Blossom Company. No. Date Account Titles and Explanation Debit Credit (a) choose a transaction date March 2March 6March 12 enter an account title enter a…arrow_forwardUse the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.) A (Click the icon to view the transactions.) Sales Journal Page Invoice Customer Post. Accounts Receivable DR Cost of Goods Sold DR Date No. Account Debited Ref. Sales Revenue CR Merchandise Inventory CR 2024 Jun. More Info Jun. 1 Sold merchandise inventory on account to Fred Jig, $1,270. Cost of goods, $1,000. Invoice no. 101. Jun. 8 Sold merchandise inventory on account to lan Frog, $2,225. Cost of goods, $1,580. Invoice no. 102. Jun. 13 Sold merchandise inventory on account to Jillian Trump, $380. Cost of goods, $300. Invoice no. 103. Jun. 28 Sold merchandise inventory on account to Glen Whitney, $900. Cost of goods, $610. Invoice no. 104. Print Donearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education