FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

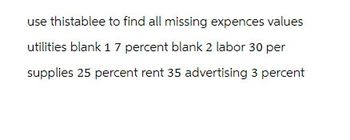

Transcribed Image Text:use thistablee to find all missing expences values

utilities blank 17 percent blank 2 labor 30 per

supplies 25 percent rent 35 advertising 3 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give me answer within 30 min plz I will give you upvote immediately its urgent ....arrow_forwardQuestion 10 Calculate the Menu price from the following: Item product cost $2, Item labour cost $.50, Overhead cost per item $.70, Desired per item Gross profit percentage 20%. $3.84 $.64 $3.20arrow_forwardFast pls solve this question correctly in 5 min pls I will give u like for sure Surbharrow_forward

- Question Completion Status: QUESTION 7 Using the following information, calculate the monthly net profit Sales for the month Food costs 73,904 25% of Sales Labor costs 45% of Sales Rent and Insurance $1500/month Supplies $2217/month Other expenses $3791/month OA. $51,733 O B. $22,171 O C. $7508 OD. $14,663 QUESTION 8 Calculate the profit margin from the last problem O A. 17.5% OB. 19.84% OC. 18.29% Click Save and Submit to save and submit. Click Save All Answers to save all answers OD.22.22%arrow_forwardNeed help with question 2arrow_forwardit View History M faith@.. tems 37.66% ··· Bookmarks Window AOL Ma.... B E C eBook U Sales Mail - F... Cost of goods sold Help Operating income Expenses: Selling expenses Administrative expenses The following multiple-step, income statement was prepared for Carlsbad Company contains errors: CARLSBAD COMPANY Income Statement For the Year Ended February 28, 2018 Delivery expense Total expenses Other expense: Interest revenue Gross profit R V Portal h... Check My Work 10 more Check My Work uses remaining. % G Chapter... B v2.cengagenow.com Prepare a corrected income statement for Carlsbad Company for the year ended February 28, 2018. Carlsbad Company Income Statement 6 $ 1,800,000 1,350,000 112,500 H C Cengag.. 9,495,000 (5,962,500) $3,532,500 (3,262,500) 270,000 90,000 $180,000 All work saved. N MacBook Pro ** W Activity... 8 M FA 9 K Save and Exit Submit Assignment for Grading 1arrow_forward

- Revise your worksheet to reflect these updated assumptions and then answer the questions that follow. Sales Sale Price 9,400 units 27 Date Number of Units Unit Cost Total Cost Beginning 1,500 10.30 $15,450 March 12 2,700 10.20 27,540 June 5 1,400 10.10 14,140 October 22 5,300 9.90 52,470 Totals 10,900 $109,600 Required: 1. Use your spreadsheet to recalculate the Cost of Goods Sold, Inventory balances, and Gross Profit under each method and enter your results below: (Round your answers to the nearest whole dollar amount.). FIFO LIFO Weighted Average Cost of Goods Sold Ending Inventory Gross Profit < Prev ♡ 14 of 14 Nextarrow_forwardNo chatgpt used i will give 5 upvotes typing pleasearrow_forwardanswer both parts correctlyarrow_forward

- b Preview File Edit View Go Tools Window ♥ mgt120h-a17.pdf Page 4 of 10 Cost-Volume-Profit Analysis Help 40 The Effect Of Prepaid Taxes On Assets And Liabili... O 13. Goodwill can be recorded a. When customers keep returning because they are satisfied with the company's products. b. When the company acquires a good location for its business. c. When the company has exceptional management. d. Only when there is an exchange transaction involving the purchase of an entire business. Debenture Valuation CC 7 Www D mi popisiva V Search ------- (Cª Ơ www Sat Apr 15 3:05 PM Page 4 of 11 wwwarrow_forwardThe unit price for pictire frame isarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education