Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I got all answers wrong:( annual premium I got 1,088. Semiannual I got $566. Quarterly I got 283. Monthly I got $98. Please help

Transcribed Image Text:2.

Using Table 19-1 and

Semi annual, quarterly

insurance policy.

(Round

Face of Value Sex-age

$40,000

Incured

male-40

19-2 Calculate

the annual,

and monthly (in $) for the life

answer to nearest Cent)?

Jour

Type Anqual premists Sami annual Quarterly Monthly

whole

↑

life

tab

fn

shift

esc

$

caps lock

!

1

control

000

FI

Q

A

@

2

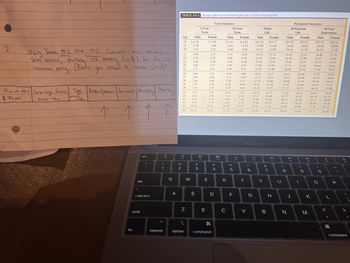

TABLE 19-1 Annual Life Insurance Premiums (per $1,000 of Face Value)

Age

18

19

20

21

22

23

24

25

26

27

28

29

30

35

40

45

50

55

60

-30%-

F2

N

2

option

W

Male

$2.32

2.38

2.43

2.49

2.55

2.62

2.69

2.77

2.84

2.90

2.98

3.07

3.14

3.43

4.23

6.12

9.72

16.25

24.10

S

5-Year

Term

#

3

80

X

Female

$ 1.90

1.96

2.07

Term Insurance

288835836

E

2.15

2.22

2.30

2.37

2.45

2.51

2.58

2.64

2.70

2.78

2.92

3.90

5.18

8.73

12.82

19.43

command

$

4

D

Male

$4.33

4.42

4.49

4.57

4.64

4.70

4.79

4.85

C

4.92

5.11

5.18

5.23

5.30

6.42

7.14

R

8.81

14.19

22.03

10-Year

Term

37.70

%

5

F

*

12088999999633333333

Female

FS

$ 4.01

4.12

4.20

4.29

4.36

4.42

4.47

4.51

4.60

4.69

4.77

4.84

4.93

5.35

6.24

7.40

9.11

13.17

24.82

T

V

^

6

MacBook Air

G

Male Female

$13.22 $11.17

13.60 11.68

14.12 12.09

14.53

12.53

14.97 12.96

15.39 13.41

15.90 13.92

16.38 14.38

16.91

Whole

Life

14.77

17.27 15.23

17.76 15.66

16.18

18.12

18.54

16.71

24.19 22.52

27.21 25.40

33.02 29.16

37.94 33.57

45.83 37.02

53.98 42.24

FA

Y

&

7

B

99

17

H

U

Male

$23.14

24.42

25.10

32.15

37.10

42.27

48.73

56.31

61.09

70.43

25.83

26.42

27.01

27.74

28.40

29.11

29.97

30.68

31.52

8

20-Payment

Life

N

Dil

J

Permanent Insurance

Female Male Female

$19.21

20.92

21.50

$33.22 $29.12

33.68 30.04

34.42 31.28

34.90

35.27

31.79

32.40

35.70

32.93

33.61

36.49

37.02

37.67

34,87

38.23

38.96

39.42

40.19

22.11

22.89

23.47

24.26

25.04

25.96

26.83

27.54

28.09

28.73

33.12

36.29

39.08

44.16

49.40

52.55

1

(

9

43.67

48.20

51.11

58.49

71.28

79.15

DD

14

K

M

1

20-Year

Endowment

O

O

35.30

35.96

36.44

37,21

37.80

39.19

42.25

46.04

49,20

53.16

58.08

9

FO

F10

L

<

I

H

P

ep

>

command

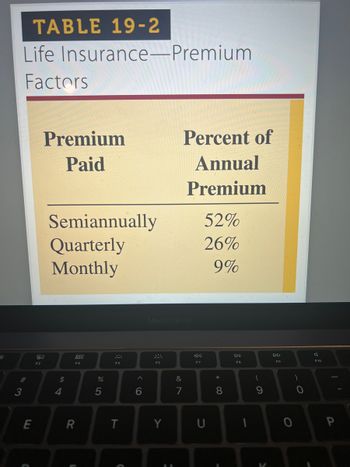

Transcribed Image Text:TABLE 19-2

Life Insurance-Premium

Factors

#

3

E

C

Premium

Paid

80

F3

Semiannually

Quarterly

Monthly

54

$

F4

R

1

%

5

0

F5

T

C

6

MacBook Air

F6

Y

Percent of

Annual

Premium

&

7

8

F7

52%

26%

9%

U

* 00

8

DII

FB

1

61

(

9

F9

)

