PLEASE

Use the photo at exercise 14 to solve the problem below

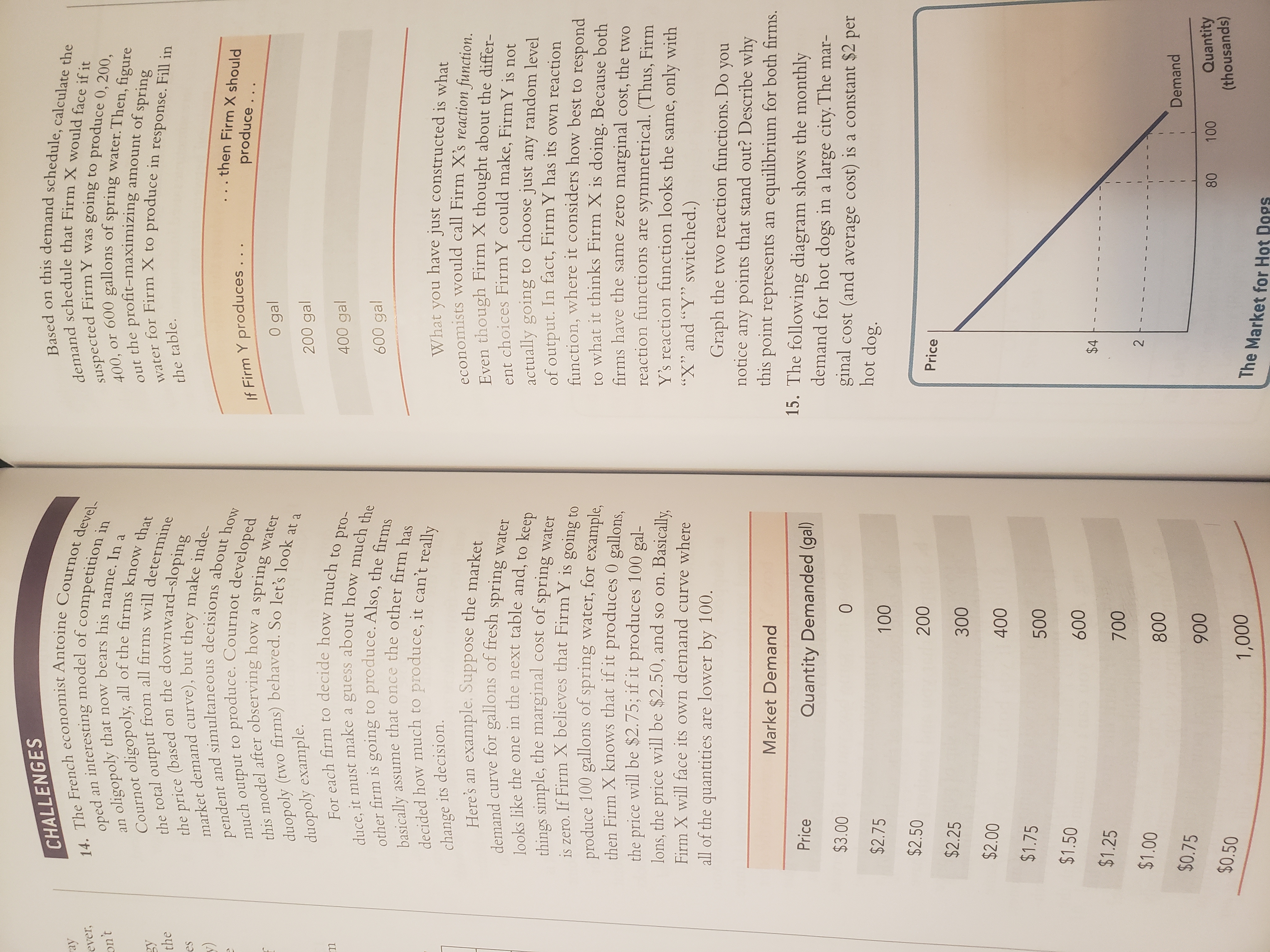

With the Firm Y response function Qy=600-1/2Qx

and the Firm X response function Qx=600-1/2Qy

Imagine that firm X chooses their quantity first, then firm Y observes the quantity of firm X and chooses their own quantity. What quantities will they end up choosing? Is there a first or second-mover advantage here?

[You may assume that firm X can only choose quantities that are multiples of 200. This prevents you from having to deal with prices that are not on the schedule. just a little thinking about how equilibrium works in a sequential-move game. Oh, and just give me the quantity for each firm, don't worry about giving me a complete strategy for firm Y.]

