Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

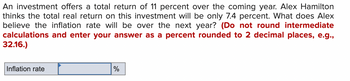

Transcribed Image Text:An investment offers a total return of 11 percent over the coming year. Alex Hamilton

thinks the total real return on this investment will be only 7.4 percent. What does Alex

believe the inflation rate will be over the next year? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

Inflation rate

%

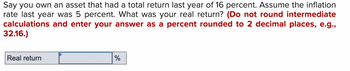

Transcribed Image Text:Say you own an asset that had a total return last year of 16 percent. Assume the inflation

rate last year was 5 percent. What was your real return? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

Real return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If the rate of inflation is 3.9% per year, the future price pt (in dollars) of a certain item can be modeled by the following exponential function, where t is the number of years from today. =p (t)= 600(1.039)t Find the current price of the item and the price 10 years from today.Round your answers to the nearest dollar as necessary.arrow_forwardok Assume the returns from holding an asset are normally distributed. Also assume the average annual return for holding the asset a period of time was 15.4 percent and the standard deviation of this asset for the period was 33.3 percent. Use the NORMDIST function in Excel to answer the following questions. a. What is the approximate probability that your money will double in value in a single year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161. b. What is the approximate probability that your money will triple in value in a single year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 8 decimal places, e.g., 32.16161616. ences a. Probability b. Probability % %arrow_forwardYou ́re considering an investment that you expect will produce an 9% return next year, and you expect that your real rate of return on this investment will be 4%. What do you expect inflation to be next year?arrow_forward

- . Evaluate the following statement:Consider two riskless perpetuities: (i) pays $120 every year; (ii) pays $10 every month. If the rates of returns of the two perpetuities are the same, investors must buy perpetuity (ii) because it makes more interest payments.arrow_forwardThe one-year spot rate is currently 4%; the one-year spot rate one year from now will be 3%; and the one- year spot rate two years from now will be 6%. Under the unbiased expectations theory, what must today's three-year spot rate be? Suppose the three-year spot rate is actually 3.75%, how could you take advantage of this? Explain.arrow_forwardThe current one-year T-bill rate is .50 percent and the expected one-year rate 12 months from now is 1.38 percent. According to the unbiased expectations theory, what should be the current rate for a two-year Treasury security? (Do not round intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) Current rate= %arrow_forward

- Raghubhaiarrow_forwardYogesharrow_forwardAt present, the real risk free rate of interest is 0.020 while inflation is expected to be 0.020 for the next 2 years. If a 2 year Treasure Note vields 0.047. What is the Maturity Risk Premium for this 2 ear Treasury Note? GIVE ANSWER IN DECIMAL NUMBERS. (3 DECIMAL PLACES) Assume the expected inflation rate to be 0.034. If the current current real rate of Iinterest is 0.065. What would the nominal rate of interest be? GIVE ANSWER IN DECIMAL NUMBERS. (3 DECIMAL PLACES) At present, 10 year Treasury Bonds are yielding 0.039. while a 10 year Corporate Bond is yielding 0.066. If the liquidity risk premium on the corporate bond is 0.003. What is the Corporate Bonds Default Risk Premium?ANSWER IN DECIMAL NUMBERS ONLY TO 3 PLACES (AS SHOWN IN THE You are considering an investment that you expect will return an 0.089 return next year and you expect your real rate of return will be 0.125. What do you expect inflation to be next vear?GIVE ANSWER IN DECIMAL NUMBERS. (3 DECIMAL PLACES)arrow_forward

- At present, the real risk free rate of interest is 0.020 while inflation is expected to be 0.020 for the next 2 years. If a 2 year Treasure Note vields 0.045. What is the Maturity Risk Premium for this 2 ear Treasury Note? GIVE ANSWER IN DECIMAL NUMBERS. (3 DECIMAL PLACES) Assume the expected inflation rate to be 0.040. If the current current real rate of Iinterest is 0.083. What would the nominal rate of interest be? GIVE ANSWER IN DECIMAL NUMBERS. (3 DECIMAL PLACES) At present, 10 year Treasury Bonds are yielding 0.039. while a 10 year Corporate Bond is yielding 0.066. If the liquidity risk premium on the corporate bond is 0.003. What is the Corporate Bonds Default Risk Premium?ANSWER IN DECIMAL NUMBERS ONLY TO 3 PLACES (AS SHOWN IN THE You are considering an investment that you expect will return an 0.038 return next year and you expect your real rate of return will be 0.69. What do you expect inflation to be next vear?GIVE ANSWER IN DECIMAL NUMBERS. (3 DECIMAL PLACES)arrow_forwardJoan, the project manager, asks you to evaluate alternatives A and B on the basis of their PW values using a real interest rate of 10% per year and an inflation rate of 3% per year (a) without any adjustment for inflation, and (b) with inflation considered. Also, write the spreadsheet functions that will display the correct PW values. (c) Joan clearly wants alternative A to be selected. If inflation is steady at 3% per year, what real return i would machine A have to generate each year to make the choice between A and B indifferent? What is the required return with inflation considered? Machine A B First cost, $ −31,000 −48,000 AOC, $ per year −28,000 −19,000 Salvage, $ 5,000 7,000 Life, years 5 5arrow_forwardPlease show working. Please answer 1 and 2 1. The real risk-free rate is 2.75%, and inflation is expected to be 4.00% for the next 2 years. A 2-year Treasury security yields 8.25%. What is the maturity risk premium for the 2-year security? Round your answer to two decimal places. 2. The real risk-free rate is 2.9%. Inflation is expected to be 2.2% this year, 4.8% next year, and 2.65% thereafter. The maturity risk premium is estimated to be 0.05 × (t - 1)%, where t = number of years to maturity. What is the yield on a 7-year Treasury note? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education