0

0

7

F10

1

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Simmons Corporation can borrow from its bank at 21 percent to take a cash discount. The terms of the cash discount are 2.5/14, net 50. Compute the cost of not taking the cash discount. Note: Use a 360-day year. Do not round intermediate calculations. Input your final answer as a percent rounded to 2 decimal places.arrow_forward(1)If compounding monthly, how would I find percent and intrest of a problem? (2) How do I compute if I paid $5 weekly for cofee and $175 monthly for food? What percentage of coffe did I pay over food? (3) suppose you start saving today for a $45,000 down payment that you plan to make on a house in 6 years. Assume you make no deposits in the account after initial deposit. For the account below, how much would you have to deposit now to reach $45000 in 6 years : an account with daily compounding and apr of 7%arrow_forwardMr. Hugh Warner is a very cautious businessman. His supplier offers trade credit terms of 2/12, net 75. Mr. Warner never takes the discount offered, but he pays his suppliers in 65 days rather than the 75 days allowed so that he is sure the payments are never late. What is Mr. Warner's cost of not taking the cash discount? Note: Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)arrow_forward

- How do we work out how much was saved by making the partial payment? I know the answer is $26.91, but I don't know how to get there. Please help me. Polly Flynn borrowed $6,000 for 90 days at 7%. On day 20, Polly made a $2000 partial payment. (Assume ordinary interest) What is Polly’s ending balance due? How much did Polly save by making the partial payment?arrow_forwardMy company made $x. The credit card company takes 3.5% off of every transaction. I received $522.22. What is x?arrow_forwardGert needs to borrow $415,000 to purchase a home. He is able to obtain a thirty year mortage with a fixed-rate of 3.0%. What is his monthly payment? For numerical entries, please 1. do NOT enter commas 2. do NOT enter the dollar symbol: $ 3. DO enter the percent symbol when it is needed: % 4. enter dollar amounts to the nearest cent, for example: 12345.67 Please complete the TVM Framework table to compute Gert's monthly payment on this mortgage: Time Value of Money (TVM) Framework i PV PMT с Please complete the first rows of the amortization table: Amortization Table INTEREST LA n n Principal Balance Excess Payment FV type CPT Principal Remaining If Gert started this mortgage at the beginning of December, how much interest would he pay during its first calendar year?arrow_forward

- Complete the following table: (Use Table 15.1.) Note: Do not round intermediate calculations. Round your answers to the nearest cent. selling price down payment amount mortgage rate years monthly payment first payment broken down into interest first payment broken down into principal Balance at end of month $236,000 47,200 $188,800 7.00% 15 Monthly payment is NOT 1694.23 first payment broken down into interest is NOT 1,101.23 first payment principal is NOT 592.90 balance at end is NOT 188,207.10 TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2.000 0.16667 9.20135 6.43509 5.05883 4.23854 3.69619 3.02826 2.125 0.17708 9.25743 6.49281 5.11825 4.29966 3.75902 3.09444 2.250 0.18750 9.31374 6.55085 5.17808 4.36131 3.82246 3.16142 2.375 0.19792 9.37026 6.60921 5.23834 4.42348 3.88653 3.22921 2.500 0.20833 9.42699 6.66789 5.29903 4.48617 3.95121 3.29778 2.625…arrow_forwardGive answer with explnation and calculation And Explain All Correct and incorrect optionarrow_forwardBig Dom’s Pawn Shop charges an interest rate of 26.8 percent per month on loans to its customers. Like all lenders, Big Dom must report an APR to consumers. a. What rate should the shop report? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b. What is the effective annual rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education