Step by stepSolved in 3 steps with 6 images

- When firms face downward sloping demand curves for their products,arrow_forwardConsider the pharmaceutical company Mylan that produces epinephrine injection devices called EpiPens. In the presence of other firms producing substitutes for this good, the price of EpiPens is $150. Now suppose that competitors to Mylan no longer produce epinephrine injection devices, so Mylan now has pricing power in this market. As the economist on staff at Mylan, you are charged with the task of figuring out what your company's new pricing strategy should be. The following graph shows the marginal cost (MC), which is assumed to be constant, and the average total cost (ATC) of Mylan. The graph also shows the demand curve (D) for EpiPens and the marginal revenue curve (MR) once the firm has market power. On the graph, use the grey point (star symbol) to indicate the quantity of EpiPens demanded if Mylan continues to charge $150. Dashed drop lines will automatically extend to both axes. PRICE (Dollars per EpiPen) 1000 900 800 700 600 500 400 300 200 100 0 0 1 MR 4 2 3 7 5 6 QUANTITY…arrow_forwardUse the photo at exercise 14 to solve the problem below With the Firm Y response function Qy=600-1/2Qx and the Firm XX response function Qx=600-1/2Qy Imagine that firm X chooses their quantity first, then firm Y observes the quantity of firm X and chooses their own quantity. What quantities will they end up choosing? Is there a first or second-mover advantage here? [You may assume that firm X can only choose quantities that are multiples of 200. This prevents you from having to deal with prices that are not on the schedule. just a little thinking about how equilibrium works in a sequential-move game. Oh, and just give me the quantity for each firm, don't worry about giving me a complete strategy for firm Y.]arrow_forward

- Assume the inverse demand function in a market is given by P(Q) = 500 - Q where Q is the total industry output, that is the sum of the output of all firms in the market. There are two firms (indexed by i = 1,2) who both have a cost of producing the good given by c(qi) = 10 * qi The two firms are competing in the Cournot manner, that is they choose their quantities simultaneously in order to maximize profits.arrow_forwardAfter talking your managerial economics class, you realize that you can probably raise your profits by price discriminating by charging different prices in the two locations. You then breakdown sales across the two locations In Laredo: You sold 200 burger meals per week at $9 and 100 meals at $10 In San Antonio: You sold 1200 meals per week at $9 and 1100 meals at $10 Using the two prices above, estimate your demand function in Laredo. What would demand be at the optimal price from Q1? Using the two prices above, estimate your demand function in San Antonio. What would demand be at the optimal price from Q1? Calculate the point price elasticity of demand at the optimal price for Q1 (and quantity from part A) in Laredo Calculate the point price elasticity of demand at the optimal price for Q1 (and quantity from part B) in San Antonio Assuming that your marginal costs are $3, are you charging more, less, or exactly the optimal price in Laredo Hint: Calculate the markup on price and…arrow_forwardThe quantity of a product demanded by consumers is a function of its price. The quantity of one product demanded may also depend on the price of other products. For example, if the only chocolate shop in town (a monopoly) sells milk and dark chocolates, the price it sets for each affects the demand of the other. The quantities demanded, q, and q2, of two products depend on their prices, p, and P2, k as follows: Enter the exact answers. If one manufacturer sells both products, how should the prices be set to generate the maximum possible revenue? What is that maximum possible revenue? P₁ = P2 = H. 9₁ = 9₂ = The maximum revenue is i 280 - 5p₁-3p2 360 - 3p₁ - 5p2.arrow_forward

- 1. It is 1908 and you are the CEO of Ford Motor Company. General Motors startedproducing cars this year and has quickly become your chief rival. Their recent entrance, as wellas your assembly line methods, allows you the advantage of producing cars faster and choosingyour output levels first. Assume the 1908 inverse demand function for cars is P = 3900 - Q(customers view cars as identical products at this point in time) and production costs are C(qi) =100qi. a. What is Ford’s profit-maximizing output level? GM's?b. What is the market equilibrium price?c. How much profit does each firm earn?d. As the assembly line is used by other firms, the first-mover advantage disappears (fast forward100 years to present day), and more firms have entered the market (e.g. FCA, Tesla, Hyundai,Toyota, Honda, etc.), what do you expect to happen to Ford’s profit (assume demand andcosts are the same)? Explain.e. From 1908 into the 1920s, Ford offered customers one car: the Model T. Further, Henry isfamous…arrow_forwardUse the photo at exercise 14 to solve the problem below With the Firm Y response function Qy=600-1/2Qx and the Firm XX response function Qx=600-1/2Qy Imagine that firm X chooses their quantity first, then firm Y observes the quantity of firm X and chooses their own quantity. What quantities will they end up choosing? Is there a first or second-mover advantage here? [You may assume that firm X can only choose quantities that are multiples of 200. This prevents you from having to deal with prices that are not on the schedule. just a little thinking about how equilibrium works in a sequential-move game. Oh, and just give me the quantity for each firm, don't worry about giving me a complete strategy for firm Y.]arrow_forwardImagine that you are the manager of a large clothing company with market power that specializes in selling blue jean pants. 1) Choose two pricing strategies that were discussed in Chapter (Pricing Strategies for Firms with Market Power) that you would implement as the firm manager. 2) Explain how exactly you would implement these two pricing strategies in the real-worldarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education