FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

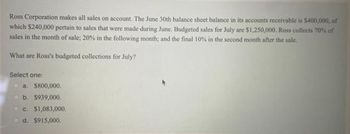

Transcribed Image Text:Ross Corporation makes all sales on account. The June 30th balance sheet balance in its accounts receivable is $400,000, of

which $240,000 pertain to sales that were made during June. Budgeted sales for July are $1,250,000. Ross collects 70% of

sales in the month of sale; 20% in the following month; and the final 10% in the second month after the sale.

What are Ross's budgeted collections for July?

Select one:

a. $800,000.

b. $939,000.

c. $1,083,000.

d. $915,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A. You are given the following information related to ABC manufacturing companyMonth Budgeted SalesMarch $200,000April 212,000May 204,000June 218,000July 210,000In addition, the gross profit rate is 40% and the desired inventory level is 30% of next month'scost of sales.Required:Prepare a purchases budget for April through June.arrow_forwardSeventy percent of Parlee Corporation's sales are collected in the month of sale, 25% in the month following sale, and 5% in the second month following sale. The following are budgeted sales data for the company: January February March April Total sales...... $600,000 $700,000 $500,000 $300,000 Total budgeted cash collections in April would be:arrow_forwardPhoto attachedarrow_forward

- Drago makes all sales on account, subject to the following collection pattern: 40% are collected in the month of sale; 50% are collected in the first month after sale; and 10% are collected in the second month after sale. If sales for January, February, and March were $80,000, $120,000, and $180,000, respectively, what were the firm's budgeted collections for March? A. $72,000 B. $120,000 C. $174,000 D. $180,000 E. $140,000arrow_forwardSeventy percent of Porter's Corporation's sales are collected in the month of sale, 20% in the month following sale, and 10% in the second month following sale. The following are budgeted sales data for the company: Budgeted sales O $175,000 O $275,000 O $70,000 January $200,000 Total budgeted cash collections in April would be: O $30,000 February $300,000 March $350,000 April $250,000arrow_forwardThe information in the following table is from a company's sales budget Expected sales April May June $ 96,000 116,000 126,000 Cash sales are normally 25% of total sales and all credit sales are expected to be collected in the month following the date of sale. The total amount of cash expected to be received from customers in June OAS118,500 O $31,500 OC$213,000 005126,000 O $87,000arrow_forward

- Sheridan, Inc. expects sales volume totaling $460000 for June. Data for the month follows: Sales commissions Sales manager's salary 4% of sales $27600 per month $23000 per month Advertising expense Shipping expense. Miscellaneous selling expenses $1932 per month plus 3/4% of sales O $78982. O $52532. O $28382. O $77050. 1% of sales How much is Sheridan's selling expense budget for June?arrow_forwardpaid in month of purchase: 10% paid n first month following purchase: 40% Paid in second month following purchase: 50% If budgeted purchases for April, May, and june are $30,000, $45,000 and $20,000, what is the budgeted accounts payable balance on June 30? a. 32500 b. 31000 c. 35000 d. 40500arrow_forwardCOVID 19 Co has forecast purchases on account to be $318,000 in March, $370,000 in April, $421,000 in May, and $493.000 in June. Sixty five percent of purchases are paid for in the month of purchase, the remaining 35% are paid in the following month, What is the budgeted Accounts Payable balance for June 30? Select one a. $172.550 b. $320,450 C $147.350 d. $273.650arrow_forward

- Center Company makes collections on sales according to the following schedule: 40% in the month of sale 50% in the month following sale 7% in the second month following sale The following sales are expected: Expected Sales January $ 106,000 February $ 142,000 March $ 125,000 Cash collections in March should be budgeted to be: $126,330. $128,420. $121,000. $125,000.arrow_forward19. SalaRita's sales are 32% cash and 68% credit. Of the credit sales, 40% of credit sales are collected in the month of sale, 45% in the month following the sale, and 15% is collected two months after. Budgeted sales data is as follows: June July August $200,000 120,000 150,000 How much is total cash collected during August? A) $145,920 B) $105,120 C) $88,800 D) $144,000arrow_forwardParvis makes all sales on account, subject to the following collection pattern: 30% are collected in the month of sale; 50% are collected in the first month after sale; and 20% are collected in the second month after sale. If sales for October, November, and December were $78,000, $68,000, and $58,000, respectively, what was the budgeted receivables balance on December 31? Multiple Choice O $67,000 None of the answers is correct. $54,200. $49,600. $40,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education