Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

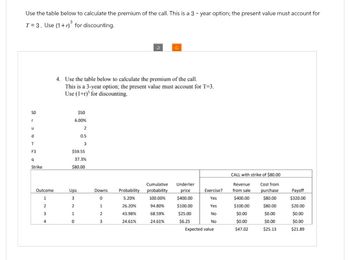

Transcribed Image Text:Use the table below to calculate the premium of the call. This is a 3-year option; the present value must account for

T 3. Use (1+r) for discounting.

4. Use the table below to calculate the premium of the call.

This is a 3-year option; the present value must account for T=3.

Use (1+r) for discounting.

SO

r

$50

6.00%

u

2

0.5

3

F3

$59.55

37.3%

Strike

$80.00

CALL with strike of $80.00

Outcome

Ups

Downs

Probability

1

3

0

5.20%

probability

100.00%

Cumulative Underlier

price

$400.00

Revenue

Cost from

Exercise?

from sale

purchase

Payoff

Yes

$400.00

$80.00

$320.00

2

2

1

26.20%

94.80%

$100.00

Yes

$100.00

$80.00

$20.00

3

1

2

43.98%

68.59%

$25.00

No

$0.00

$0.00

$0.00

4

0

3

24.61%

24.61%

$6.25

No

$0.00

$0.00

$0.00

Expected value

$47.02

$25.13

$21.89

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Q)You are given the future value of an annuity, A, the monthly payment, R, and the annual interest rate, r. Find the number of monthly payments, n. Round your answer to the nearest whole number if necessary.A = $4000; R = $70; r = 7% Solve it correctly not use excelarrow_forwardConsider three alternatives A, B, and "do-nothing." (a) Construct a choice table for interest rates from 0% to 100%. Year A B 0 1-5 –$10,000 3,200 -$15,000 4,500arrow_forwardIf annuity A has 30 payments of $500 at an interest rate of 10% and annuity B has 30 payments of $500 at an interest rate of 9%, which one has the higher present value? Select one: a. Not enough information to determine. b. B c. Aarrow_forward

- please help me find how to get that answer for this question, please help NO EXCELarrow_forwardWhat is the PV of an annuity due with 5 payments of $2,500 at an interest rate of 5.5%? Hint: when you see the word “due”, it means that the first payment happens right away (rather than at the end of the period) so you must adjust the formula, in Excel make type=1: =PV(Rate, nper, pmt, fv, type=1)arrow_forwardNeed help with 4,5,6.arrow_forward

- For problem 2, use the following information: Consider 3-month options with premium Strike 35 Call Premium Put Premium 6.13 0.44 40 2.78 1-99 45 0.97 5.08 and the effective annual interest nate 8.33% 2. write down the pay off function, profit function and draw a profit diagram for the following options: (i). Straddle: buy a call and a put with Strike 40. I will be good for both up/down but high premium). (ii) Strangle Call buy 25- strike put and 45- Strike (iii) Symmetric butterfly spreads : straddle + buy 25- Strike written put and 40- Strike 45- Strike call.arrow_forwardCompare the monthly payments and total loan costs for the following pairs of loan options. Assume that both loans are fixed rate and have the same closing costs. You need a $80,000 loan. Option 1: a 30-year loan at an APR of 8.15%. Option 2: a 15-year loan at an APR of 7.75%. Question content area bottom Part 1 Find the monthly payment for each option. The monthly payment for option 1 is $ enter your response here. The monthly payment for option 2 is $ enter your response here.arrow_forwardSee Picarrow_forward

- I dont just need answer, i want full explanationarrow_forwardFind the present value PV of the given future value. (Round your answer to the nearest cent.) future valye $1,118 at .03625 simple interest for 518 days PV = $arrow_forwardWhat discount rate should a lender charge to earn an interest of 2 1/4 % on a 90-day loan? Hint: An interest rate r and discount rate d are said to be equivalent if these two simple rates give the same present value for an amount due in the future. Thus, r = d/(1 - dt) and d = r/(1 + rt)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you